5i Research Weekly Rockets and Duds

Welcome to another week of 5i Research's stock market rockets and duds. As usual, there was lots of action last week.

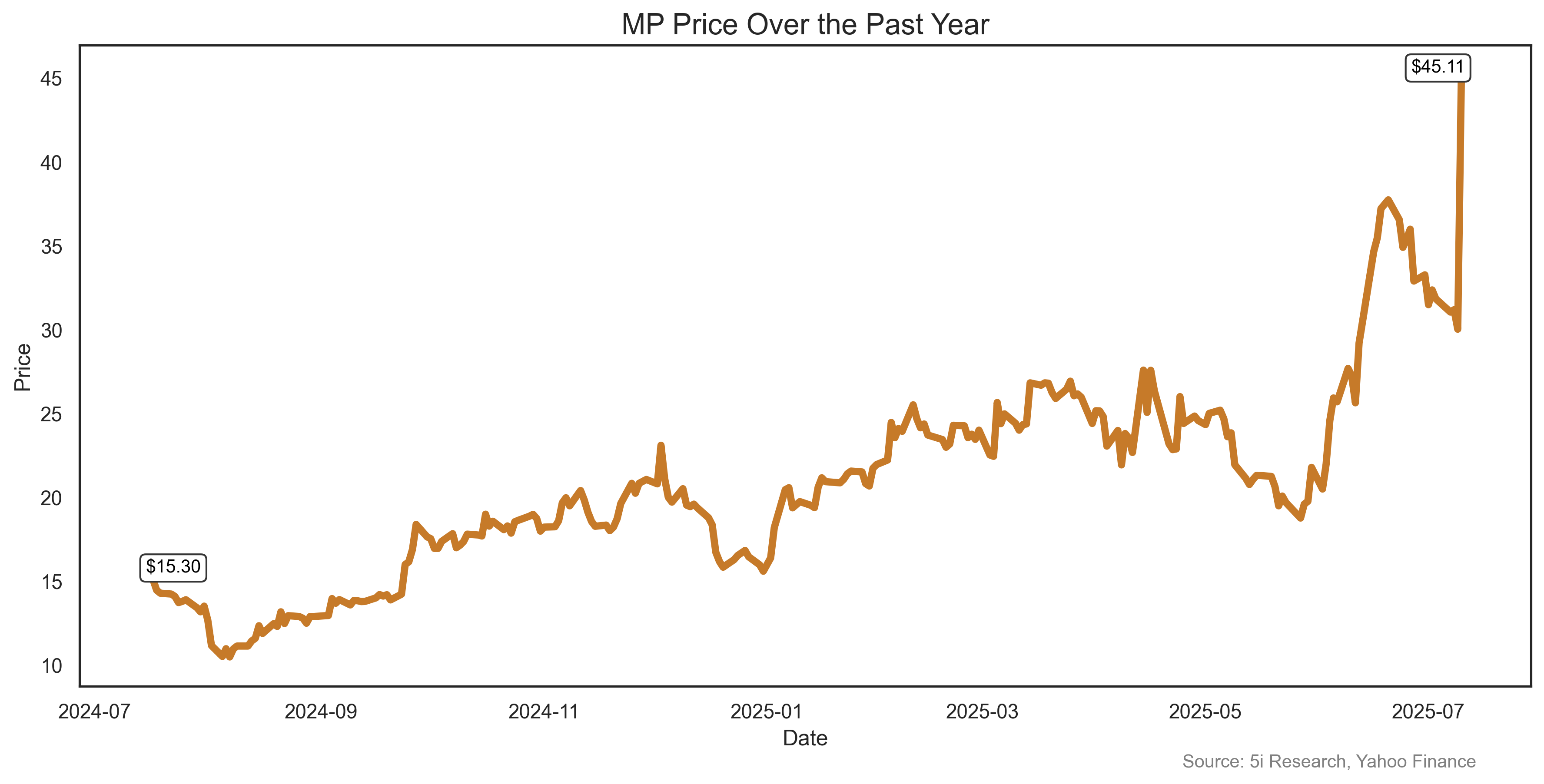

MP Materials has discovered one of the best ways to get your stock price moving. All you have to do is get the Pentagon to invest $400 million into your company. Why doesn't every company just do this? MP soared 42% on the $400 million investment as the US tries to offset the risk of China controlling the rare-earth magnet market. MP owns the only rare earth mine in the US, at Mountain Pass, California, and will use the money to build a new processing facility.

