5i Research Weekly Rockets and Duds

Last week was rougher-than-usual in the stock market, but we still found a lot of stocks that ROCKETED up and several that were DUDS. Let's go:

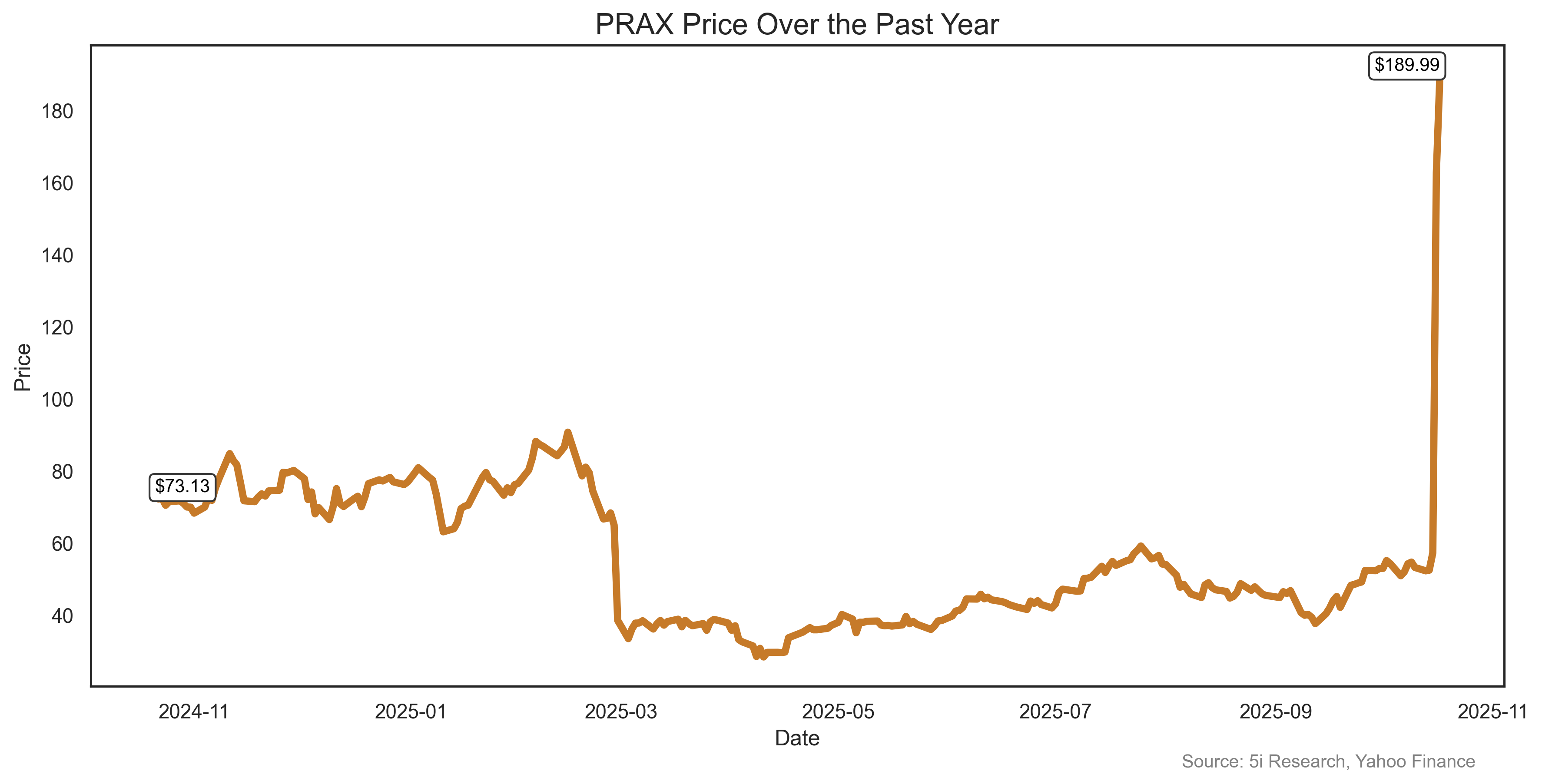

Praxis Precision Medicines Inc. PRAX

Forget bitcoin, forget gold, forget AI. The key to stock market riches clearly seems to be in picking biotech winners. PRAX soared 257% last week on news that two late-stage studies of its experimental therapy to treat tremors met their primary endpoints. Guggenheim analyst Yatin Suneja said the treatment has 'blockbuster' potential. Praxis used the good news to quickly raise $400 million in a stock sale, but even that didn't stop the shares, as shares just kept moving higher post-issue. Shareholders of Praxis still had tremors, but they were the good kind: shaking with excitement about how much money they are making.

Forget bitcoin, forget gold, forget AI. The key to stock market riches clearly seems to be in picking biotech winners. PRAX soared 257% last week on news that two late-stage studies of its experimental therapy to treat tremors met their primary endpoints. Guggenheim analyst Yatin Suneja said the treatment has 'blockbuster' potential. Praxis used the good news to quickly raise $400 million in a stock sale, but even that didn't stop the shares, as shares just kept moving higher post-issue. Shareholders of Praxis still had tremors, but they were the good kind: shaking with excitement about how much money they are making.

Forget bitcoin, forget gold, forget AI. The key to stock market riches clearly seems to be in picking biotech winners. PRAX soared 257% last week on news that two late-stage studies of its experimental therapy to treat tremors met their primary endpoints. Guggenheim analyst Yatin Suneja said the treatment has 'blockbuster' potential. Praxis used the good news to quickly raise $400 million in a stock sale, but even that didn't stop the shares, as shares just kept moving higher post-issue. Shareholders of Praxis still had tremors, but they were the good kind: shaking with excitement about how much money they are making.

Forget bitcoin, forget gold, forget AI. The key to stock market riches clearly seems to be in picking biotech winners. PRAX soared 257% last week on news that two late-stage studies of its experimental therapy to treat tremors met their primary endpoints. Guggenheim analyst Yatin Suneja said the treatment has 'blockbuster' potential. Praxis used the good news to quickly raise $400 million in a stock sale, but even that didn't stop the shares, as shares just kept moving higher post-issue. Shareholders of Praxis still had tremors, but they were the good kind: shaking with excitement about how much money they are making.

