5i Research Weekly Rockets and Duds

Welcome to another week of 5i Research Rockets and Duds. Lezzz GO!

Hey, employees, what should we call our company? We have assets, and we are an entity. How 'bout Asset Entities? Genius! Asset Entities, with perhaps one of the most boring corporate names around, has hardly been a boring stock. Like other companies trying to follow the crypto-currency-treasury model, ASST is merging with Strive Enterprises, another exciting company name, to become a bitcoin holding company. Investors didn't like it last week, with a 32% decline, but we are sure the $1.6 billion company will manage: shares are still up 821% this year.

Hey, employees, what should we call our company? We have assets, and we are an entity. How 'bout Asset Entities? Genius! Asset Entities, with perhaps one of the most boring corporate names around, has hardly been a boring stock. Like other companies trying to follow the crypto-currency-treasury model, ASST is merging with Strive Enterprises, another exciting company name, to become a bitcoin holding company. Investors didn't like it last week, with a 32% decline, but we are sure the $1.6 billion company will manage: shares are still up 821% this year.

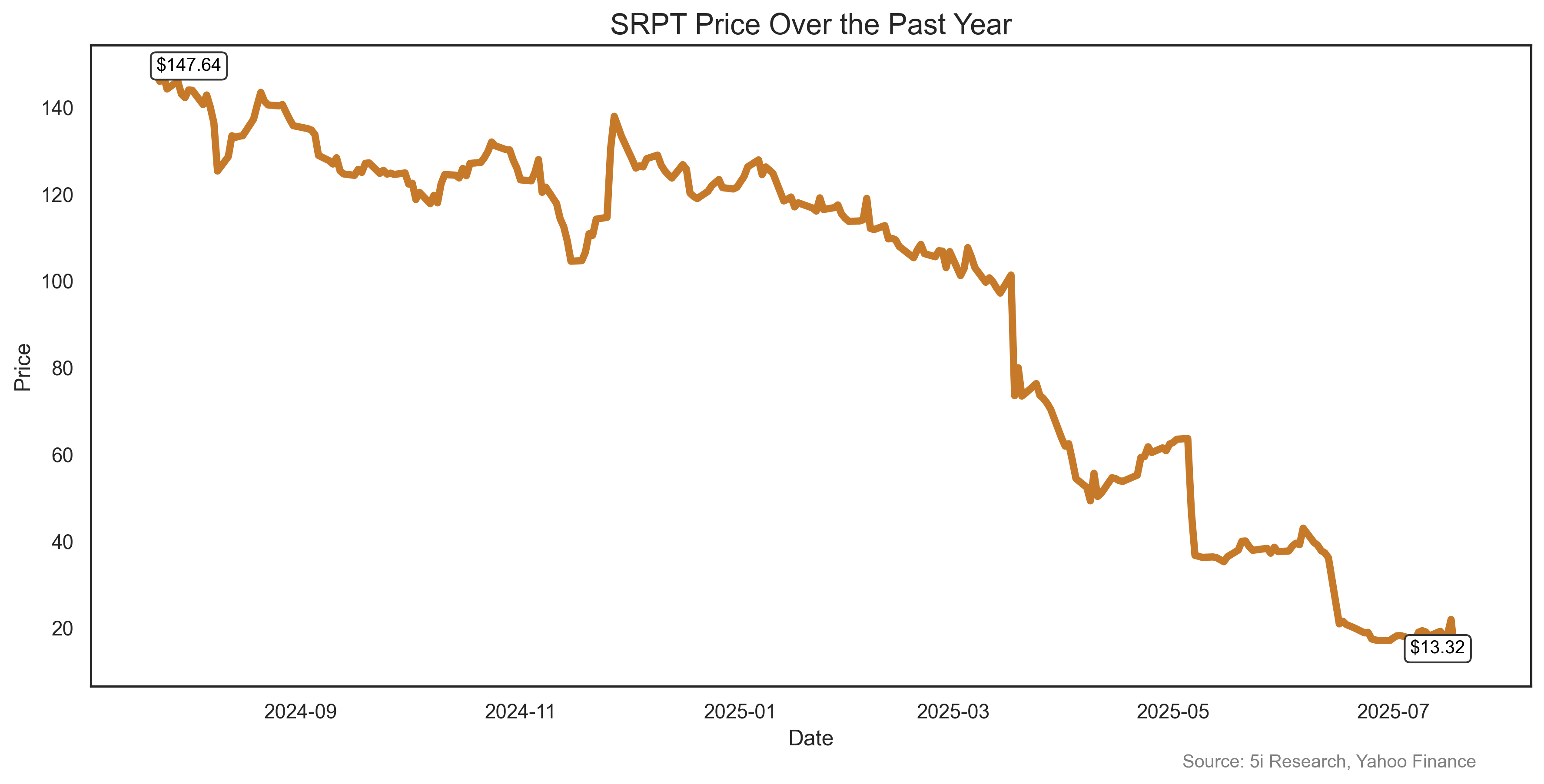

FDA: 'We think you should stop your drug trial, three people have died so far'. Sarepta: 'Na, I think we're good, we'll continue. In one of the most blatant disagreements we have ever seen, SRPT has refused the FDA's request to halt shipments of its drug Elevidys, meant to treat Muscular Dystrophy, even after the third death of a patient last week. Who loses in this fight, besides patients? Sarepta shareholders, with a 23% decline last week, and an 88% stock decline this year. Rockets and Duds reported on Sarepta after the second death earlier in 2025. Shareholders shouldn't wait around for the fourth.

FDA: 'We think you should stop your drug trial, three people have died so far'. Sarepta: 'Na, I think we're good, we'll continue. In one of the most blatant disagreements we have ever seen, SRPT has refused the FDA's request to halt shipments of its drug Elevidys, meant to treat Muscular Dystrophy, even after the third death of a patient last week. Who loses in this fight, besides patients? Sarepta shareholders, with a 23% decline last week, and an 88% stock decline this year. Rockets and Duds reported on Sarepta after the second death earlier in 2025. Shareholders shouldn't wait around for the fourth.

