5i Research Weekly Rockets and Duds

Welcome to another week of 5i Research Stock Market Rockets and Duds

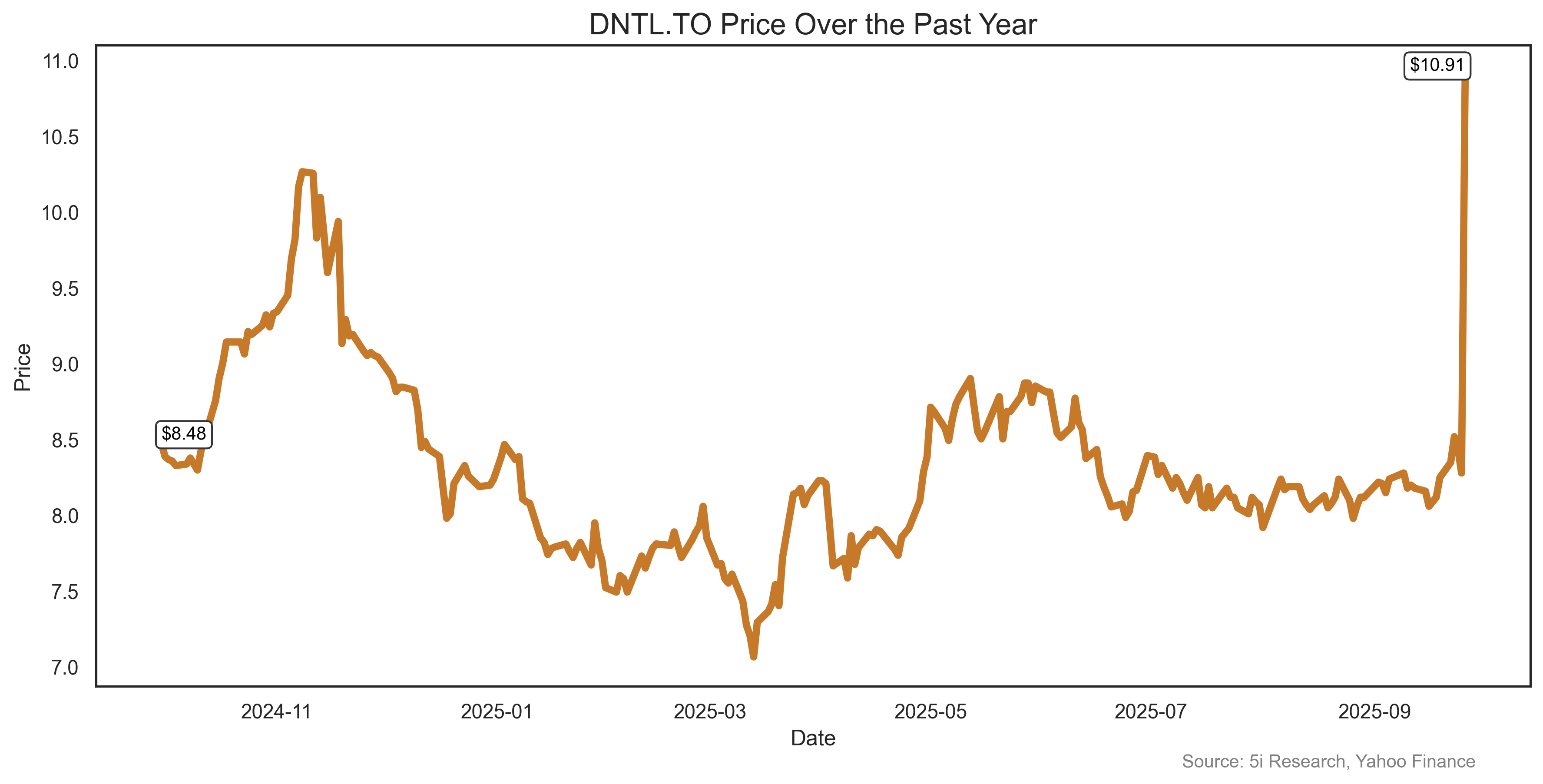

Dentalcorp Holdings Ltd. DNTL

Dentalcorp just made going to the dentist a lot easier, assuming you are a shareholder. DNTL rose 32% last week on news it was being acquired by the buyout shop GTCR. The $2.2 billion deal is at a 33% premium. And another mid cap Canadian company gets taken off the market.