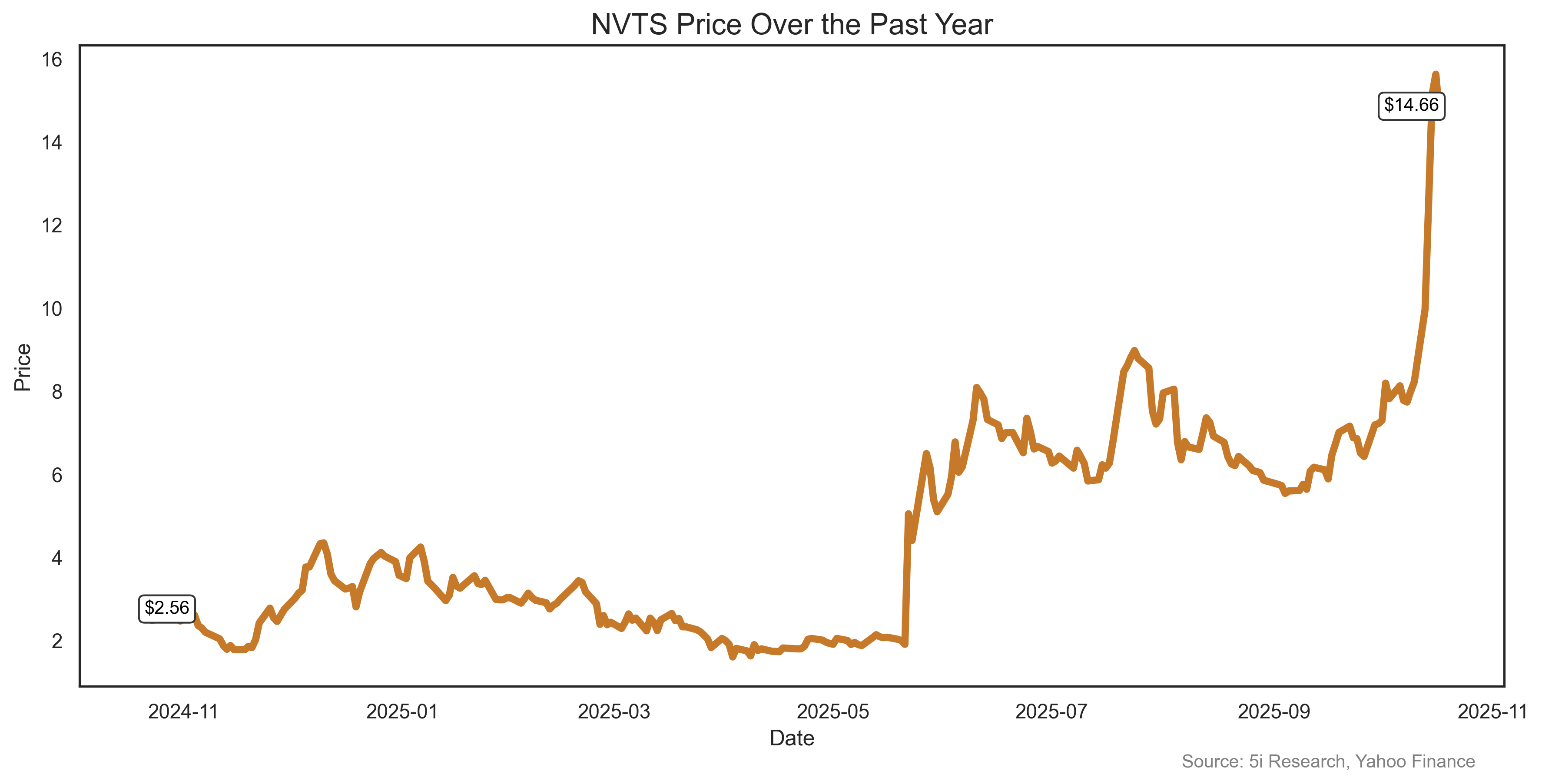

Navitas Semiconductor Corporation NVTS

NVTS is getting a lot of hype, and is up 300% this year. However, sales are low, and sales are actually lower than they were three years ago. Navitas was the first to market with fully integrated GaN power ICs. Its GaNFast chips integrate power transistors, drivers, control, and protection circuits on a single monolithic die, replacing multiple silicon components. This integration leads to faster switching (up to 100×), ultra-low resistance, smaller components, and reduced energy loss compared to conventional silicon power designs. This 'should' be good if it can scale production and have high margins. There are a lot of high expectations here, but investors believe in its technology. It rose 78% last week. Earlier in October it partnered with that little company called Nvidia Inc.

NVTS is getting a lot of hype, and is up 300% this year. However, sales are low, and sales are actually lower than they were three years ago. Navitas was the first to market with fully integrated GaN power ICs. Its GaNFast chips integrate power transistors, drivers, control, and protection circuits on a single monolithic die, replacing multiple silicon components. This integration leads to faster switching (up to 100×), ultra-low resistance, smaller components, and reduced energy loss compared to conventional silicon power designs. This 'should' be good if it can scale production and have high margins. There are a lot of high expectations here, but investors believe in its technology. It rose 78% last week. Earlier in October it partnered with that little company called Nvidia Inc.

