5i Research Weekly Rockets and Duds

After a week off, 5i Research's Stock Market Rockets and Duds is back with five big moving stocks. Here goes:

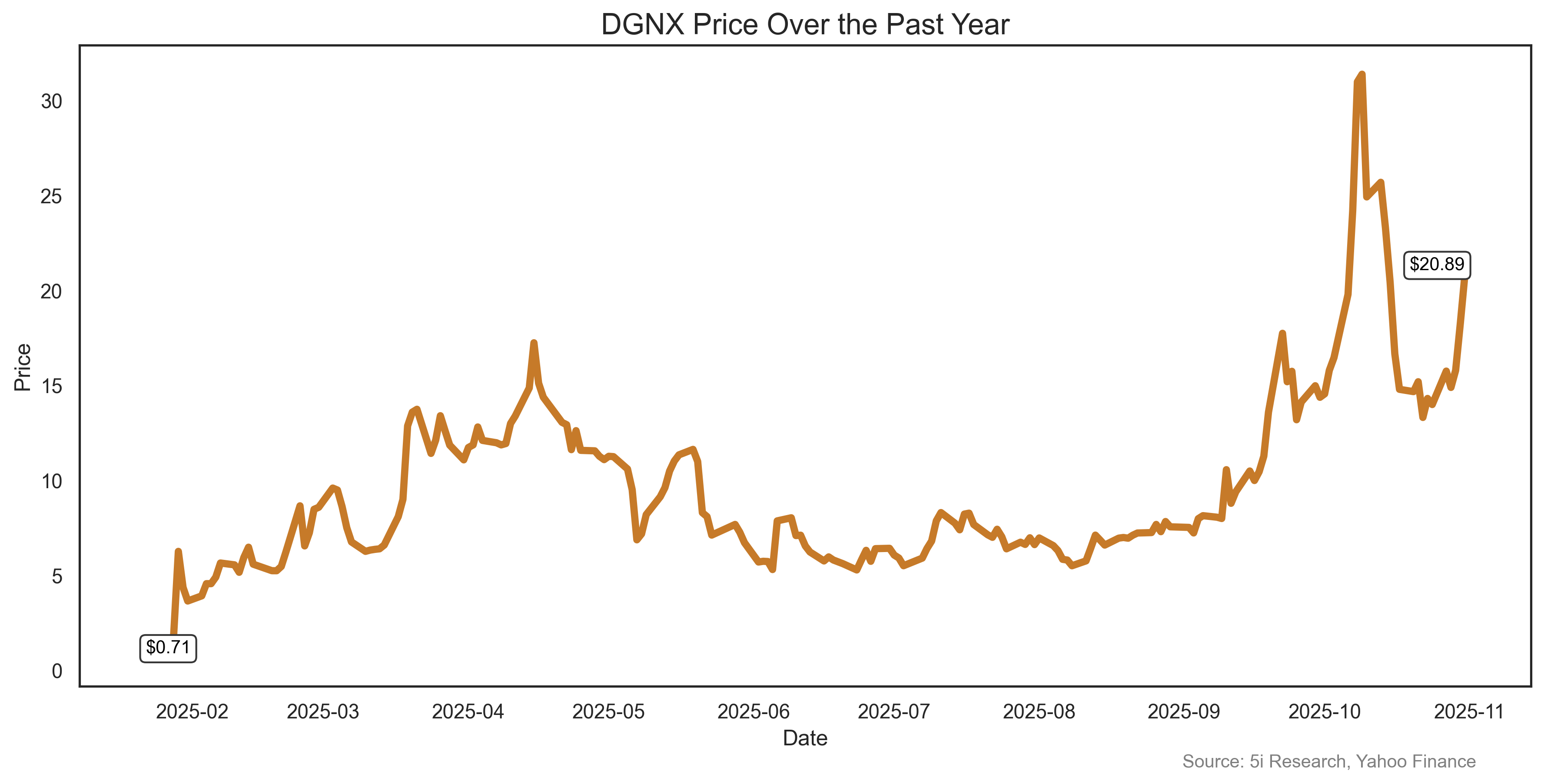

Dignext DGNX

Diginex Ltd. went public in January at $4.10 and shareholders have made out like bandits, with the stock now $21, after last week's gain of 49%. We don't know what a 'diginex' is (there is no meaning and it is a made-up word) but this week DGNX launched its diginexGHG, an AI-automated corporate carbon footprint solution certified according to Greehhouse Gas Protocols. We are not entirely sure what that is either. But investors loved the press release, so that's what counts!

