5i Research Weekly Rockets and Duds

We are back from the last long weekend of the summer and back looking for Rockets and Duds in the stock market.

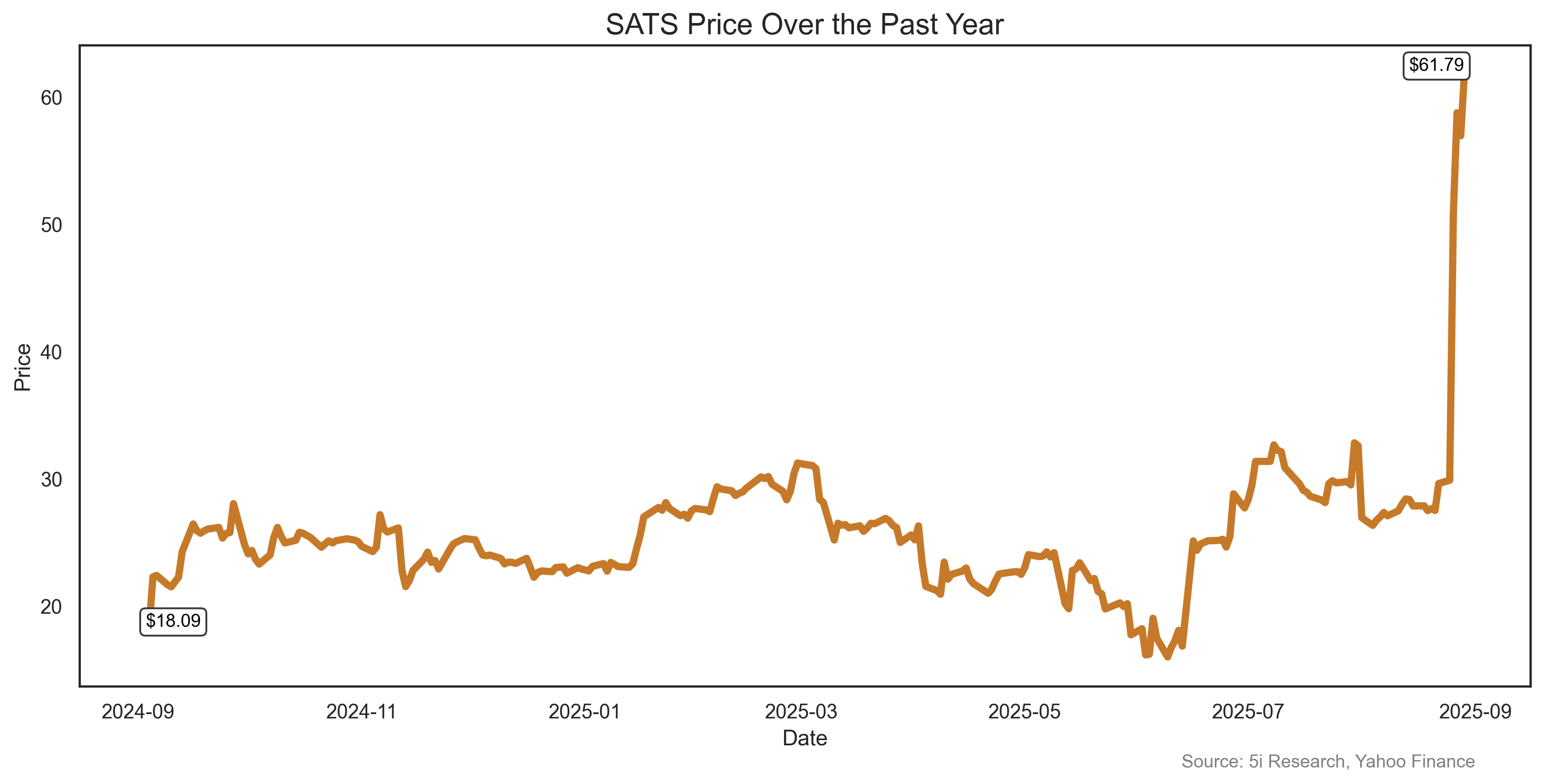

EchoStar Corporation SATS

How do you get your stock to rise 109% in a week? Easy. Just sell spectrum licenses for $23 billion when your market cap is only $10 billion. That's what EchoStar did last week, reaching a deal to sell licenses to AT&T. This caused investor interest, but also T-Mobile and Starlink also showed up later in the week expressing interest in buying some licences. The stock rose further after the deal, and is up 234% now in a year.