Dentalcorp just made going to the dentist a lot easier, assuming you are a shareholder. DNTL rose 32% last week on news it was being acquired by the buyout shop GTCR. The $2.2 billion deal is at a 33% premium. And another mid cap Canadian company gets taken off the market.

Dentalcorp just made going to the dentist a lot easier, assuming you are a shareholder. DNTL rose 32% last week on news it was being acquired by the buyout shop GTCR. The $2.2 billion deal is at a 33% premium. And another mid cap Canadian company gets taken off the market.

Dentalcorp just made going to the dentist a lot easier, assuming you are a shareholder. DNTL rose 32% last week on news it was being acquired by the buyout shop GTCR. The $2.2 billion deal is at a 33% premium. And another mid cap Canadian company gets taken off the market.

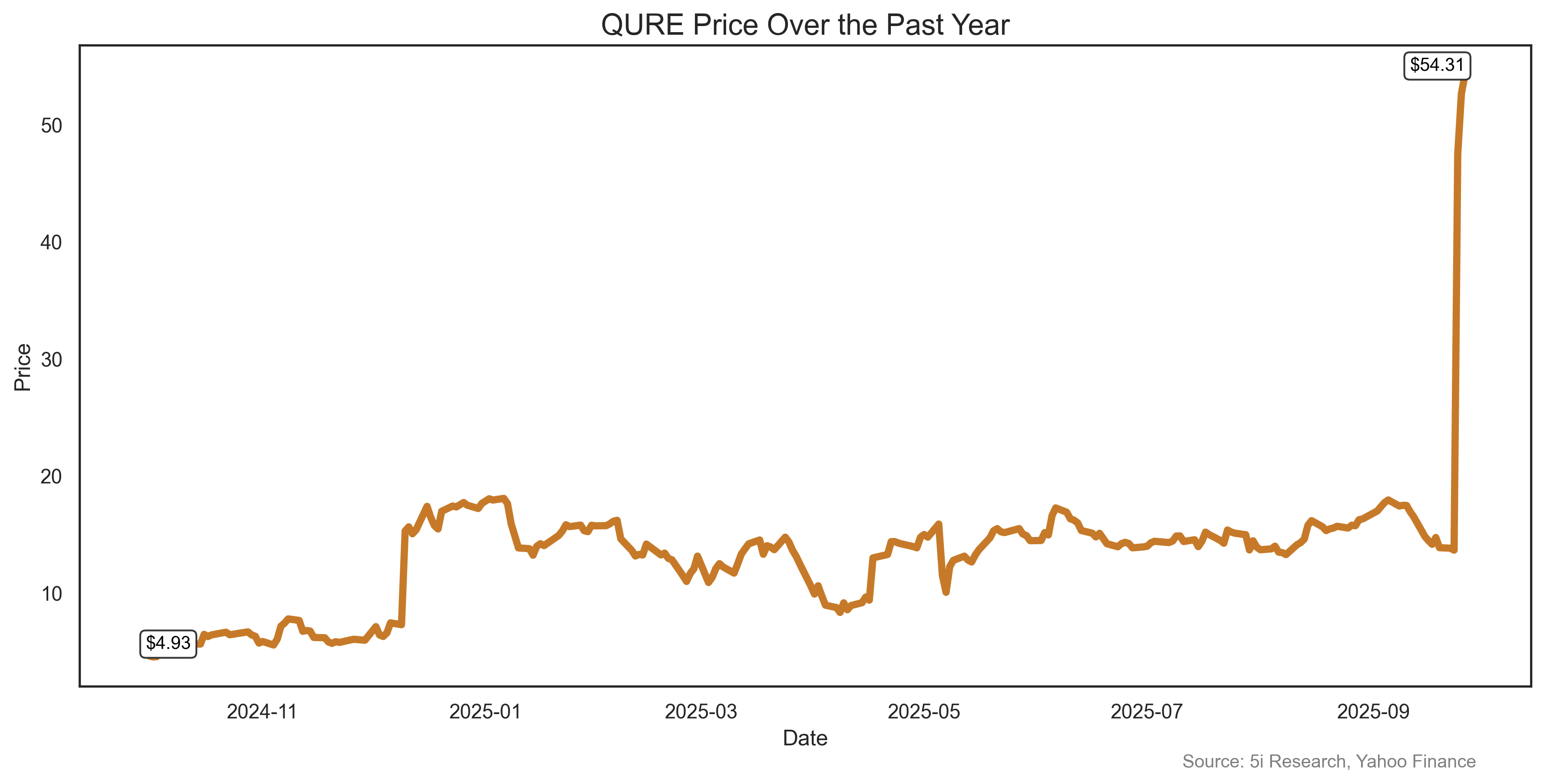

Uniqure NV QURE

QURE is a $3 billion biotech, with about $300 million in cash but only with $22 million expected in sales this year. But investors don't care about valuation when a company potentially has a new drug that could see huge sales. QURE rose 292% last week on news that its Phase I/II drug trial for its experimental treatment for patients with Huntington's disease met its primary endpoint. Huntington's is a horrible disease and the strong data could mean approval as early as next year, according to analysts. The company on Friday decided to take advantage of the big move and raise $300 million through a quick stock sale.