Diginex Ltd. went public in January at $4.10 and shareholders have made out like bandits, with the stock now $21, after last week's gain of 49%. We don't know what a 'diginex' is (there is no meaning and it is a made-up word) but this week DGNX launched its diginexGHG, an AI-automated corporate carbon footprint solution certified according to Greehhouse Gas Protocols. We are not entirely sure what that is either. But investors loved the press release, so that's what counts!

Diginex Ltd. went public in January at $4.10 and shareholders have made out like bandits, with the stock now $21, after last week's gain of 49%. We don't know what a 'diginex' is (there is no meaning and it is a made-up word) but this week DGNX launched its diginexGHG, an AI-automated corporate carbon footprint solution certified according to Greehhouse Gas Protocols. We are not entirely sure what that is either. But investors loved the press release, so that's what counts!

Diginex Ltd. went public in January at $4.10 and shareholders have made out like bandits, with the stock now $21, after last week's gain of 49%. We don't know what a 'diginex' is (there is no meaning and it is a made-up word) but this week DGNX launched its diginexGHG, an AI-automated corporate carbon footprint solution certified according to Greehhouse Gas Protocols. We are not entirely sure what that is either. But investors loved the press release, so that's what counts!

Avidity Biosciences RNA

Last week saw lots of action in the mergers and acquisition space in the biotech sector. RNA soared 42% last week as Novartis agreed to buy the company for $12 billion, a 46% premium to its prior price. Avidity is developing antibody oligonucleotide conjugates (AOCs), a novel RNA delivery technology that enables RNA drugs to reach muscle tissue, addressing genetic neuromuscular conditions such as Duchenne muscular dystrophy, facioscapulohumeral muscular dystrophy, and myotonic dystrophy type 1. These three therapies are in late-stage clinical trials, with potential approval filings expected starting in early 2026.

Last week saw lots of action in the mergers and acquisition space in the biotech sector. RNA soared 42% last week as Novartis agreed to buy the company for $12 billion, a 46% premium to its prior price. Avidity is developing antibody oligonucleotide conjugates (AOCs), a novel RNA delivery technology that enables RNA drugs to reach muscle tissue, addressing genetic neuromuscular conditions such as Duchenne muscular dystrophy, facioscapulohumeral muscular dystrophy, and myotonic dystrophy type 1. These three therapies are in late-stage clinical trials, with potential approval filings expected starting in early 2026.

Last week saw lots of action in the mergers and acquisition space in the biotech sector. RNA soared 42% last week as Novartis agreed to buy the company for $12 billion, a 46% premium to its prior price. Avidity is developing antibody oligonucleotide conjugates (AOCs), a novel RNA delivery technology that enables RNA drugs to reach muscle tissue, addressing genetic neuromuscular conditions such as Duchenne muscular dystrophy, facioscapulohumeral muscular dystrophy, and myotonic dystrophy type 1. These three therapies are in late-stage clinical trials, with potential approval filings expected starting in early 2026.

Last week saw lots of action in the mergers and acquisition space in the biotech sector. RNA soared 42% last week as Novartis agreed to buy the company for $12 billion, a 46% premium to its prior price. Avidity is developing antibody oligonucleotide conjugates (AOCs), a novel RNA delivery technology that enables RNA drugs to reach muscle tissue, addressing genetic neuromuscular conditions such as Duchenne muscular dystrophy, facioscapulohumeral muscular dystrophy, and myotonic dystrophy type 1. These three therapies are in late-stage clinical trials, with potential approval filings expected starting in early 2026.

