5i Research Weekly Rockets and Duds

Last week we got some complaints about our political opening sentence, so we are going to skip the review of the Melania movie this week. Here are last week's stock market Rockets and Duds.

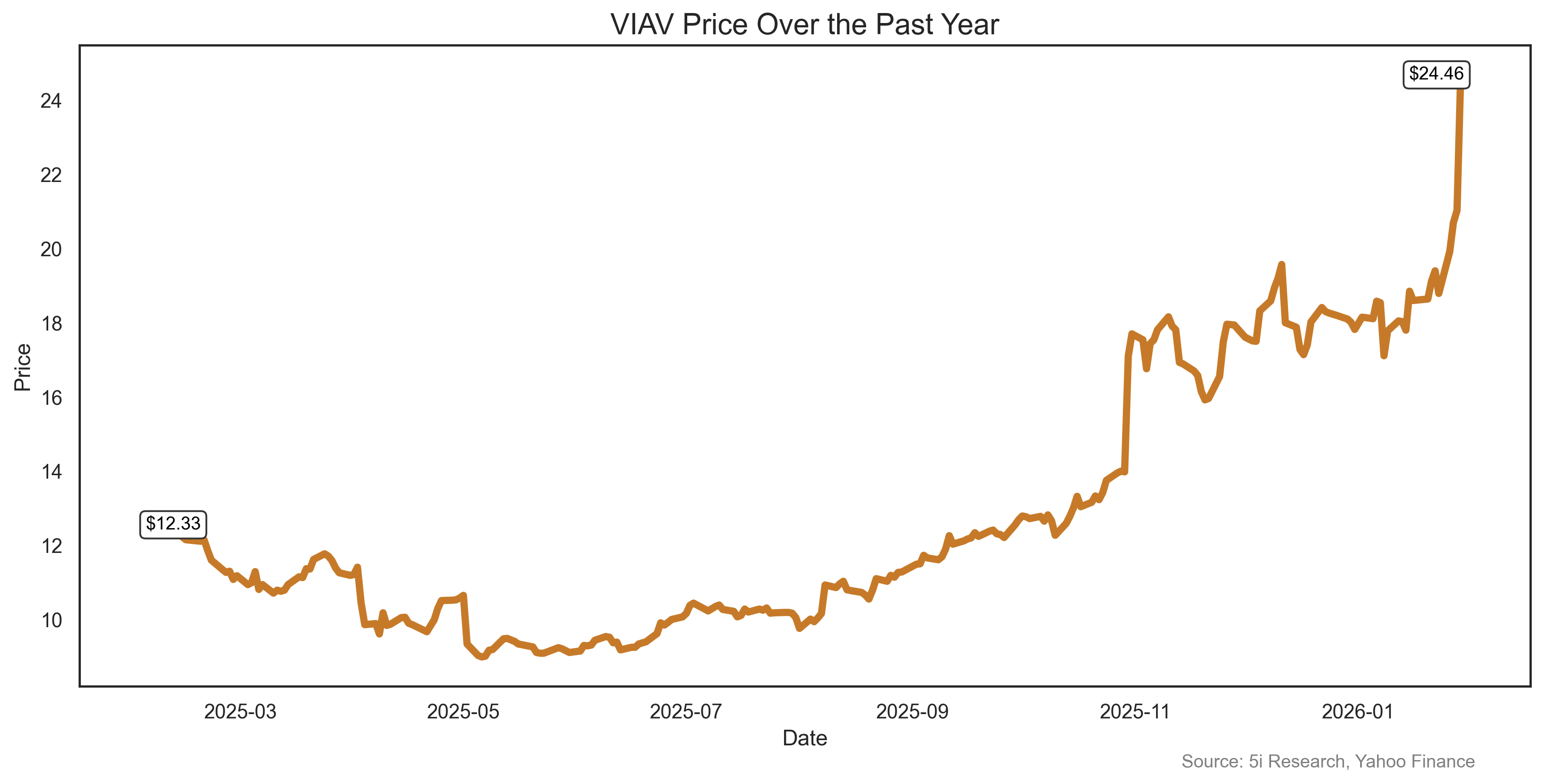

Viavi Solutions VIAV

For those of us old enough to remember the crazy days of JDS Uniphase, well, they're back, baby! VIAV, which is one of the two companies created when JDS split into two in 2015, rose 30% last week on strong results and a solid outlook. Investors even cheered the company's plan to reduce 5% of its workforce. VIAV focuses on network test, measurement and assurance technology in the Optical space.