QURE is a $3 billion biotech, with about $300 million in cash but only with $22 million expected in sales this year. But investors don't care about valuation when a company potentially has a new drug that could see huge sales. QURE rose 292% last week on news that its Phase I/II drug trial for its experimental treatment for patients with Huntington's disease met its primary endpoint. Huntington's is a horrible disease and the strong data could mean approval as early as next year, according to analysts. The company on Friday decided to take advantage of the big move and raise $300 million through a quick stock sale.

QURE is a $3 billion biotech, with about $300 million in cash but only with $22 million expected in sales this year. But investors don't care about valuation when a company potentially has a new drug that could see huge sales. QURE rose 292% last week on news that its Phase I/II drug trial for its experimental treatment for patients with Huntington's disease met its primary endpoint. Huntington's is a horrible disease and the strong data could mean approval as early as next year, according to analysts. The company on Friday decided to take advantage of the big move and raise $300 million through a quick stock sale.

QURE is a $3 billion biotech, with about $300 million in cash but only with $22 million expected in sales this year. But investors don't care about valuation when a company potentially has a new drug that could see huge sales. QURE rose 292% last week on news that its Phase I/II drug trial for its experimental treatment for patients with Huntington's disease met its primary endpoint. Huntington's is a horrible disease and the strong data could mean approval as early as next year, according to analysts. The company on Friday decided to take advantage of the big move and raise $300 million through a quick stock sale.