How do you get your stock to rise 109% in a week? Easy. Just sell spectrum licenses for $23 billion when your market cap is only $10 billion. That's what EchoStar did last week, reaching a deal to sell licenses to AT&T. This caused investor interest, but also T-Mobile and Starlink also showed up later in the week expressing interest in buying some licences. The stock rose further after the deal, and is up 234% now in a year.

How do you get your stock to rise 109% in a week? Easy. Just sell spectrum licenses for $23 billion when your market cap is only $10 billion. That's what EchoStar did last week, reaching a deal to sell licenses to AT&T. This caused investor interest, but also T-Mobile and Starlink also showed up later in the week expressing interest in buying some licences. The stock rose further after the deal, and is up 234% now in a year.

How do you get your stock to rise 109% in a week? Easy. Just sell spectrum licenses for $23 billion when your market cap is only $10 billion. That's what EchoStar did last week, reaching a deal to sell licenses to AT&T. This caused investor interest, but also T-Mobile and Starlink also showed up later in the week expressing interest in buying some licences. The stock rose further after the deal, and is up 234% now in a year.

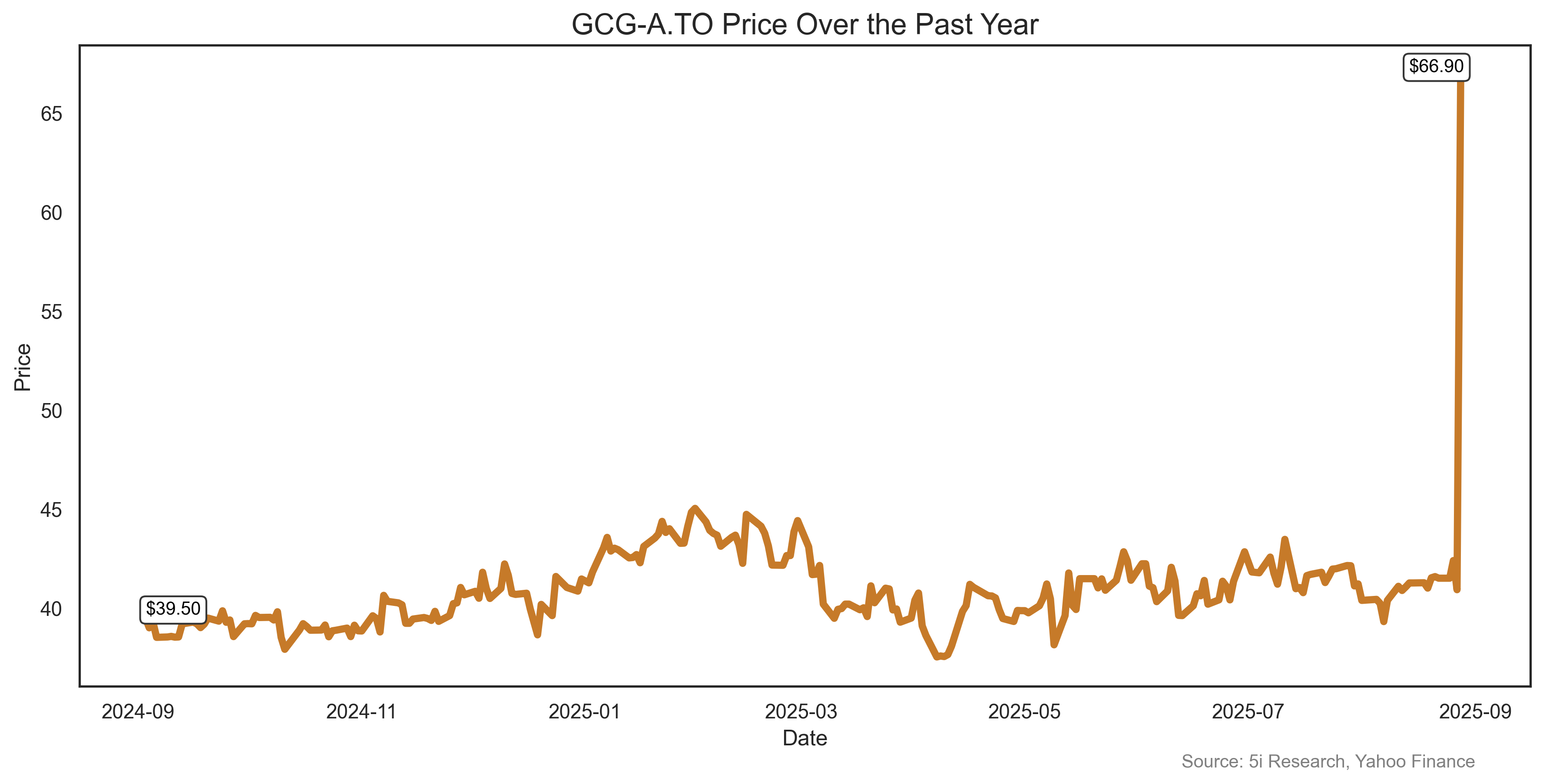

Guardian Capital Group Ltd. GCG.A