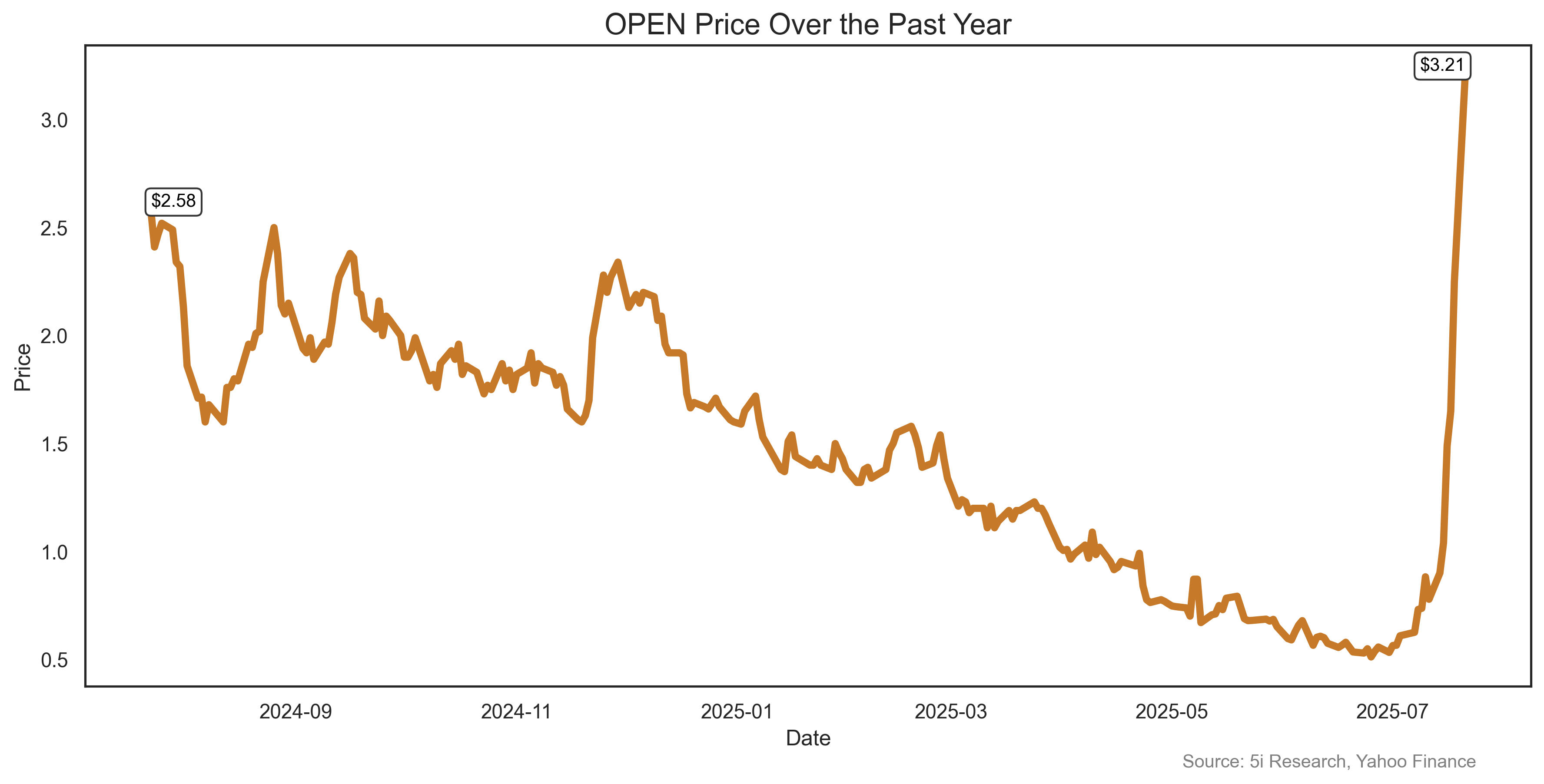

OpenDoor opened a lot of bank vault doors last week, with a massive 189% return. The stock was profiled in social media posts by EMJ Capital, noting that IF revenue expectations are met, and IF it returns to 2021 valuation multiples, it is a potential 100-bagger stock. That's a lot of IFs, but investors bought anyway. The company relies on technology to buy homes directly for cash, performs basic renovations and then sells them. This was once a popular real estate approach, but many peer companies have retreated from it.

OpenDoor opened a lot of bank vault doors last week, with a massive 189% return. The stock was profiled in social media posts by EMJ Capital, noting that IF revenue expectations are met, and IF it returns to 2021 valuation multiples, it is a potential 100-bagger stock. That's a lot of IFs, but investors bought anyway. The company relies on technology to buy homes directly for cash, performs basic renovations and then sells them. This was once a popular real estate approach, but many peer companies have retreated from it.