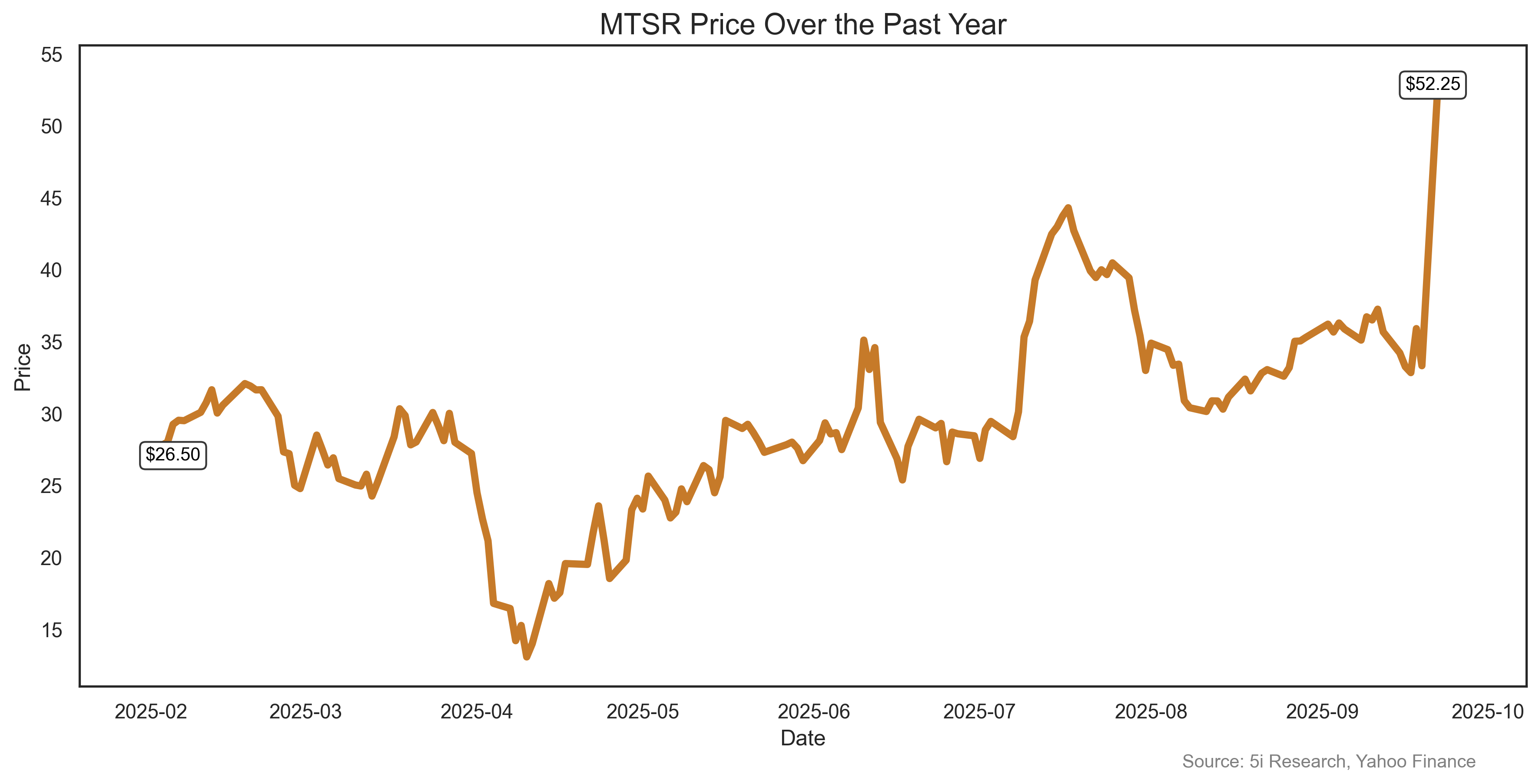

Metsera Inc. MTSR

Metsera shareholders and founders dreamed of riches when the company went public eight months ago at $18 per share. But we do not think that even in their wildest dreams did they think they would be taken over at a big premium less than eight months later. Pfizer Inc. (PFE) made a $47.50 cash bid for the company, sending shares up 57% last week. MTSR, like others, has an obesity-drug portfolio, but analysts have said that with the deal PFE gets an 'impressive obesity portfolio'. Interestingly, the deal has a potential additional $22.50 per share to MTSR shareholders if certain milestones are reached. Also interestingly, Pfizer gave up on its own obesity program only five months ago. Shareholdershere have made out like, um, fat cats?

Metsera shareholders and founders dreamed of riches when the company went public eight months ago at $18 per share. But we do not think that even in their wildest dreams did they think they would be taken over at a big premium less than eight months later. Pfizer Inc. (PFE) made a $47.50 cash bid for the company, sending shares up 57% last week. MTSR, like others, has an obesity-drug portfolio, but analysts have said that with the deal PFE gets an 'impressive obesity portfolio'. Interestingly, the deal has a potential additional $22.50 per share to MTSR shareholders if certain milestones are reached. Also interestingly, Pfizer gave up on its own obesity program only five months ago. Shareholdershere have made out like, um, fat cats?

Metsera shareholders and founders dreamed of riches when the company went public eight months ago at $18 per share. But we do not think that even in their wildest dreams did they think they would be taken over at a big premium less than eight months later. Pfizer Inc. (PFE) made a $47.50 cash bid for the company, sending shares up 57% last week. MTSR, like others, has an obesity-drug portfolio, but analysts have said that with the deal PFE gets an 'impressive obesity portfolio'. Interestingly, the deal has a potential additional $22.50 per share to MTSR shareholders if certain milestones are reached. Also interestingly, Pfizer gave up on its own obesity program only five months ago. Shareholdershere have made out like, um, fat cats?