NVTS is getting a lot of hype, and is up 300% this year. However, sales are low, and sales are actually lower than they were three years ago. Navitas was the first to market with fully integrated GaN power ICs. Its GaNFast chips integrate power transistors, drivers, control, and protection circuits on a single monolithic die, replacing multiple silicon components. This integration leads to faster switching (up to 100×), ultra-low resistance, smaller components, and reduced energy loss compared to conventional silicon power designs. This 'should' be good if it can scale production and have high margins. There are a lot of high expectations here, but investors believe in its technology. It rose 78% last week. Earlier in October it partnered with that little company called Nvidia Inc.

NVTS is getting a lot of hype, and is up 300% this year. However, sales are low, and sales are actually lower than they were three years ago. Navitas was the first to market with fully integrated GaN power ICs. Its GaNFast chips integrate power transistors, drivers, control, and protection circuits on a single monolithic die, replacing multiple silicon components. This integration leads to faster switching (up to 100×), ultra-low resistance, smaller components, and reduced energy loss compared to conventional silicon power designs. This 'should' be good if it can scale production and have high margins. There are a lot of high expectations here, but investors believe in its technology. It rose 78% last week. Earlier in October it partnered with that little company called Nvidia Inc.

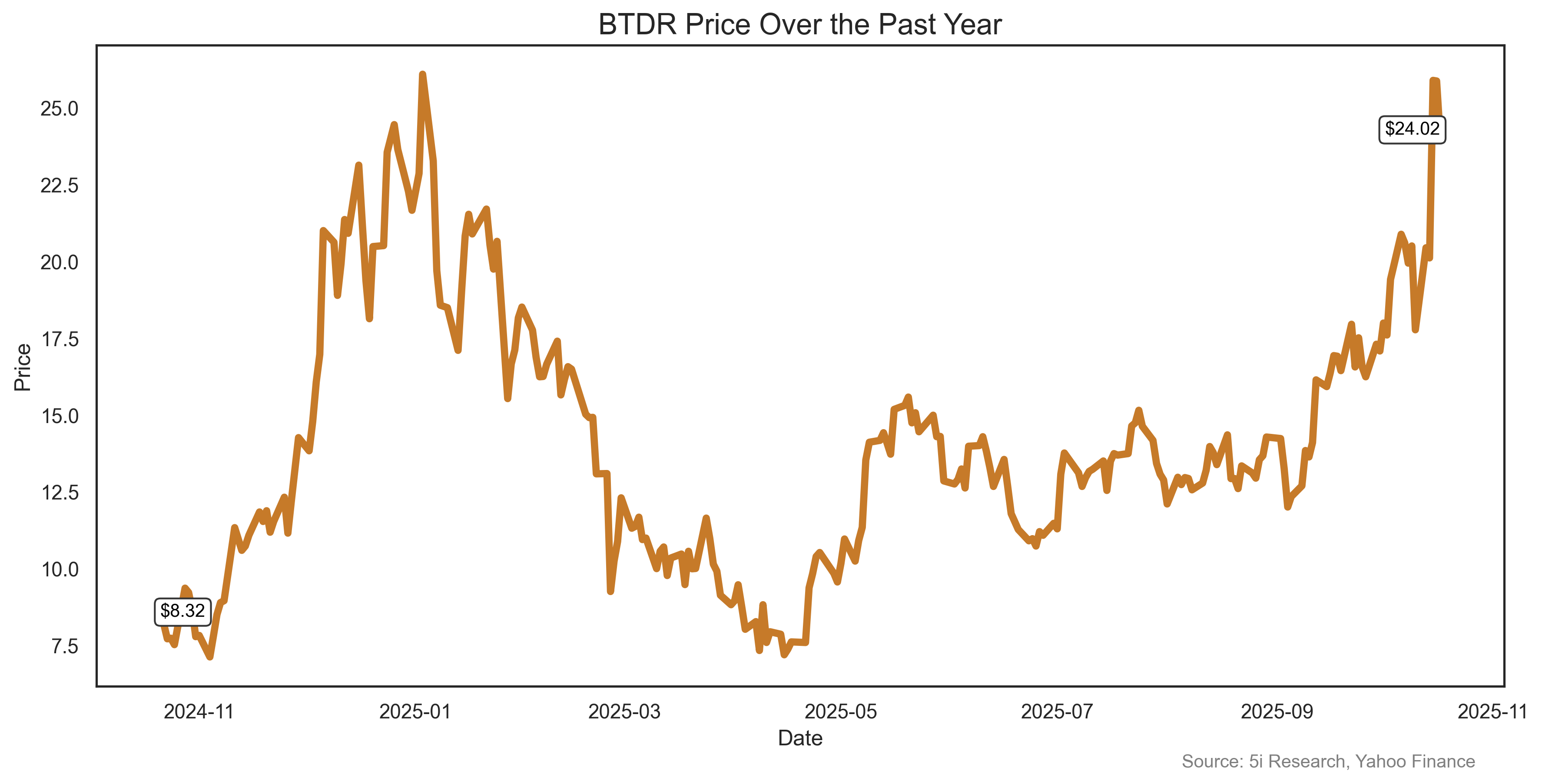

Bitdeer Technologies Group BTDR

How lucky can bitcoin miners get? First, their stocks soar as bitcoin climbs to near-daily records. Then, the bitcoin miners realize that their facilities are perfectly set up to shift to data centres, with power contracts and capacity already in place. Bitdeer is just another in a long line of companies in crypto making the switch to datacentres, and shares rose 35% last week. With a site conversion and GPUs to be bought (hello, Nvidia), Bitdeer is targeting $2 billion in annual recurring revenue from datacentres by the end of 2026. With market cap barely over $4 billion, investors heated up with excitement knowing their company is involved in two of the hottest of sectors right now.