Value investors: Rejoice!! It can be so tough being a value investor. Sometimes, you will sit on a stock for years, if not decades. It can be a boring, painful, lonely stock experience. But then, once in a while, it's all worthwhile. Guardian was a true value stock, for DECADES. It traded at a ridiculously low valuation, and no one cared. Until last week, that is, with a 61% gain on news that Desjardins is to buy the company in a $1.5 billion deal.

Value investors: Rejoice!! It can be so tough being a value investor. Sometimes, you will sit on a stock for years, if not decades. It can be a boring, painful, lonely stock experience. But then, once in a while, it's all worthwhile. Guardian was a true value stock, for DECADES. It traded at a ridiculously low valuation, and no one cared. Until last week, that is, with a 61% gain on news that Desjardins is to buy the company in a $1.5 billion deal.

Value investors: Rejoice!! It can be so tough being a value investor. Sometimes, you will sit on a stock for years, if not decades. It can be a boring, painful, lonely stock experience. But then, once in a while, it's all worthwhile. Guardian was a true value stock, for DECADES. It traded at a ridiculously low valuation, and no one cared. Until last week, that is, with a 61% gain on news that Desjardins is to buy the company in a $1.5 billion deal.

Value investors: Rejoice!! It can be so tough being a value investor. Sometimes, you will sit on a stock for years, if not decades. It can be a boring, painful, lonely stock experience. But then, once in a while, it's all worthwhile. Guardian was a true value stock, for DECADES. It traded at a ridiculously low valuation, and no one cared. Until last week, that is, with a 61% gain on news that Desjardins is to buy the company in a $1.5 billion deal.