Metsera shareholders and founders dreamed of riches when the company went public eight months ago at $18 per share. But we do not think that even in their wildest dreams did they think they would be taken over at a big premium less than eight months later. Pfizer Inc. (PFE) made a $47.50 cash bid for the company, sending shares up 57% last week. MTSR, like others, has an obesity-drug portfolio, but analysts have said that with the deal PFE gets an 'impressive obesity portfolio'. Interestingly, the deal has a potential additional $22.50 per share to MTSR shareholders if certain milestones are reached. Also interestingly, Pfizer gave up on its own obesity program only five months ago. Shareholdershere have made out like, um, fat cats?

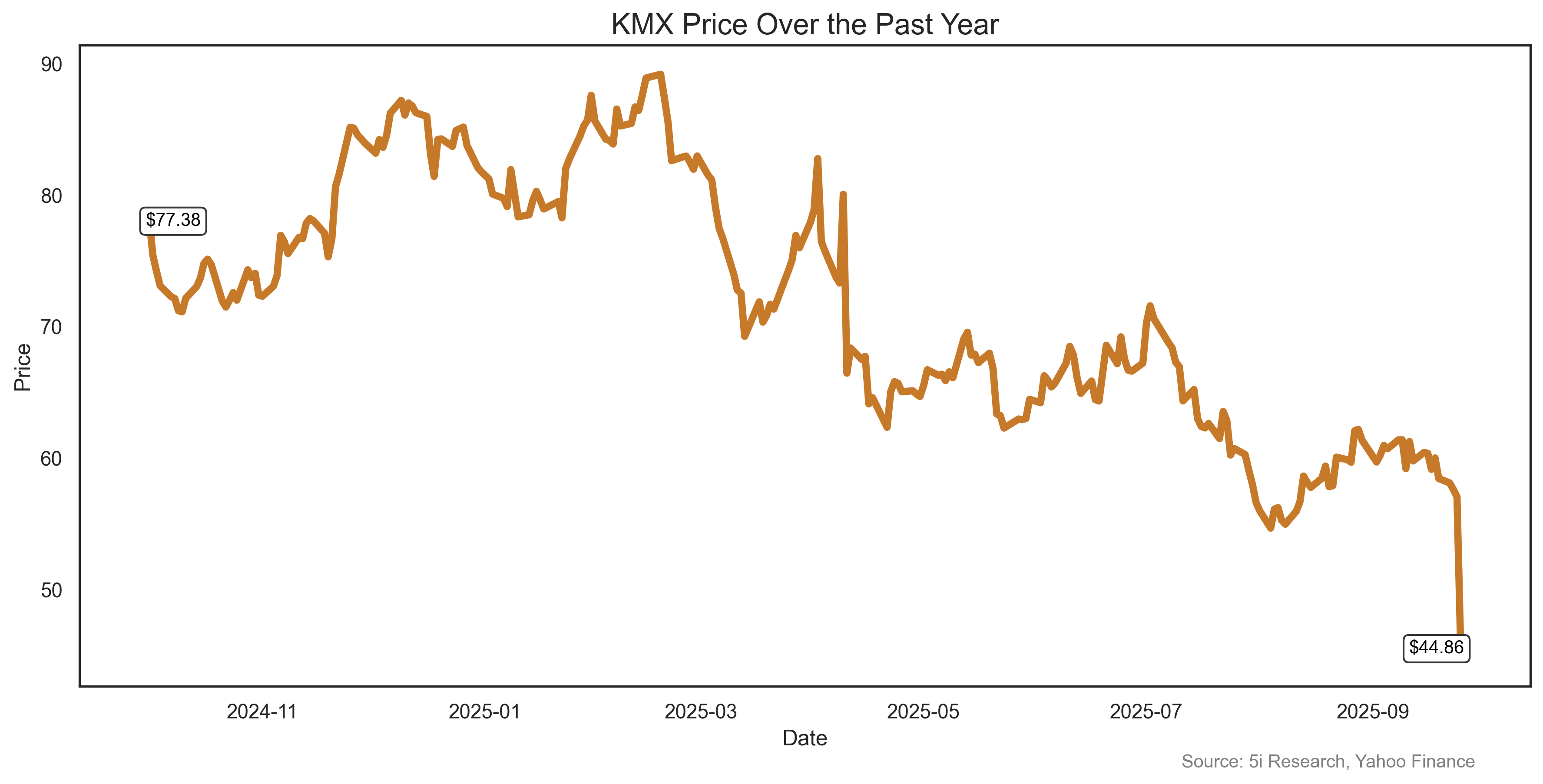

Carmax Inc. KMX

Nobody really likes used car salespeople, and that sentiment is not going to improve with recent results from Carmax, a $6.6 billion used vehicle sales company. KMX shares fell 23% on news that second-quarter earnings were not anywhere close to estimates. Analysts expected $1.04 per share, and the company delivered a LEMON--$0.64 per share. Same-store unit sales fell 6.3%, and analysts expected 1.1% growth. The results are particularly appalling since used-car prices remain buoyant. Is this a harbinger for rough economic times ahead? Could be. Meanwhile, let me show this hot little number that was only driven by an old lady once a week to church.