For those of us old enough to remember the crazy days of JDS Uniphase, well, they're back, baby! VIAV, which is one of the two companies created when JDS split into two in 2015, rose 30% last week on strong results and a solid outlook. Investors even cheered the company's plan to reduce 5% of its workforce. VIAV focuses on network test, measurement and assurance technology in the Optical space.

For those of us old enough to remember the crazy days of JDS Uniphase, well, they're back, baby! VIAV, which is one of the two companies created when JDS split into two in 2015, rose 30% last week on strong results and a solid outlook. Investors even cheered the company's plan to reduce 5% of its workforce. VIAV focuses on network test, measurement and assurance technology in the Optical space.

For those of us old enough to remember the crazy days of JDS Uniphase, well, they're back, baby! VIAV, which is one of the two companies created when JDS split into two in 2015, rose 30% last week on strong results and a solid outlook. Investors even cheered the company's plan to reduce 5% of its workforce. VIAV focuses on network test, measurement and assurance technology in the Optical space.

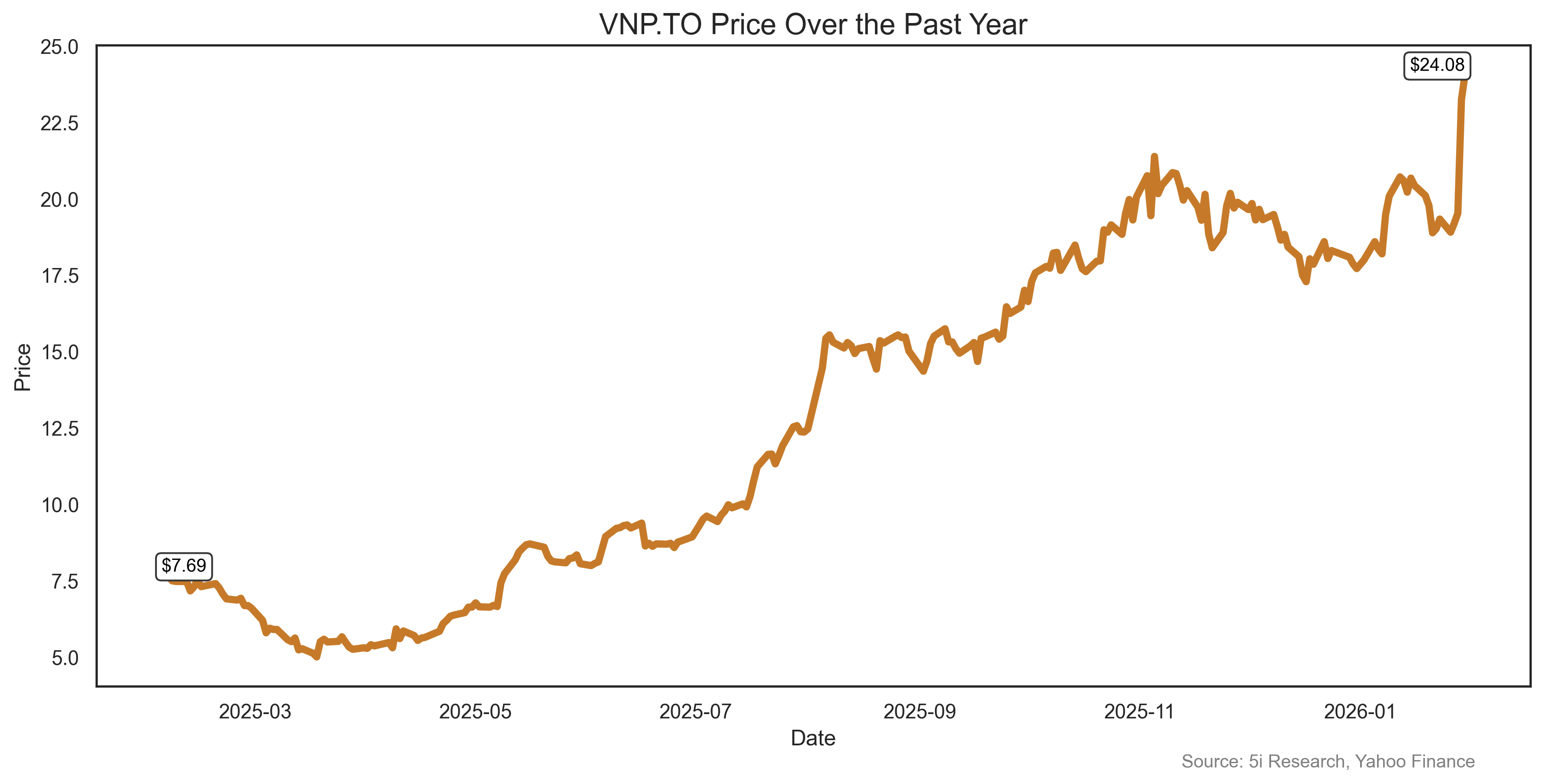

5N Plus VNP

An overnight success story 20 years in the making. VNP went public 19 years ago at $3.00 per share. For an embarrassingly-long time, the stock did nothing. But that was then and this is now. VNP shares rose 25% last week, bringing their one-year gain to 211%. It turns out that getting a marquee contract from the Pentagon for germanium refining is a good thing. What is germanium, you ask? Well, it is only a crucial material used in the production of semiconductors. Kind of a big market for those things, or so we are told.