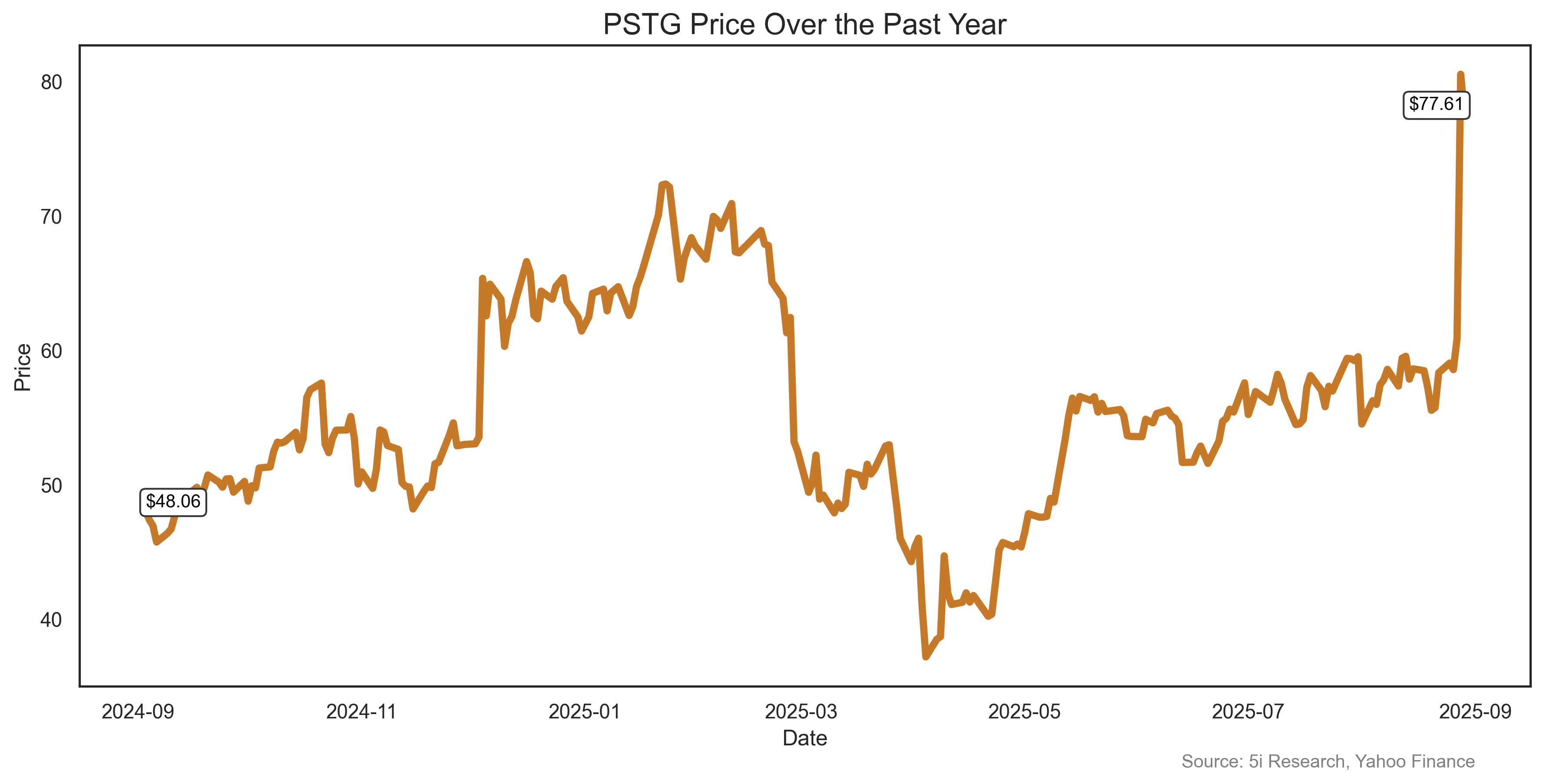

Pure Storage Inc. PSTG

Sometimes, investing seems easy--in hindsight! With all the hype over AI these days, Pure Storage, which offers flash arrays for high performance storage and workloads, was just sitting there not doing much, until last week when it rose 33% on strong quarterly results. Turns out, all that AI stuff needs to be stored, somewhere. PSTG has benefited from AI, the cloud and other high growth sectors, and raised its guidance last week.

Sometimes, investing seems easy--in hindsight! With all the hype over AI these days, Pure Storage, which offers flash arrays for high performance storage and workloads, was just sitting there not doing much, until last week when it rose 33% on strong quarterly results. Turns out, all that AI stuff needs to be stored, somewhere. PSTG has benefited from AI, the cloud and other high growth sectors, and raised its guidance last week.