Nobody really likes used car salespeople, and that sentiment is not going to improve with recent results from Carmax, a $6.6 billion used vehicle sales company. KMX shares fell 23% on news that second-quarter earnings were not anywhere close to estimates. Analysts expected $1.04 per share, and the company delivered a LEMON--$0.64 per share. Same-store unit sales fell 6.3%, and analysts expected 1.1% growth. The results are particularly appalling since used-car prices remain buoyant. Is this a harbinger for rough economic times ahead? Could be. Meanwhile, let me show this hot little number that was only driven by an old lady once a week to church.

Nobody really likes used car salespeople, and that sentiment is not going to improve with recent results from Carmax, a $6.6 billion used vehicle sales company. KMX shares fell 23% on news that second-quarter earnings were not anywhere close to estimates. Analysts expected $1.04 per share, and the company delivered a LEMON--$0.64 per share. Same-store unit sales fell 6.3%, and analysts expected 1.1% growth. The results are particularly appalling since used-car prices remain buoyant. Is this a harbinger for rough economic times ahead? Could be. Meanwhile, let me show this hot little number that was only driven by an old lady once a week to church.

Nobody really likes used car salespeople, and that sentiment is not going to improve with recent results from Carmax, a $6.6 billion used vehicle sales company. KMX shares fell 23% on news that second-quarter earnings were not anywhere close to estimates. Analysts expected $1.04 per share, and the company delivered a LEMON--$0.64 per share. Same-store unit sales fell 6.3%, and analysts expected 1.1% growth. The results are particularly appalling since used-car prices remain buoyant. Is this a harbinger for rough economic times ahead? Could be. Meanwhile, let me show this hot little number that was only driven by an old lady once a week to church.