MP Materials has discovered one of the best ways to get your stock price moving. All you have to do is get the Pentagon to invest $400 million into your company. Why doesn't every company just do this? MP soared 42% on the $400 million investment as the US tries to offset the risk of China controlling the rare-earth magnet market. MP owns the only rare earth mine in the US, at Mountain Pass, California, and will use the money to build a new processing facility.

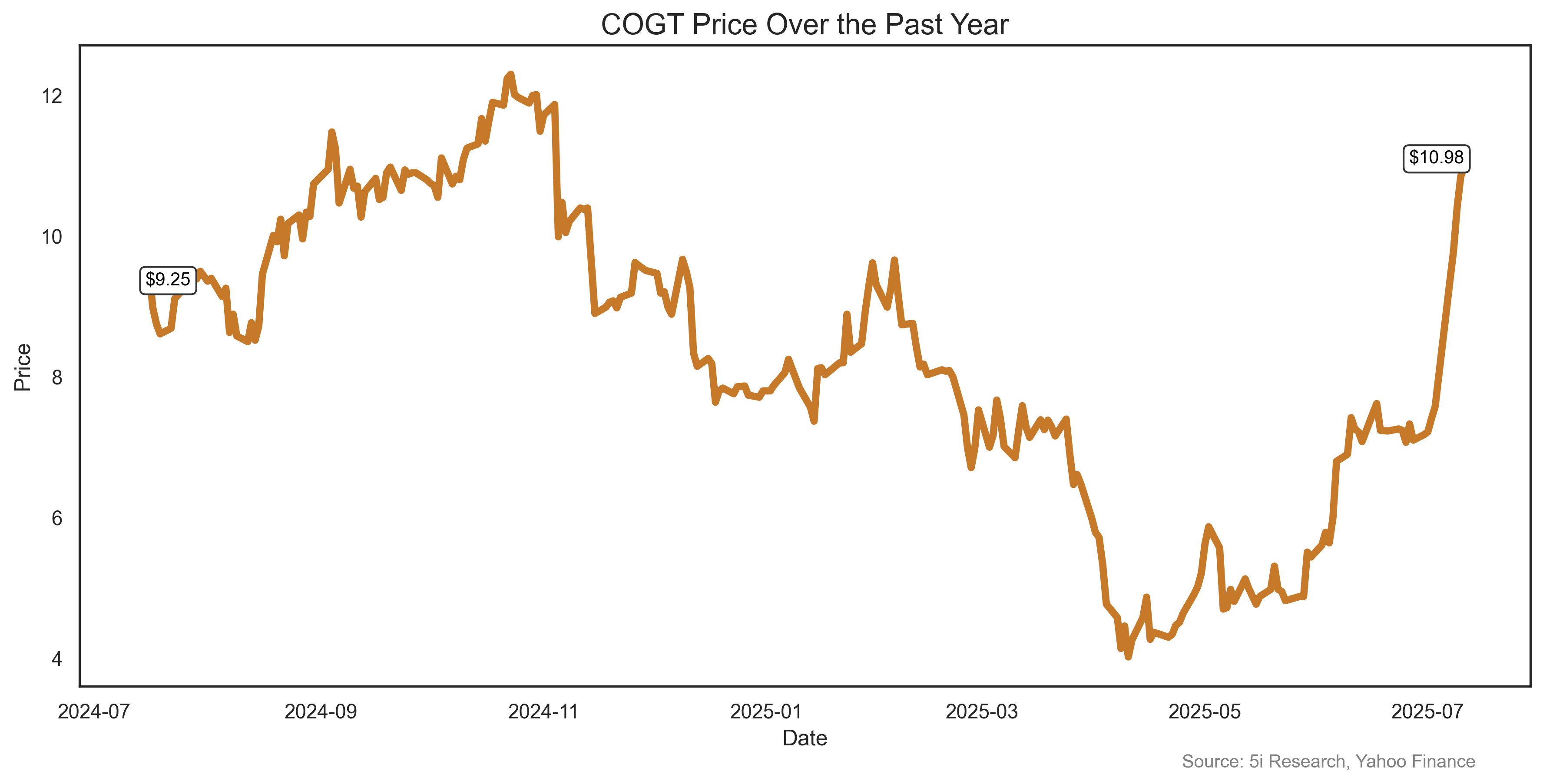

Cogent, a biotech company with no reported revenue yet, rose 45% last week after its experimental treatment for a rare white cell blood disorder met all primary and secondary endpoints in its clinical trial. The company used its new found popularity to do a $230 million stock sale. The news got the stock several broker upgrades.

Cogent, a biotech company with no reported revenue yet, rose 45% last week after its experimental treatment for a rare white cell blood disorder met all primary and secondary endpoints in its clinical trial. The company used its new found popularity to do a $230 million stock sale. The news got the stock several broker upgrades.