Sometimes, investing seems easy--in hindsight! With all the hype over AI these days, Pure Storage, which offers flash arrays for high performance storage and workloads, was just sitting there not doing much, until last week when it rose 33% on strong quarterly results. Turns out, all that AI stuff needs to be stored, somewhere. PSTG has benefited from AI, the cloud and other high growth sectors, and raised its guidance last week.

Sometimes, investing seems easy--in hindsight! With all the hype over AI these days, Pure Storage, which offers flash arrays for high performance storage and workloads, was just sitting there not doing much, until last week when it rose 33% on strong quarterly results. Turns out, all that AI stuff needs to be stored, somewhere. PSTG has benefited from AI, the cloud and other high growth sectors, and raised its guidance last week.

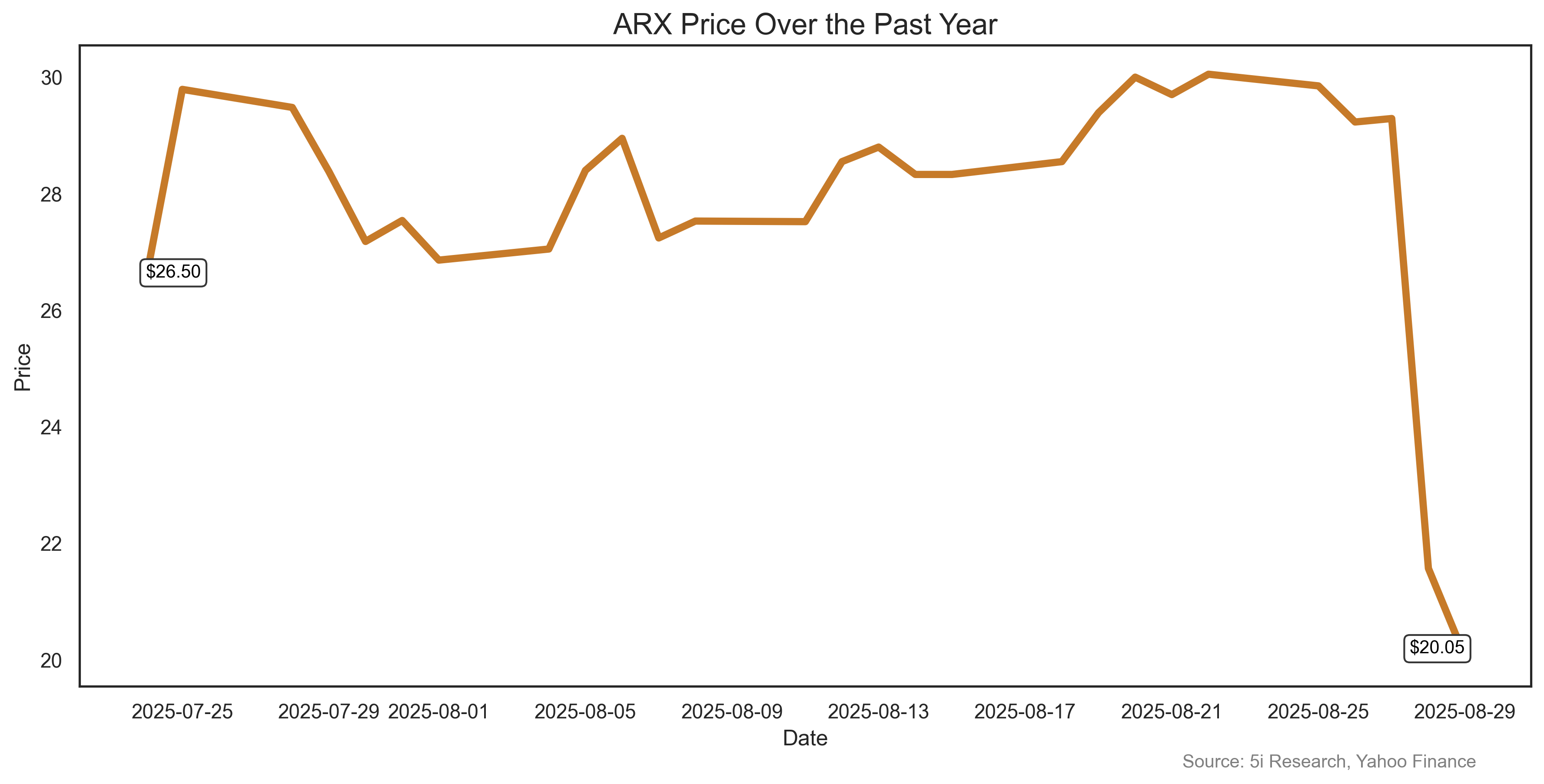

Accelerant Holdings ARX

Don't get fooled by the company name. This company's stock did not 'accelerate' last week, and fell 33%. We think Wall Street needs to teach a class on what 'not to do' after your company goes public. ARX went public in July at $21 per share. Then, last week, in its very first publicly reported quarter, it missed revenue estimates by more than 13%. New IPO shareholders can't be too happy, and will remember this digression for some time. Shareholders who paid $31+ post-IPO are likely even more pissed off.

Don't get fooled by the company name. This company's stock did not 'accelerate' last week, and fell 33%. We think Wall Street needs to teach a class on what 'not to do' after your company goes public. ARX went public in July at $21 per share. Then, last week, in its very first publicly reported quarter, it missed revenue estimates by more than 13%. New IPO shareholders can't be too happy, and will remember this digression for some time. Shareholders who paid $31+ post-IPO are likely even more pissed off.

Don't get fooled by the company name. This company's stock did not 'accelerate' last week, and fell 33%. We think Wall Street needs to teach a class on what 'not to do' after your company goes public. ARX went public in July at $21 per share. Then, last week, in its very first publicly reported quarter, it missed revenue estimates by more than 13%. New IPO shareholders can't be too happy, and will remember this digression for some time. Shareholders who paid $31+ post-IPO are likely even more pissed off.

Don't get fooled by the company name. This company's stock did not 'accelerate' last week, and fell 33%. We think Wall Street needs to teach a class on what 'not to do' after your company goes public. ARX went public in July at $21 per share. Then, last week, in its very first publicly reported quarter, it missed revenue estimates by more than 13%. New IPO shareholders can't be too happy, and will remember this digression for some time. Shareholders who paid $31+ post-IPO are likely even more pissed off.