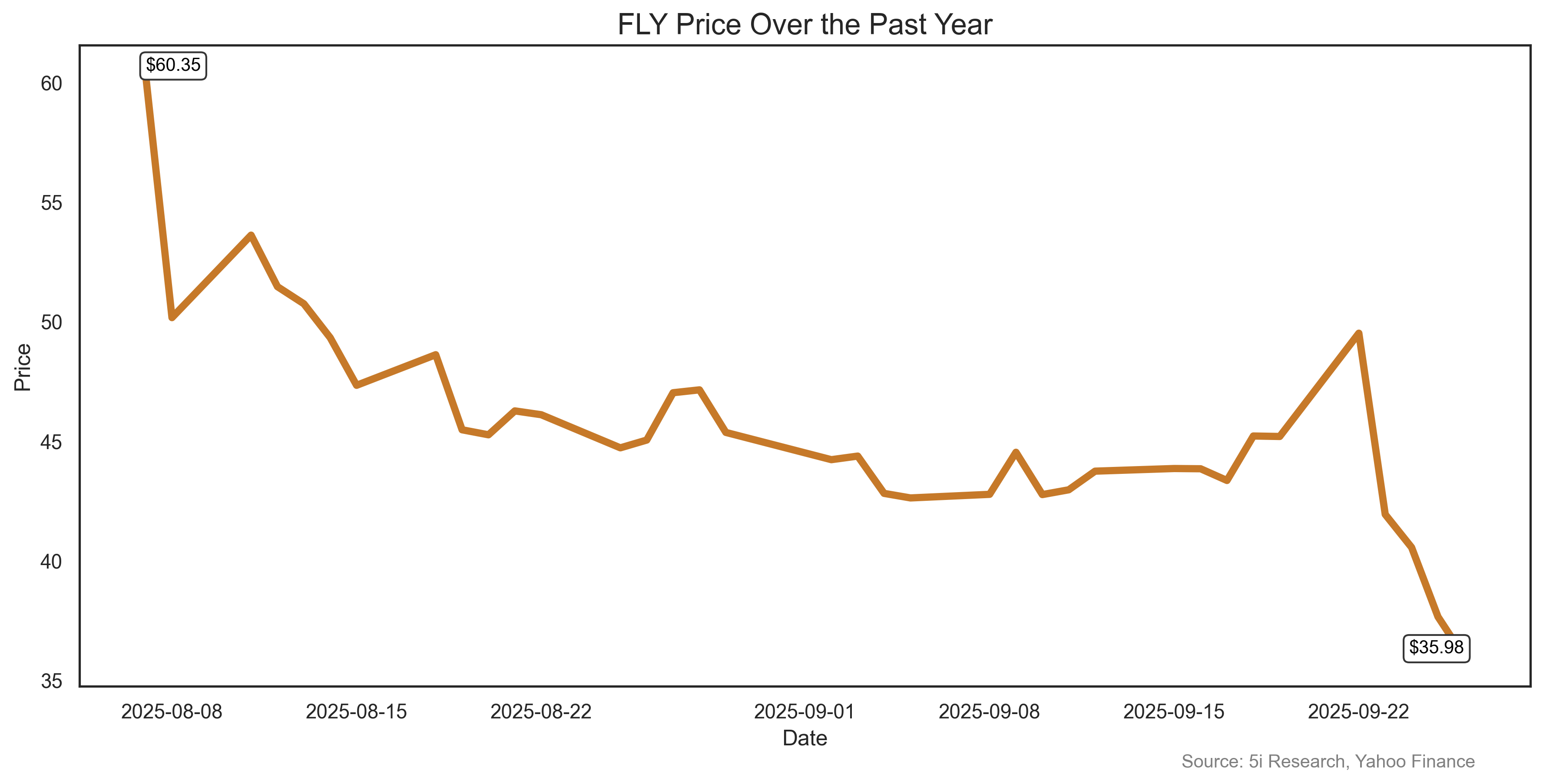

Firefly Aerospace Inc. FLY

Aerospace is hot. Defense is hot. The why did Firefly shares drop 20% last week, and why are they down 20% from their IPO price less than two months ago? Well, if there is anything companies should NOT do, it is miss revenue projections in their very-first public reporting quarter, which is what FLY did last week. The company blamed higher research and development expenses, which, we guess, is a valid excuse. We are not rocket scientists, but we are guessing it costs a lot of money to launch a spacecraft. We don't really know, but we imagine it might cost something. With the miss, the usual bunch of lawsuits came out, which always show up when a company's stock drops quickly.

Aerospace is hot. Defense is hot. The why did Firefly shares drop 20% last week, and why are they down 20% from their IPO price less than two months ago? Well, if there is anything companies should NOT do, it is miss revenue projections in their very-first public reporting quarter, which is what FLY did last week. The company blamed higher research and development expenses, which, we guess, is a valid excuse. We are not rocket scientists, but we are guessing it costs a lot of money to launch a spacecraft. We don't really know, but we imagine it might cost something. With the miss, the usual bunch of lawsuits came out, which always show up when a company's stock drops quickly.

Aerospace is hot. Defense is hot. The why did Firefly shares drop 20% last week, and why are they down 20% from their IPO price less than two months ago? Well, if there is anything companies should NOT do, it is miss revenue projections in their very-first public reporting quarter, which is what FLY did last week. The company blamed higher research and development expenses, which, we guess, is a valid excuse. We are not rocket scientists, but we are guessing it costs a lot of money to launch a spacecraft. We don't really know, but we imagine it might cost something. With the miss, the usual bunch of lawsuits came out, which always show up when a company's stock drops quickly.

Aerospace is hot. Defense is hot. The why did Firefly shares drop 20% last week, and why are they down 20% from their IPO price less than two months ago? Well, if there is anything companies should NOT do, it is miss revenue projections in their very-first public reporting quarter, which is what FLY did last week. The company blamed higher research and development expenses, which, we guess, is a valid excuse. We are not rocket scientists, but we are guessing it costs a lot of money to launch a spacecraft. We don't really know, but we imagine it might cost something. With the miss, the usual bunch of lawsuits came out, which always show up when a company's stock drops quickly.

Take Care,

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report do not have a financial or other interest in securities mentioned. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.