An overnight success story 20 years in the making. VNP went public 19 years ago at $3.00 per share. For an embarrassingly-long time, the stock did nothing. But that was then and this is now. VNP shares rose 25% last week, bringing their one-year gain to 211%. It turns out that getting a marquee contract from the Pentagon for germanium refining is a good thing. What is germanium, you ask? Well, it is only a crucial material used in the production of semiconductors. Kind of a big market for those things, or so we are told.

An overnight success story 20 years in the making. VNP went public 19 years ago at $3.00 per share. For an embarrassingly-long time, the stock did nothing. But that was then and this is now. VNP shares rose 25% last week, bringing their one-year gain to 211%. It turns out that getting a marquee contract from the Pentagon for germanium refining is a good thing. What is germanium, you ask? Well, it is only a crucial material used in the production of semiconductors. Kind of a big market for those things, or so we are told.

An overnight success story 20 years in the making. VNP went public 19 years ago at $3.00 per share. For an embarrassingly-long time, the stock did nothing. But that was then and this is now. VNP shares rose 25% last week, bringing their one-year gain to 211%. It turns out that getting a marquee contract from the Pentagon for germanium refining is a good thing. What is germanium, you ask? Well, it is only a crucial material used in the production of semiconductors. Kind of a big market for those things, or so we are told.