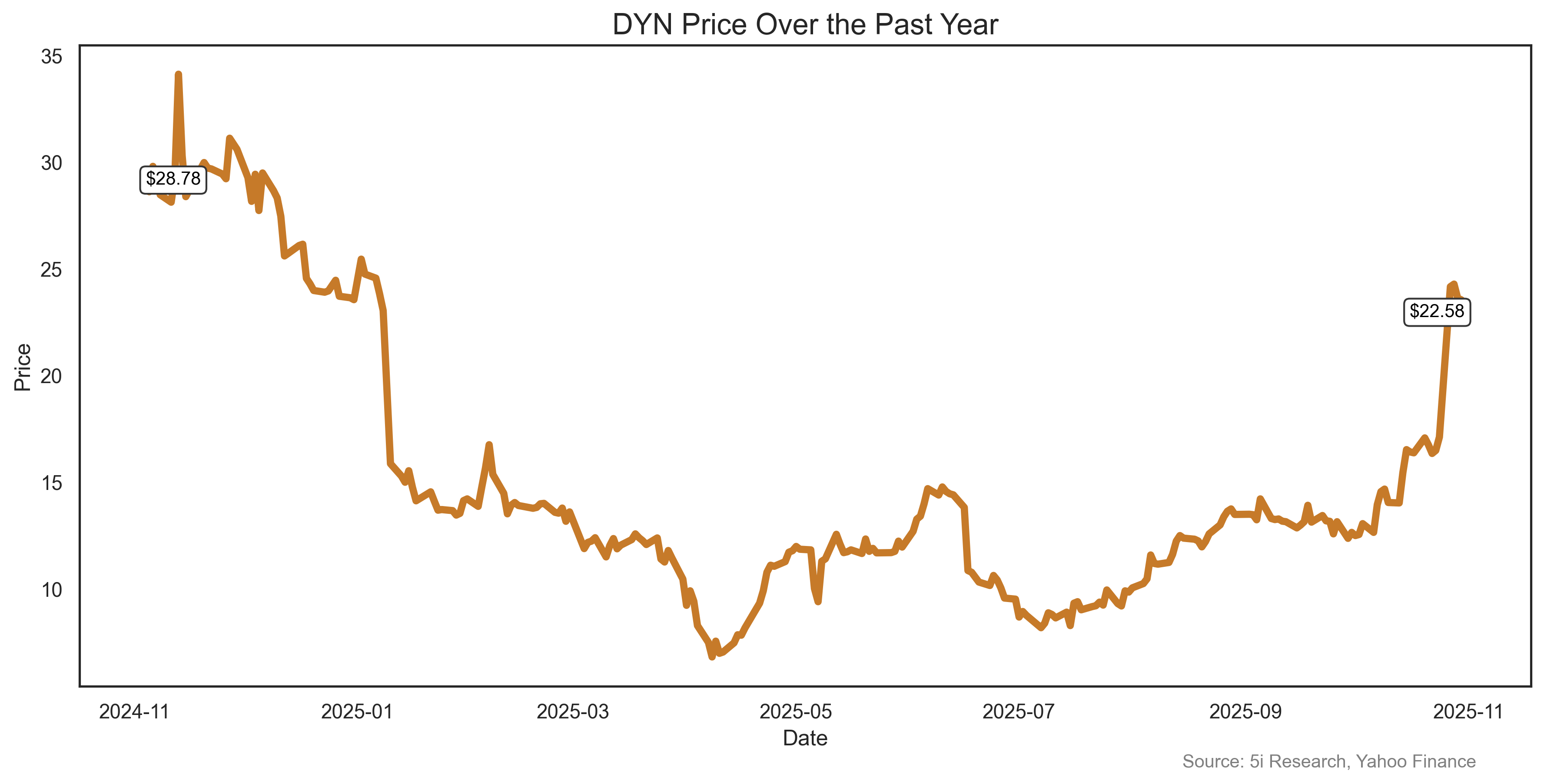

Dyne Therapeutics DYN

Still in the biotech space, Dyne rose 39% last week as it too, is in the targeted RNA delivery to the muscle sector, like Avidity. Morgan Stanley reminded investors that if someone likes Avidity enough to buy it, Dyne might attract a suitor, too. Still, despite all the excitement, Dyne stock is still down 4% in 2025.

Still in the biotech space, Dyne rose 39% last week as it too, is in the targeted RNA delivery to the muscle sector, like Avidity. Morgan Stanley reminded investors that if someone likes Avidity enough to buy it, Dyne might attract a suitor, too. Still, despite all the excitement, Dyne stock is still down 4% in 2025.