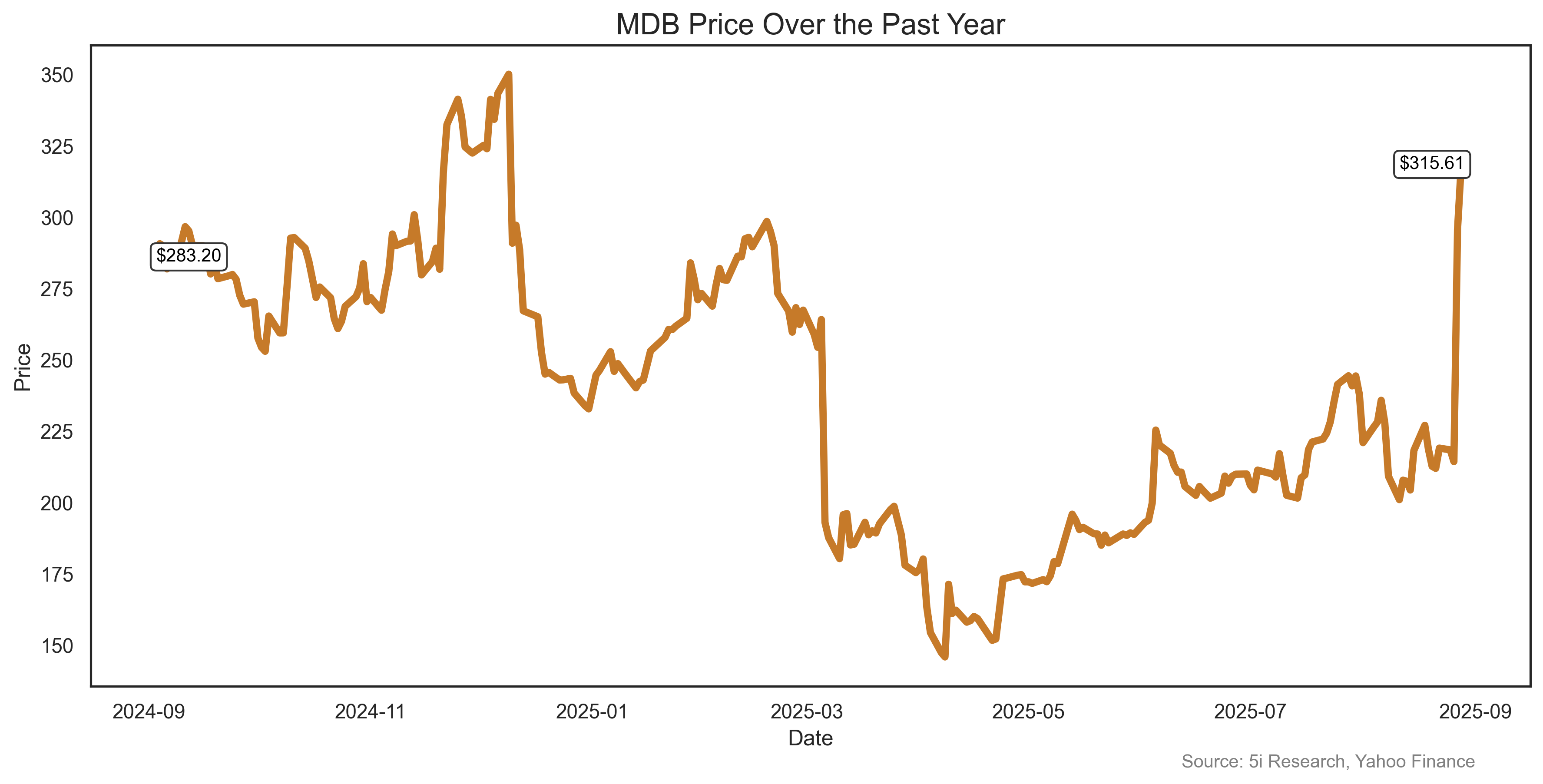

MongoDB Inc. MDB

We had to use an AI chatbot to find out what MongoDB means. Turns out, it is derived from the English word 'humongous' and is meant to highlight MDB's vast, scalable database for modern applications. Well, MDB had a 'humongous' stock move last week with a 44% gain, pretty impressive for a $25 billion company. Second quarter earnings beat estimates by 53%. BIG! HUGE! HUMONGOUS!

We had to use an AI chatbot to find out what MongoDB means. Turns out, it is derived from the English word 'humongous' and is meant to highlight MDB's vast, scalable database for modern applications. Well, MDB had a 'humongous' stock move last week with a 44% gain, pretty impressive for a $25 billion company. Second quarter earnings beat estimates by 53%. BIG! HUGE! HUMONGOUS!

We had to use an AI chatbot to find out what MongoDB means. Turns out, it is derived from the English word 'humongous' and is meant to highlight MDB's vast, scalable database for modern applications. Well, MDB had a 'humongous' stock move last week with a 44% gain, pretty impressive for a $25 billion company. Second quarter earnings beat estimates by 53%. BIG! HUGE! HUMONGOUS!

We had to use an AI chatbot to find out what MongoDB means. Turns out, it is derived from the English word 'humongous' and is meant to highlight MDB's vast, scalable database for modern applications. Well, MDB had a 'humongous' stock move last week with a 44% gain, pretty impressive for a $25 billion company. Second quarter earnings beat estimates by 53%. BIG! HUGE! HUMONGOUS!

Take Care,

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Analysts of 5i Research responsible for this report do not have a financial or other interest in securities mentioned. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.