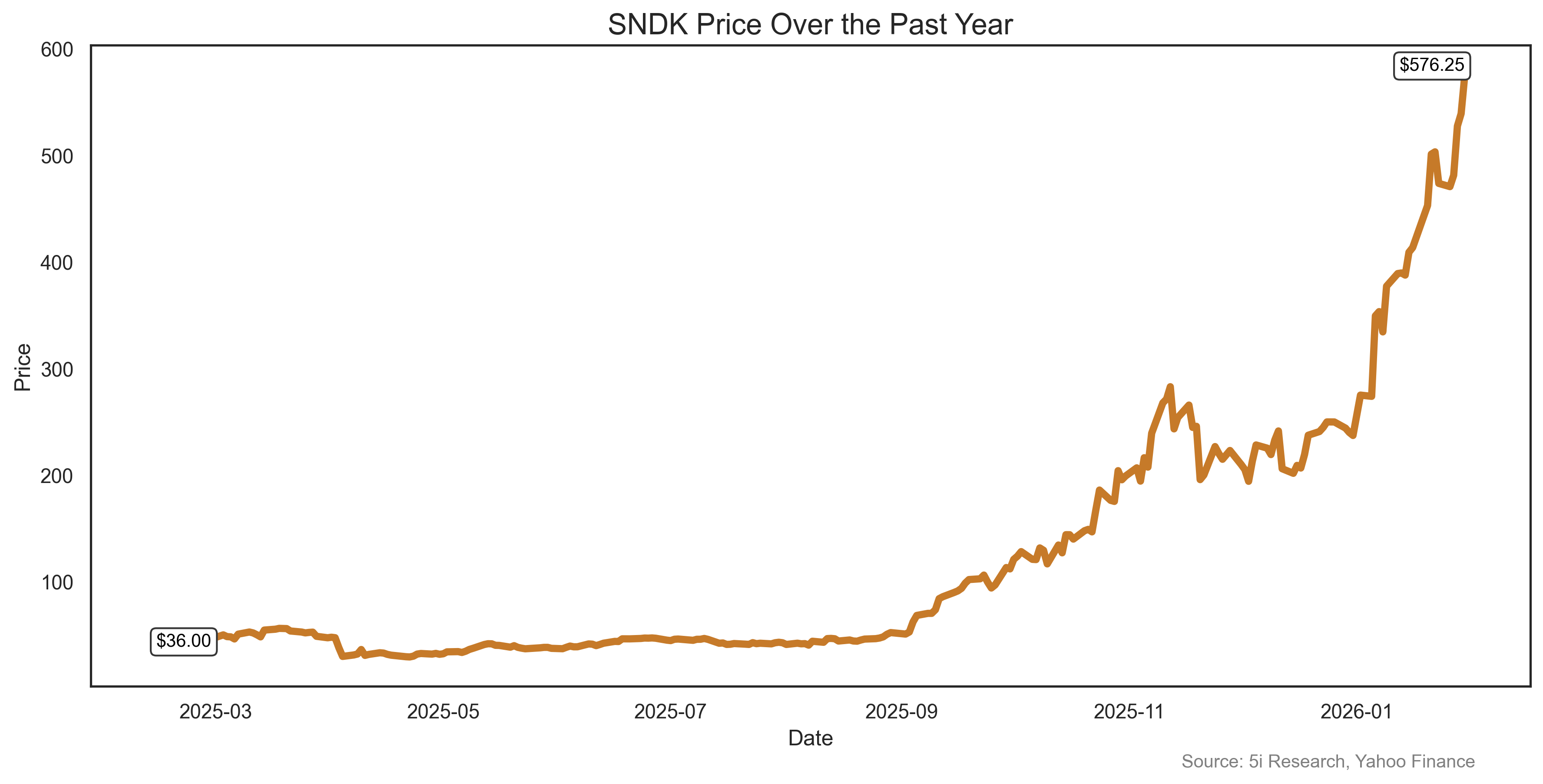

Sandisk SNDK

Hey Luke, re-boot the hard drive on C3PO! SNDK shares rose 22% last week, for a year-to-date return now of 142%. As it turns out, you can't have AI and robots without memory. A strong earnings beat and strong guidance reminded investors that memory is important to a lot of things. Most companies are sold out for at least a year, and are able to raise prices at will. If MY memory serves me correctly, SNDK spun out of Western Digital less than a year ago, and might be the greatest spin out ever, with a 1500% gain since cutting loose on its own.

Hey Luke, re-boot the hard drive on C3PO! SNDK shares rose 22% last week, for a year-to-date return now of 142%. As it turns out, you can't have AI and robots without memory. A strong earnings beat and strong guidance reminded investors that memory is important to a lot of things. Most companies are sold out for at least a year, and are able to raise prices at will. If MY memory serves me correctly, SNDK spun out of Western Digital less than a year ago, and might be the greatest spin out ever, with a 1500% gain since cutting loose on its own.