Still in the biotech space, Dyne rose 39% last week as it too, is in the targeted RNA delivery to the muscle sector, like Avidity. Morgan Stanley reminded investors that if someone likes Avidity enough to buy it, Dyne might attract a suitor, too. Still, despite all the excitement, Dyne stock is still down 4% in 2025.

Still in the biotech space, Dyne rose 39% last week as it too, is in the targeted RNA delivery to the muscle sector, like Avidity. Morgan Stanley reminded investors that if someone likes Avidity enough to buy it, Dyne might attract a suitor, too. Still, despite all the excitement, Dyne stock is still down 4% in 2025.

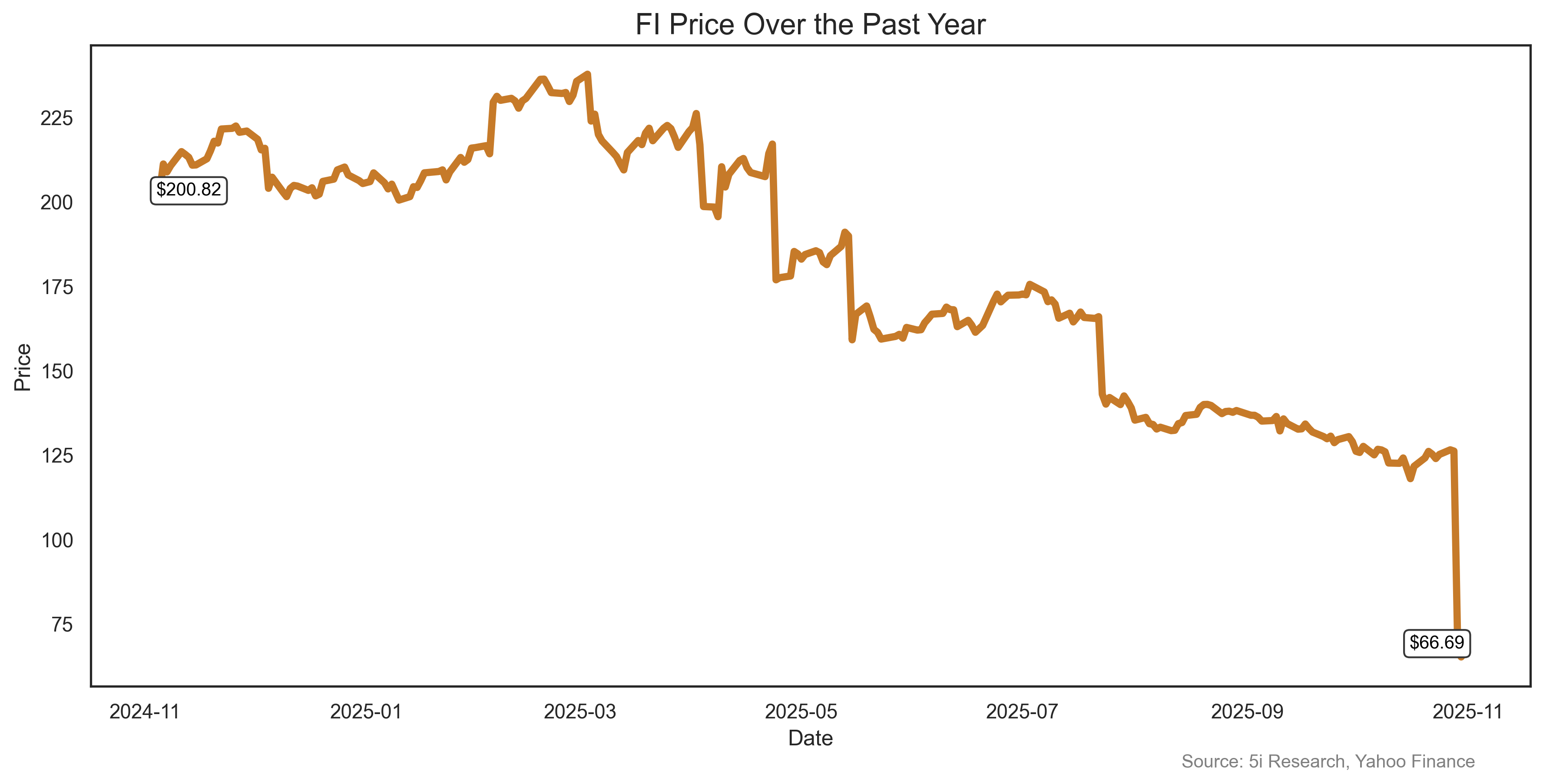

Fiserv Inc. FI

It's not every week that a (former) $100 billion company makes it onto our Rockets and Duds list. But then again it's not every week that a stock in the S&P 500 index falls 47% in a single week, as FI did last week. It's now down 67% for the year, and might get kicked out of the prestigious S&P index, at this rate. FI wiped out $30 billion in investor value, with an 'abysmal' forecast. Kudos go out to Rothschild analyst Dominic Ball, the single only analyst that had a SELL rating on the stock, while 80% of analysts loved it and a few were neutral. Mr. Ball is just 26 years old, so chalk one up to the youth squad.

It's not every week that a (former) $100 billion company makes it onto our Rockets and Duds list. But then again it's not every week that a stock in the S&P 500 index falls 47% in a single week, as FI did last week. It's now down 67% for the year, and might get kicked out