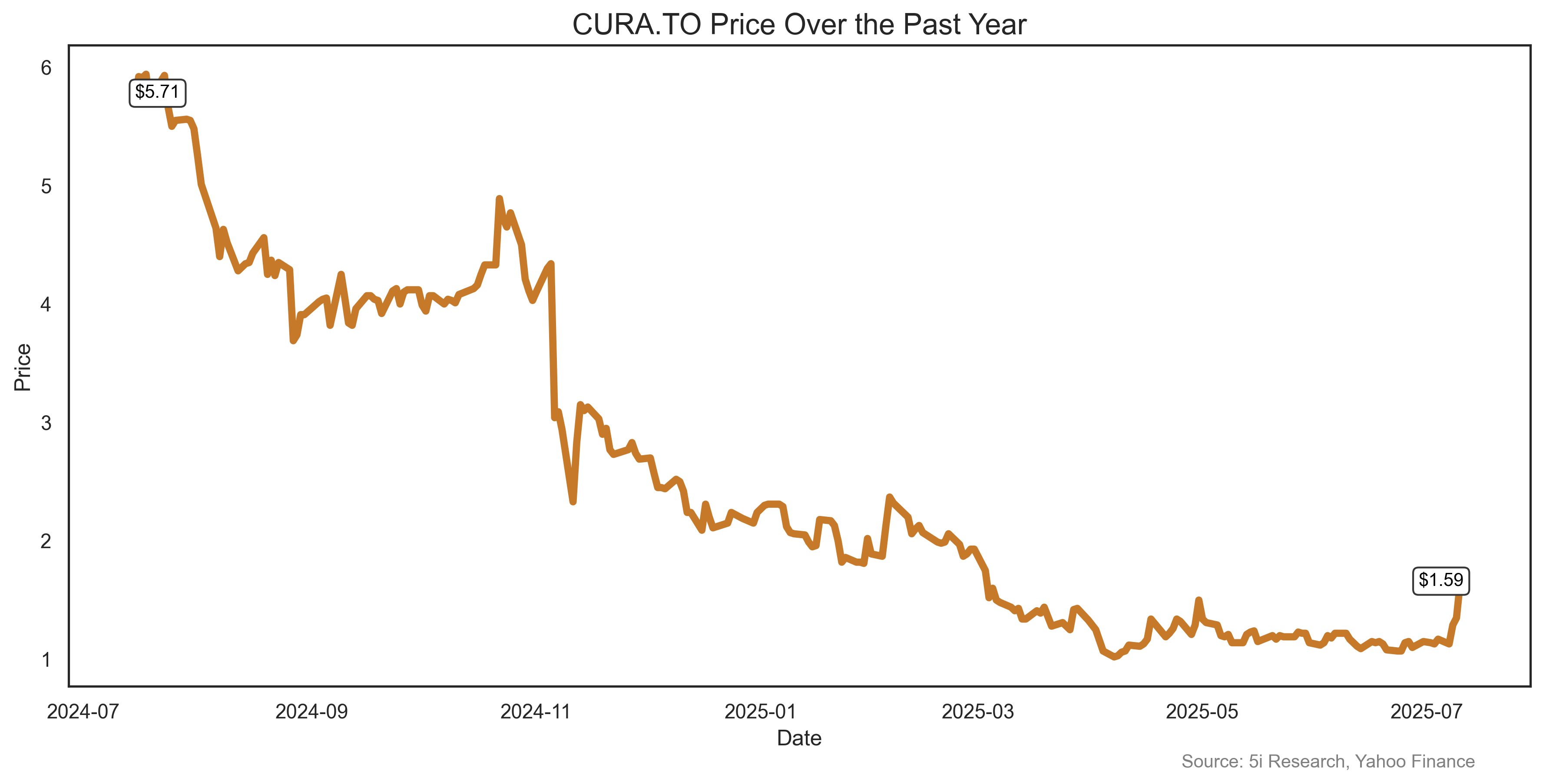

What's this? A cannabis company in the 'Rockets' section and up 36% in a week? What have we been smoking?? Yes, it's true. Curaleaf rose sharply on Thursday as it announced it had bought out a minority investor in its European business, returning that business to 100% ownership. Still, best to hold off on any predictions of a Cannabis Two stock market bubble: Despite last week's move, CURA stock is still down 29% this year, 72% over one year, and 79% since 2018.

What's this? A cannabis company in the 'Rockets' section and up 36% in a week? What have we been smoking?? Yes, it's true. Curaleaf rose sharply on Thursday as it announced it had bought out a minority investor in its European business, returning that business to 100% ownership. Still, best to hold off on any predictions of a Cannabis Two stock market bubble: Despite last week's move, CURA stock is still down 29% this year, 72% over one year, and 79% since 2018.