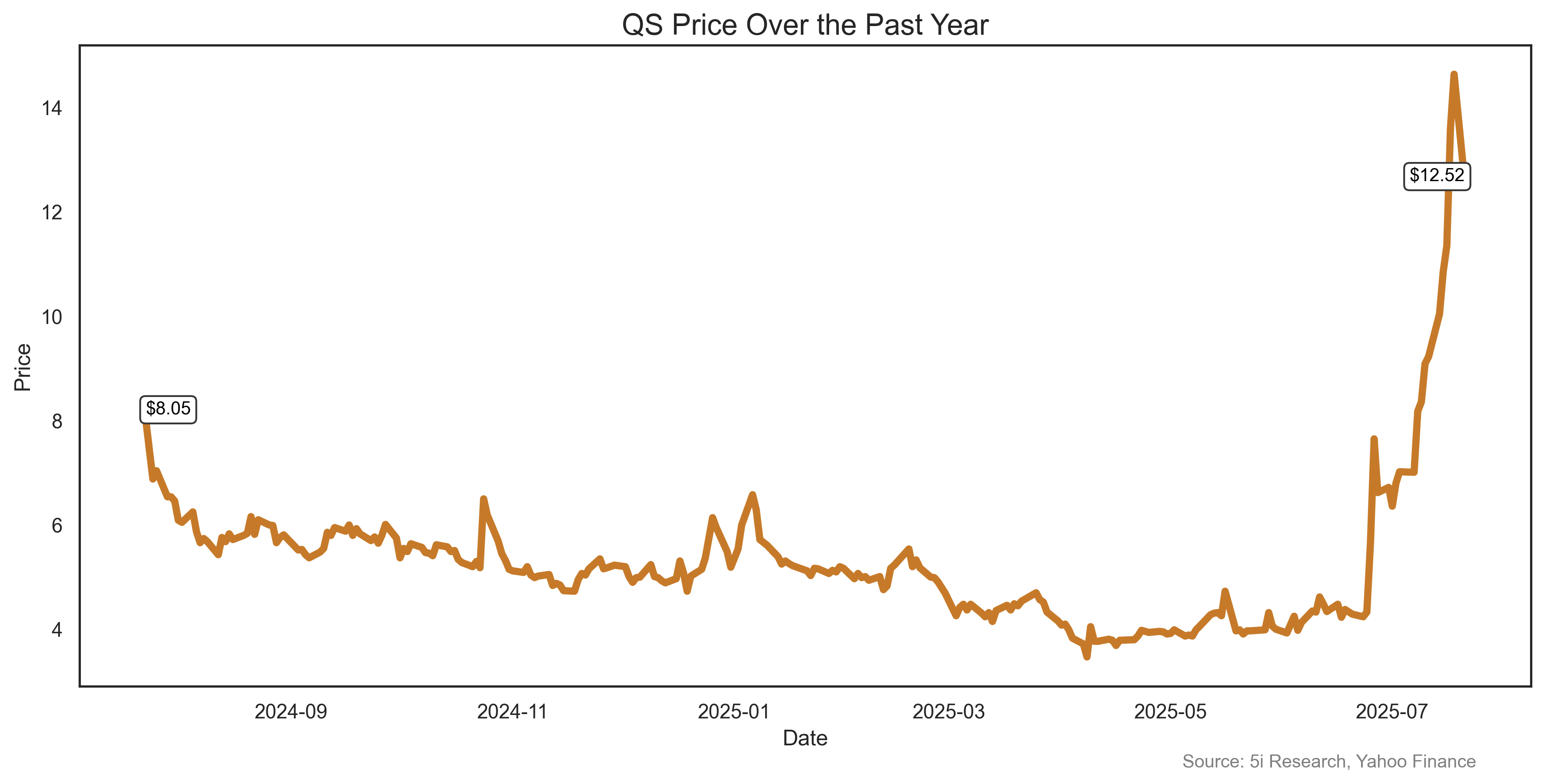

Yes, quantum stocks are back with a vengeance. Quantumscape share rose 59% last week on news of.....WAIT A SECOND.......Quantumscape is not a quantum computing company. It is an EV battery company. But hey, having Quantum in your corporate name can't be bad, can it, with the quantum tech bubble ongoing? There was no real news here, but the options market in QS exploded last week along with many other 'meme' stocks. Fun times indeed.

Yes, quantum stocks are back with a vengeance. Quantumscape share rose 59% last week on news of.....WAIT A SECOND.......Quantumscape is not a quantum computing company. It is an EV battery company. But hey, having Quantum in your corporate name can't be bad, can it, with the quantum tech bubble ongoing? There was no real news here, but the options market in QS exploded last week along with many other 'meme' stocks. Fun times indeed.

, oops...

, oops...