of the prestigious S&P index, at this rate. FI wiped out $30 billion in investor value, with an 'abysmal' forecast. Kudos go out to Rothschild analyst Dominic Ball, the single only analyst that had a SELL rating on the stock, while 80% of analysts loved it and a few were neutral. Mr. Ball is just 26 years old, so chalk one up to the youth squad.

It's not every week that a (former) $100 billion company makes it onto our Rockets and Duds list. But then again it's not every week that a stock in the S&P 500 index falls 47% in a single week, as FI did last week. It's now down 67% for the year, and might get kicked out of the prestigious S&P index, at this rate. FI wiped out $30 billion in investor value, with an 'abysmal' forecast. Kudos go out to Rothschild analyst Dominic Ball, the single only analyst that had a SELL rating on the stock, while 80% of analysts loved it and a few were neutral. Mr. Ball is just 26 years old, so chalk one up to the youth squad.

It's not every week that a (former) $100 billion company makes it onto our Rockets and Duds list. But then again it's not every week that a stock in the S&P 500 index falls 47% in a single week, as FI did last week. It's now down 67% for the year, and might get kicked out of the prestigious S&P index, at this rate. FI wiped out $30 billion in investor value, with an 'abysmal' forecast. Kudos go out to Rothschild analyst Dominic Ball, the single only analyst that had a SELL rating on the stock, while 80% of analysts loved it and a few were neutral. Mr. Ball is just 26 years old, so chalk one up to the youth squad.