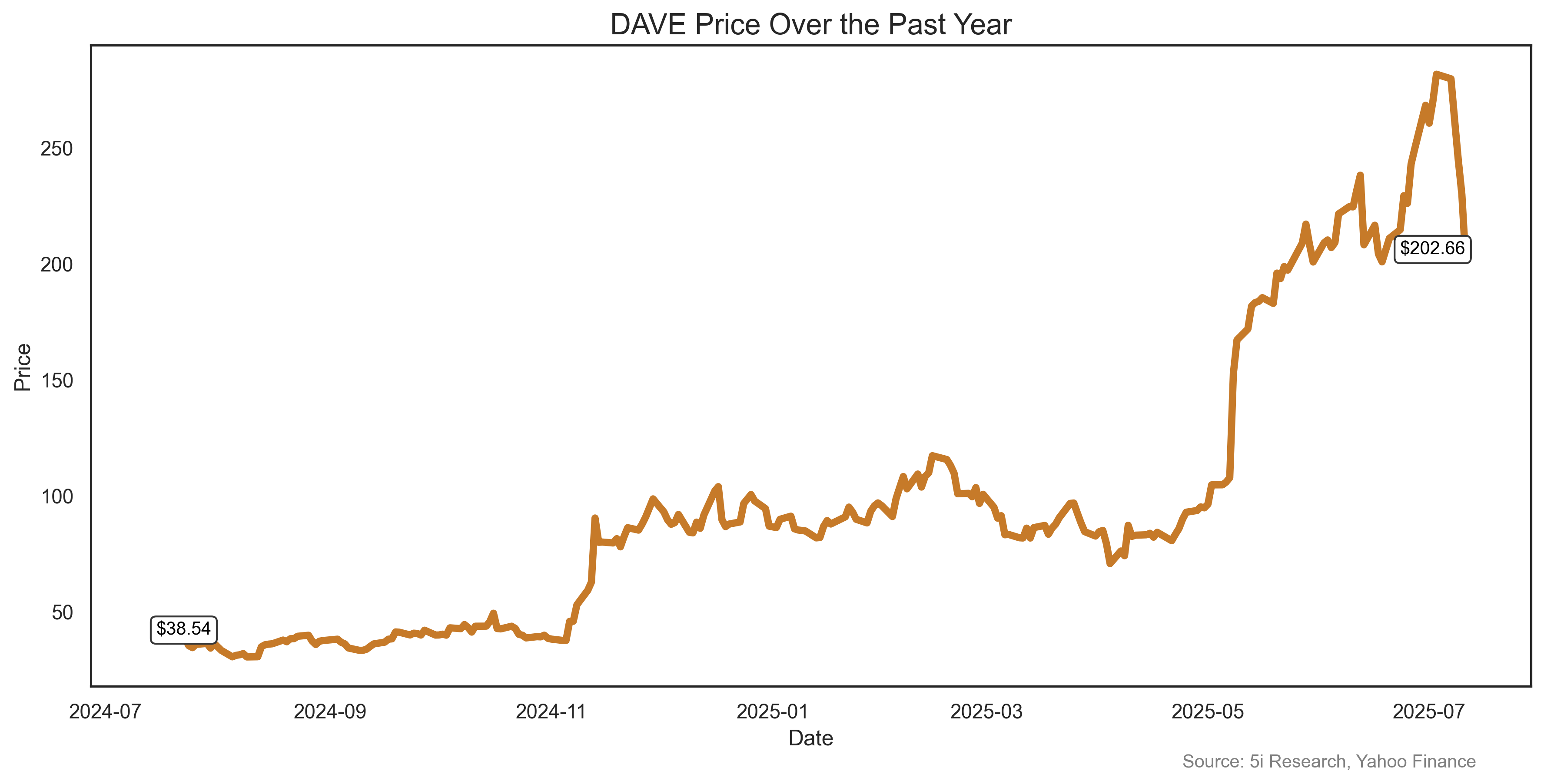

Hey Dave! Why are you down? Why are you down 28% last week, DAVE? Dave, a digital banking services company, had absolutely no news to report to account for the decline. But hey, DAVE stock is up 133% this year, and are up 444% in 52 weeks. Give DAVE a break.

Hey Dave! Why are you down? Why are you down 28% last week, DAVE? Dave, a digital banking services company, had absolutely no news to report to account for the decline. But hey, DAVE stock is up 133% this year, and are up 444% in 52 weeks. Give DAVE a break.