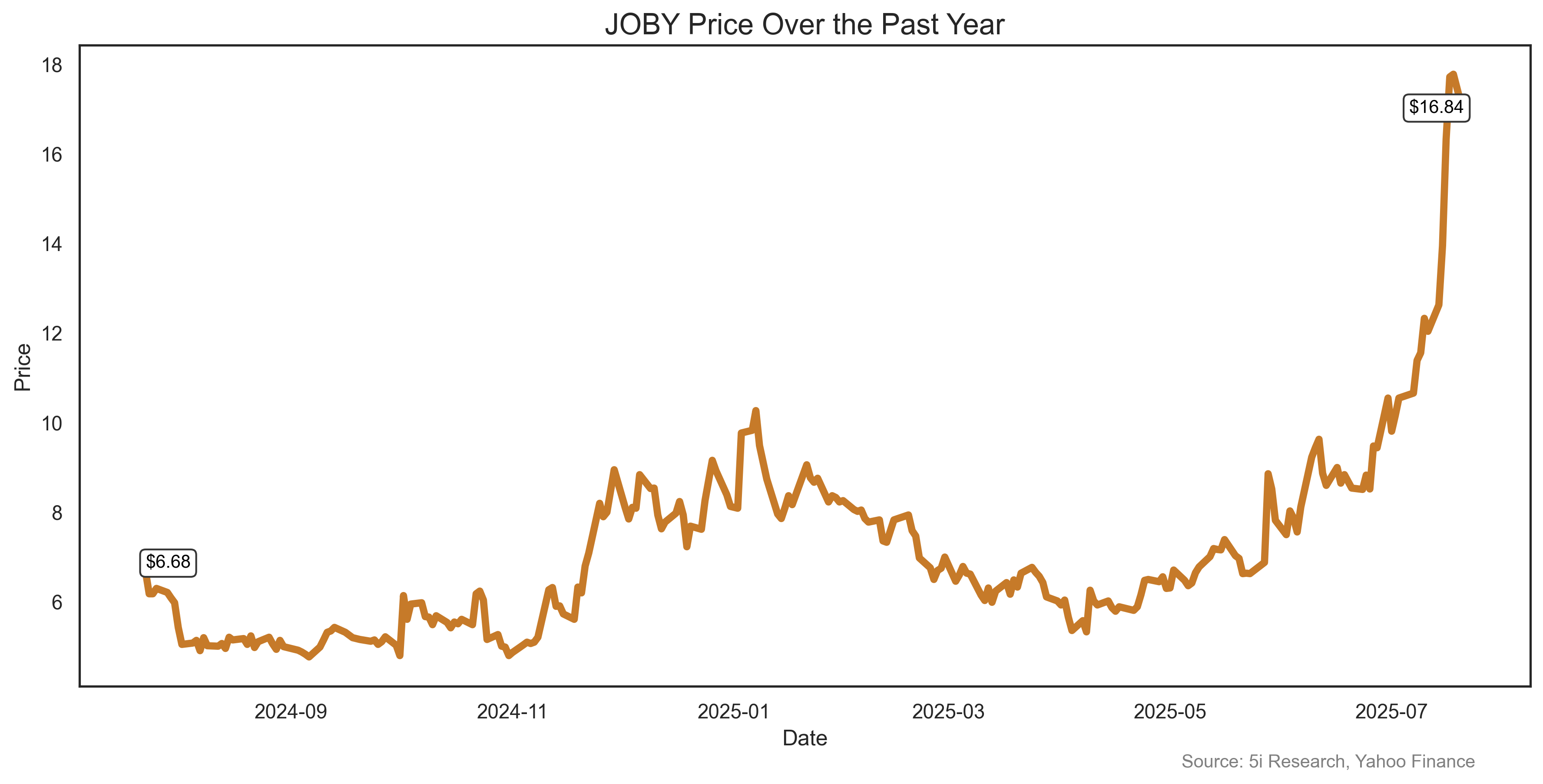

JOBY again makes our Rockets and Duds list for last week, with a 49% gain. Year to date gain: 107%. JOBY is a vertical take off and landing aircraft company, with minimal revenue so far. But JOBY last week said it would launch commercial service in 2026, in, where else, Dubai, where citizens are rich enough to take a ride in a flying car. Plus, it is good diversification for Toyota, the company's largest shareholder with a 16% interest. Dubai citizens are not big buyers of Toyota Corollas, preferring Lamborghinis instead.

JOBY again makes our Rockets and Duds list for last week, with a 49% gain. Year to date gain: 107%. JOBY is a vertical take off and landing aircraft company, with minimal revenue so far. But JOBY last week said it would launch commercial service in 2026, in, where else, Dubai, where citizens are rich enough to take a ride in a flying car. Plus, it is good diversification for Toyota, the company's largest shareholder with a 16% interest. Dubai citizens are not big buyers of Toyota Corollas, preferring Lamborghinis instead.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Comments

Login to post a comment.