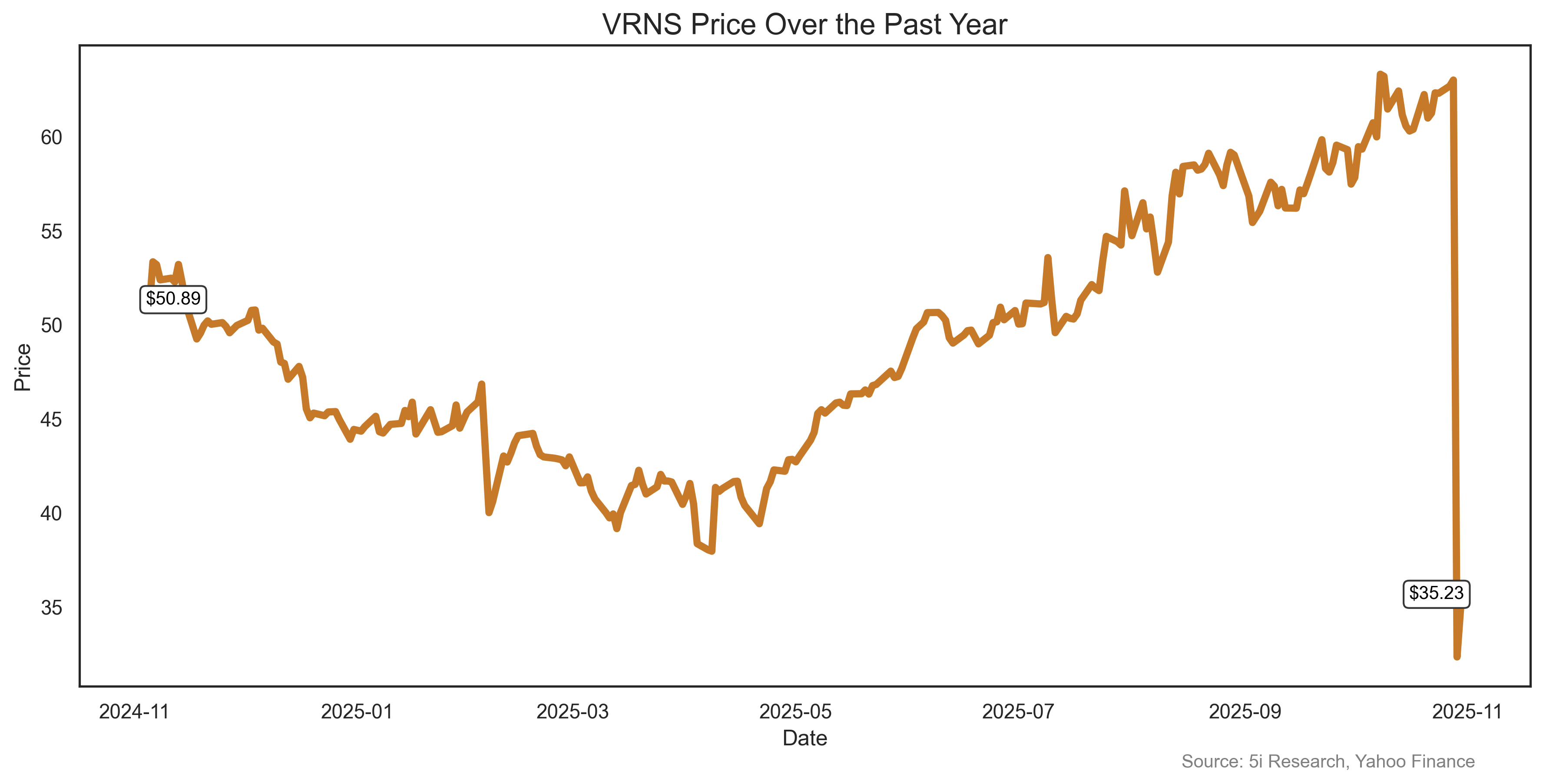

Varonis Systems VRNS.

We thought data security and database management was going to be a huge growth industry with the advent of AI. The robots are getting so smart we can barely tell what's real or fake anymore. Doesn't that mean data and security companies should do well? Well, maybe not. Varonis fell 44% last week on weak guidance and missed revenue. Renewal rates slowed down, scaring investors. We do not know this company too well, but we are sure its price-to-earnings ratio of 266 times had nothing to do with the decline, right?

We thought data security and database management was going to be a huge growth industry with the advent of AI. The robots are getting so smart we can barely tell what's real or fake anymore. Doesn't that mean data and security companies should do well? Well, maybe not. Varonis fell 44% last week on weak guidance and missed revenue. Renewal rates slowed down, scaring investors. We do not know this company too well, but we are sure its price-to-earnings ratio of 266 times had nothing to do with the decline, right?

We thought data security and database management was going to be a huge growth industry with the advent of AI. The robots are getting so smart we can barely tell what's real or fake anymore. Doesn't that mean data and security companies should do well? Well, maybe not. Varonis fell 44% last week on weak guidance and missed revenue. Renewal rates slowed down, scaring investors. We do not know this company too well, but we are sure its price-to-earnings ratio of 266 times had nothing to do with the decline, right?

We thought data security and database management was going to be a huge growth industry with the advent of AI. The robots are getting so smart we can barely tell what's real or fake anymore. Doesn't that mean data and security companies should do well? Well, maybe not. Varonis fell 44% last week on weak guidance and missed revenue. Renewal rates slowed down, scaring investors. We do not know this company too well, but we are sure its price-to-earnings ratio of 266 times had nothing to do with the decline, right?

Take Care,

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report have a financial or other interest in FI. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.