How lucky can bitcoin miners get? First, their stocks soar as bitcoin climbs to near-daily records. Then, the bitcoin miners realize that their facilities are perfectly set up to shift to data centres, with power contracts and capacity already in place. Bitdeer is just another in a long line of companies in crypto making the switch to datacentres, and shares rose 35% last week. With a site conversion and GPUs to be bought (hello, Nvidia), Bitdeer is targeting $2 billion in annual recurring revenue from datacentres by the end of 2026. With market cap barely over $4 billion, investors heated up with excitement knowing their company is involved in two of the hottest of sectors right now.

How lucky can bitcoin miners get? First, their stocks soar as bitcoin climbs to near-daily records. Then, the bitcoin miners realize that their facilities are perfectly set up to shift to data centres, with power contracts and capacity already in place. Bitdeer is just another in a long line of companies in crypto making the switch to datacentres, and shares rose 35% last week. With a site conversion and GPUs to be bought (hello, Nvidia), Bitdeer is targeting $2 billion in annual recurring revenue from datacentres by the end of 2026. With market cap barely over $4 billion, investors heated up with excitement knowing their company is involved in two of the hottest of sectors right now.

How lucky can bitcoin miners get? First, their stocks soar as bitcoin climbs to near-daily records. Then, the bitcoin miners realize that their facilities are perfectly set up to shift to data centres, with power contracts and capacity already in place. Bitdeer is just another in a long line of companies in crypto making the switch to datacentres, and shares rose 35% last week. With a site conversion and GPUs to be bought (hello, Nvidia), Bitdeer is targeting $2 billion in annual recurring revenue from datacentres by the end of 2026. With market cap barely over $4 billion, investors heated up with excitement knowing their company is involved in two of the hottest of sectors right now.