Hey Luke, re-boot the hard drive on C3PO! SNDK shares rose 22% last week, for a year-to-date return now of 142%. As it turns out, you can't have AI and robots without memory. A strong earnings beat and strong guidance reminded investors that memory is important to a lot of things. Most companies are sold out for at least a year, and are able to raise prices at will. If MY memory serves me correctly, SNDK spun out of Western Digital less than a year ago, and might be the greatest spin out ever, with a 1500% gain since cutting loose on its own.

Hey Luke, re-boot the hard drive on C3PO! SNDK shares rose 22% last week, for a year-to-date return now of 142%. As it turns out, you can't have AI and robots without memory. A strong earnings beat and strong guidance reminded investors that memory is important to a lot of things. Most companies are sold out for at least a year, and are able to raise prices at will. If MY memory serves me correctly, SNDK spun out of Western Digital less than a year ago, and might be the greatest spin out ever, with a 1500% gain since cutting loose on its own.

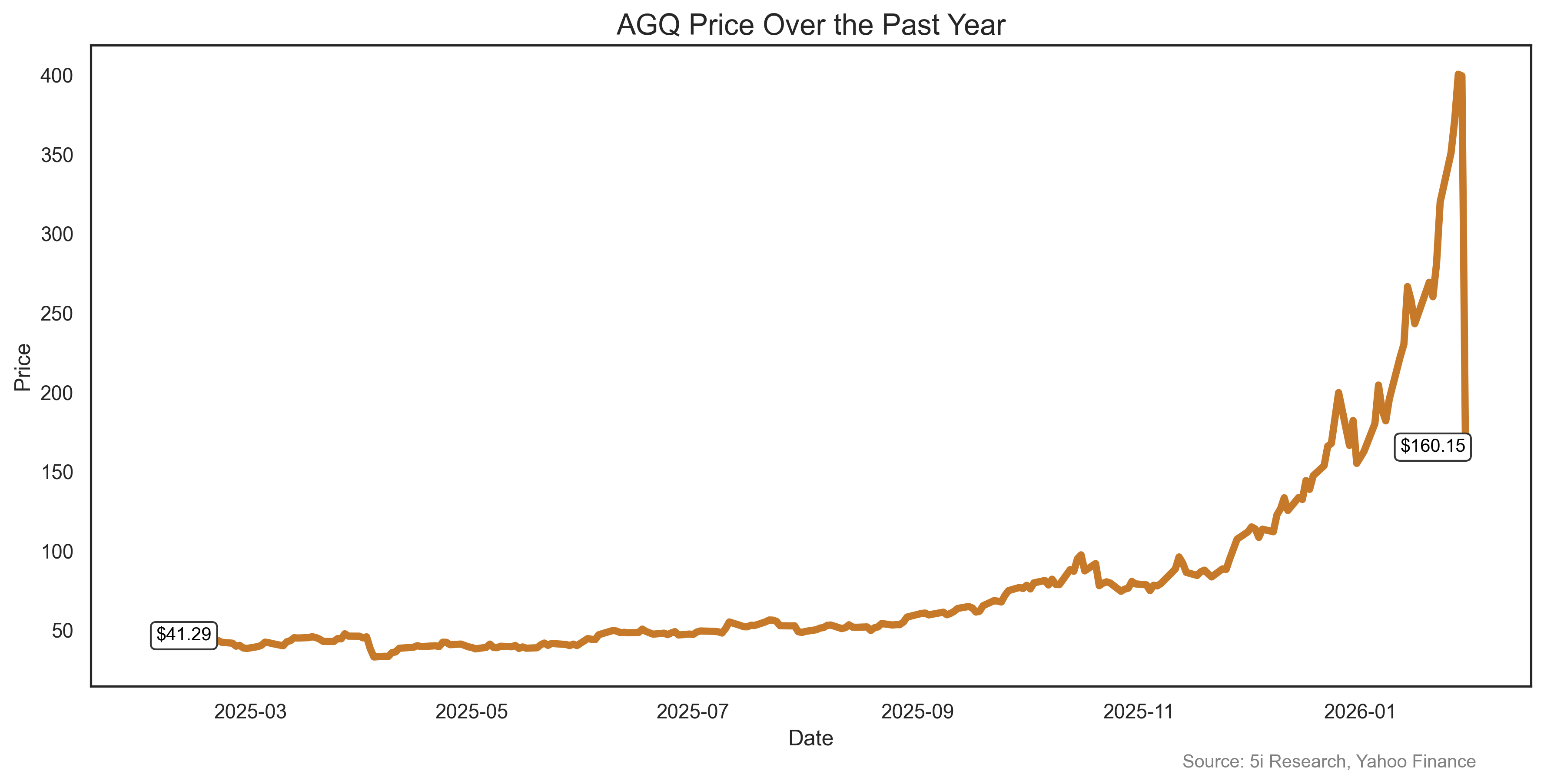

Proshares Ultra Silver AGQ

Leverage = BAD! We are always telling our 5i Research clients to avoid 2X leveraged ETFs. Sure, you can be right sometimes on day trades, and these ETFs can boost returns at times. But when you are wrong, you can be very wrong. AGQ fell 50% last week, with a single day drop of 60% on Thursday, when silver fell the most on record. You know, when you are down 60%, you need a gain of 150% just to break even. Math is harsh.

Leverage = BAD! We are always telling our 5i Research clients to avoid 2X leveraged ETFs. Sure, you can be right sometimes on day trades, and these ETFs can boost returns at times. But when you are wrong, you can be very wrong. AGQ fell 50% last week, with a single day drop of 60% on Thursday, when silver fell the most on record. You know, when you are down 60%, you need a gain of 150% just to break even. Math is harsh.

Leverage = BAD! We are always telling our 5i Research clients to avoid 2X leveraged ETFs. Sure, you can be right sometimes on day trades, and these ETFs can boost returns at times. But when you are wrong, you can be very wrong. AGQ fell 50% last week, with a single day drop of 60% on Thursday, when silver fell the most on record. You know, when you are down 60%, you need a gain of 150% just to break even. Math is harsh.

Leverage = BAD! We are always telling our 5i Research clients to avoid 2X leveraged ETFs. Sure, you can be right sometimes on day trades, and these ETFs can boost returns at times. But when you are wrong, you can be very wrong. AGQ fell 50% last week, with a single day drop of 60% on Thursday, when silver fell the most on record. You know, when you are down 60%, you need a gain of 150% just to break even. Math is harsh.