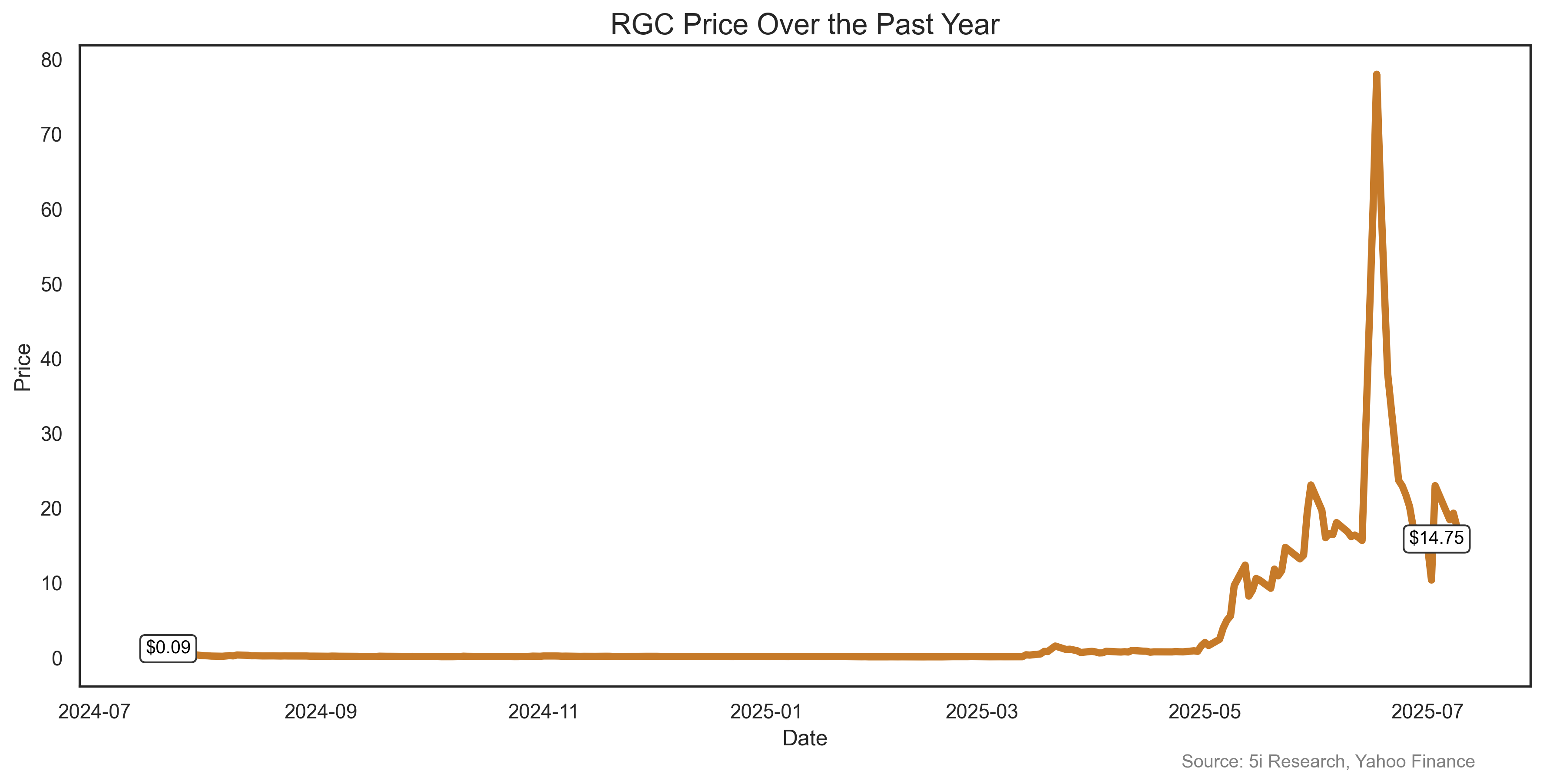

We have never wanted to list RGC in our Rockets and Duds blog, since it is a $7 billion company based in Hong Kong and the company has no reported revenue. Yet, every week when we screen stocks for this blog, it shows up, so we thought we would mention it, at least once. In the past, it has been one of the bigger winners. That of course happens when your stock is up 11,000% in less than a year. Yes, RGC was a 7-cent stock in July 2024 and is now $14. But guess what? It peaked at $83 less than a month ago. It makes our 'DUDS' list for last week's 36% decline. RGC is a 'traditional Chinese medicine company' that has never made money. It sells herbal treatments for ADHD and other disorders. To us, it sounds like a hippie selling drugs from the back of their van, but a van with a $7 billion valuation. It is a meme stock, a retail-promotion, a pump and dump, or something else. But the stock moves a lot, and we are guessing it is going to go back to 7 cents again when this bubble pops. Extreme caution is warranted.

We have never wanted to list RGC in our Rockets and Duds blog, since it is a $7 billion company based in Hong Kong and the company has no reported revenue. Yet, every week when we screen stocks for this blog, it shows up, so we thought we would mention it, at least once. In the past, it has been one of the bigger winners. That of course happens when your stock is up 11,000% in less than a year. Yes, RGC was a 7-cent stock in July 2024 and is now $14. But guess what? It peaked at $83 less than a month ago. It makes our 'DUDS' list for last week's 36% decline. RGC is a 'traditional Chinese medicine company' that has never made money. It sells herbal treatments for ADHD and other disorders. To us, it sounds like a hippie selling drugs from the back of their van, but a van with a $7 billion valuation. It is a meme stock, a retail-promotion, a pump and dump, or something else. But the stock moves a lot, and we are guessing it is going to go back to 7 cents again when this bubble pops. Extreme caution is warranted.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More..

Comments

Login to post a comment.