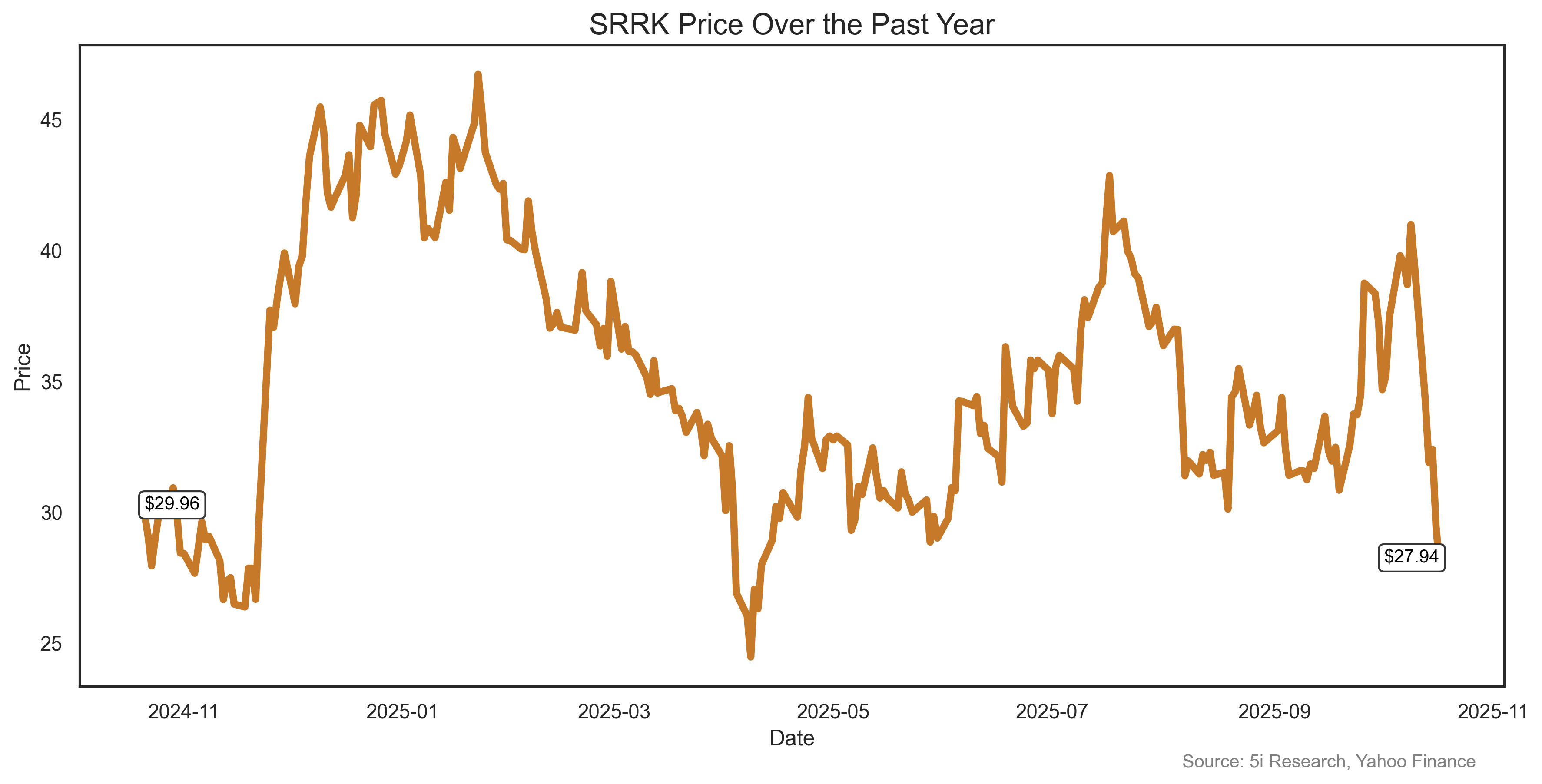

Scholar Rock Holding Corporation SRRK

-29%. It's time for Scholar to study harder. Mid-terms are coming up! Scholar had a tough September after the FDA rejected the company's application for a treatment of a muscle disorder, and October is not going any better for the company. Last week shares fell 29% as the FDA officially recommended administration actions against a third-party plant that is used by Scholar. That third party is Novo Nordisk, which has its own problems with Trump now randomly dictating what drug prices should be. Analysts say the actions could delay the launch of a new drug by Scholar by as much as a year.