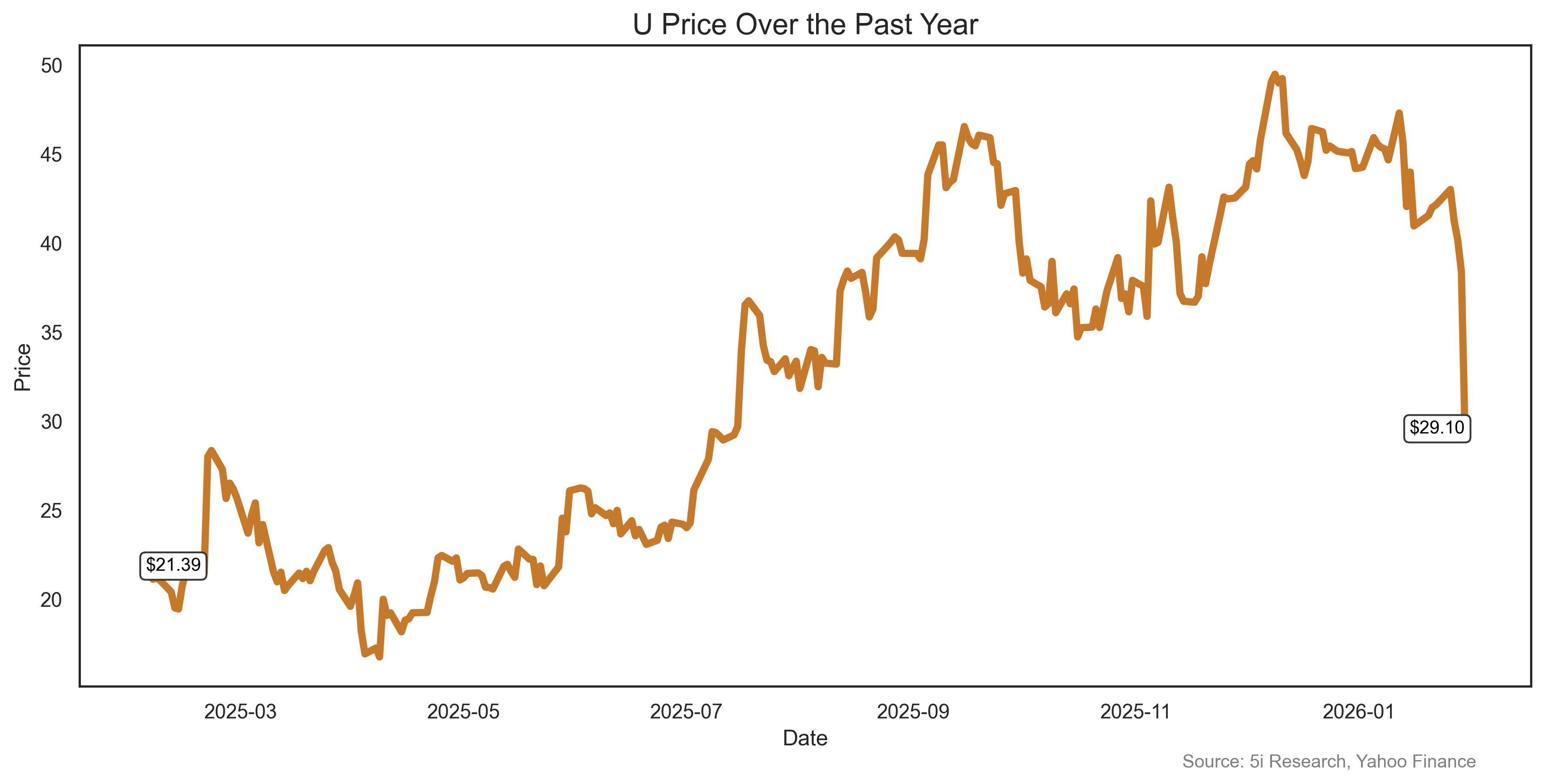

Unity Software U

Is Alphabet (GOOG) just going to kill everything? GOOG has already more or less won the AI game. It has more autonomous miles driven than Tesla. It makes a bazillion dollars a year. We did the math: GOOG makes $414 million in cash flow each day. $17 million per hour. GOOG used some of that dough to create Project Geni, which allows users to create whole new video worlds and games. The gaming sector, companies such as Unity and Roblox, did not like this news. Unity fell 31% last week on this news.

Is Alphabet (GOOG) just going to kill everything? GOOG has already more or less won the AI game. It has more autonomous miles driven than Tesla. It makes a bazillion dollars a year. We did the math: GOOG makes $414 million in cash flow each day. $17 million per hour. GOOG used some of that dough to create Project Geni, which allows users to create whole new video worlds and games. The gaming sector, companies such as Unity and Roblox, did not like this news. Unity fell 31% last week on this news.

Is Alphabet (GOOG) just going to kill everything? GOOG has already more or less won the AI game. It has more autonomous miles driven than Tesla. It makes a bazillion dollars a year. We did the math: GOOG makes $414 million in cash flow each day. $17 million per hour. GOOG used some of that dough to create Project Geni, which allows users to create whole new video worlds and games. The gaming sector, companies such as Unity and Roblox, did not like this news. Unity fell 31% last week on this news.

Is Alphabet (GOOG) just going to kill everything? GOOG has already more or less won the AI game. It has more autonomous miles driven than Tesla. It makes a bazillion dollars a year. We did the math: GOOG makes $414 million in cash flow each day. $17 million per hour. GOOG used some of that dough to create Project Geni, which allows users to create whole new video worlds and games. The gaming sector, companies such as Unity and Roblox, did not like this news. Unity fell 31% last week on this news.

Take Care,

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report do not have a financial or other interest in securities mentioned. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.