-29%. It's time for Scholar to study harder. Mid-terms are coming up! Scholar had a tough September after the FDA rejected the company's application for a treatment of a muscle disorder, and October is not going any better for the company. Last week shares fell 29% as the FDA officially recommended administration actions against a third-party plant that is used by Scholar. That third party is Novo Nordisk, which has its own problems with Trump now randomly dictating what drug prices should be. Analysts say the actions could delay the launch of a new drug by Scholar by as much as a year.

-29%. It's time for Scholar to study harder. Mid-terms are coming up! Scholar had a tough September after the FDA rejected the company's application for a treatment of a muscle disorder, and October is not going any better for the company. Last week shares fell 29% as the FDA officially recommended administration actions against a third-party plant that is used by Scholar. That third party is Novo Nordisk, which has its own problems with Trump now randomly dictating what drug prices should be. Analysts say the actions could delay the launch of a new drug by Scholar by as much as a year.

-29%. It's time for Scholar to study harder. Mid-terms are coming up! Scholar had a tough September after the FDA rejected the company's application for a treatment of a muscle disorder, and October is not going any better for the company. Last week shares fell 29% as the FDA officially recommended administration actions against a third-party plant that is used by Scholar. That third party is Novo Nordisk, which has its own problems with Trump now randomly dictating what drug prices should be. Analysts say the actions could delay the launch of a new drug by Scholar by as much as a year.

Astera Labs, Inc. ALAB

Ah, competition. It's the oil in the engine that drives capitalism. Or something like that. But it's true: whenever there is high growth and high margins, competition will surely follow. ALAB was on the wrong side of this mantra last week, with a 23% decline on news that Arista Networks introduced a new Ethernet ecosystem, potentially threatening ALAB's cushy customer relationships with Meta and Microsoft. ALAB tried to fight this news with its own announcement that it was joining the Arm Ecosystem to accelerate custom AI chip development. But investors were in a bad mood and didn't care much about this, worrying more about that nasty thing called competition.

Ah, competition. It's the oil in the engine that drives capitalism. Or something like that. But it's true: whenever there is high growth and high margins, competition will surely follow. ALAB was on the wrong side of this mantra last week, with a 23% decline on news that Arista Networks introduced a new Ethernet ecosystem, potentially threatening ALAB's cushy customer relationships with Meta and Microsoft. ALAB tried to fight this news with its own announcement that it was joining the Arm Ecosystem to accelerate custom AI chip development. But investors were in a bad mood and didn't care much about this, worrying more about that nasty thing called competition.

Ah, competition. It's the oil in the engine that drives capitalism. Or something like that. But it's true: whenever there is high growth and high margins, competition will surely follow. ALAB was on the wrong side of this mantra last week, with a 23% decline on news that Arista Networks introduced a new Ethernet ecosystem, potentially threatening ALAB's cushy customer relationships with Meta and Microsoft. ALAB tried to fight this news with its own announcement that it was joining the Arm Ecosystem to accelerate custom AI chip development. But investors were in a bad mood and didn't care much about this, worrying more about that nasty thing called competition.

Ah, competition. It's the oil in the engine that drives capitalism. Or something like that. But it's true: whenever there is high growth and high margins, competition will surely follow. ALAB was on the wrong side of this mantra last week, with a 23% decline on news that Arista Networks introduced a new Ethernet ecosystem, potentially threatening ALAB's cushy customer relationships with Meta and Microsoft. ALAB tried to fight this news with its own announcement that it was joining the Arm Ecosystem to accelerate custom AI chip development. But investors were in a bad mood and didn't care much about this, worrying more about that nasty thing called competition.

Take Care,

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report do not have a financial or other interest in securities mentioned. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.