5i Research Weekly Rockets and Duds

This week's 5i Research Rockets

and Duds

and Duds

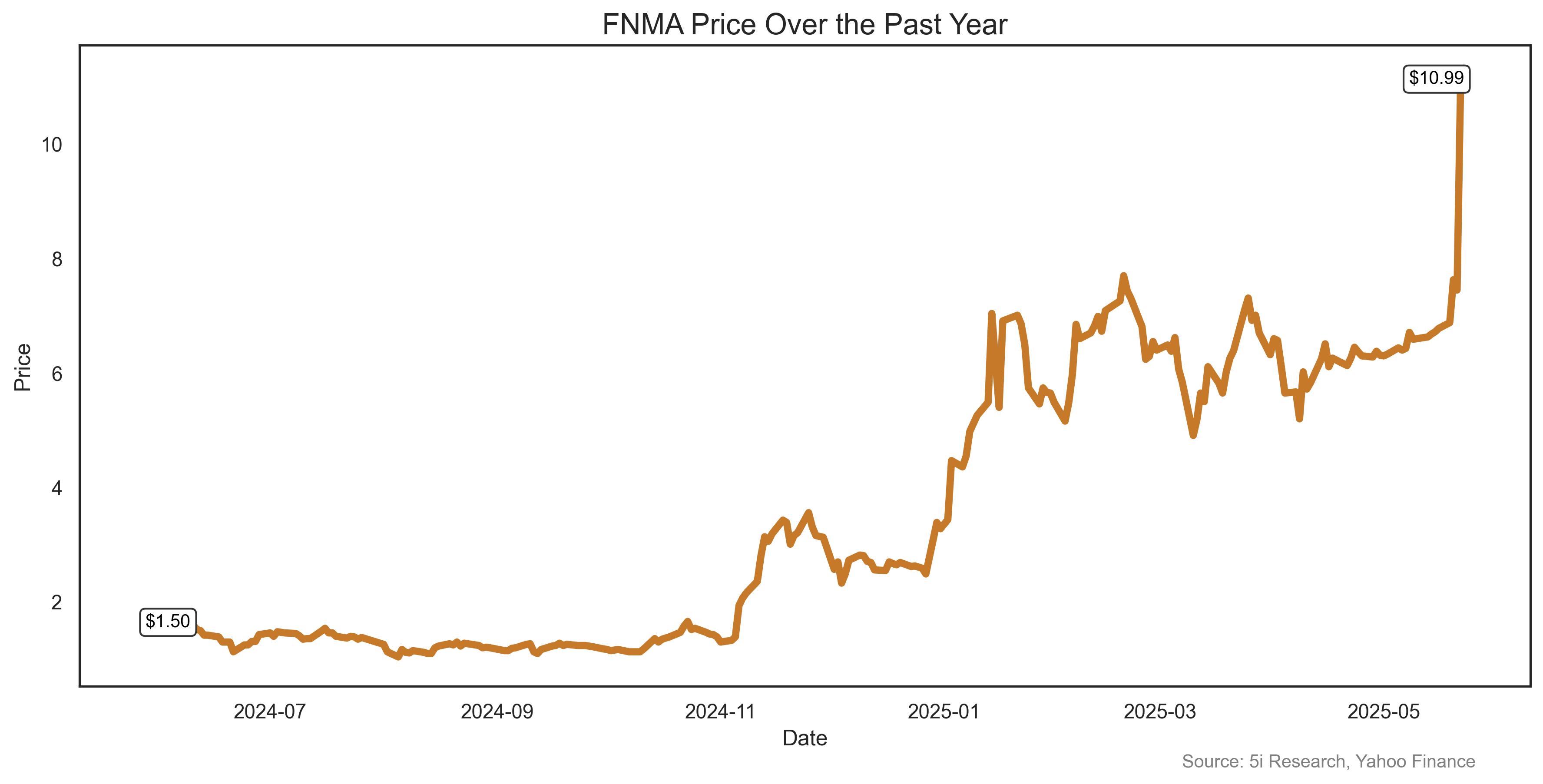

It's not often a $63 billion company makes our list of Rockets. Fannie Mae soared 62% last week as President Trump floated the idea of selling the government's stake after more than a decade of being under governmental control. The US took over the reigns of Fannie following the Great Financial Crisis of 2008 and 2009, when the company nearly went under. Through warrants, the government controls 80% of the company right now. But, unlike in 2008, it is now highly profitable, and shares have soared more than 600% in the past year.

It's not often a $63 billion company makes our list of Rockets. Fannie Mae soared 62% last week as President Trump floated the idea of selling the government's stake after more than a decade of being under governmental control. The US took over the reigns of Fannie following the Great Financial Crisis of 2008 and 2009, when the company nearly went under. Through warrants, the government controls 80% of the company right now. But, unlike in 2008, it is now highly profitable, and shares have soared more than 600% in the past year.

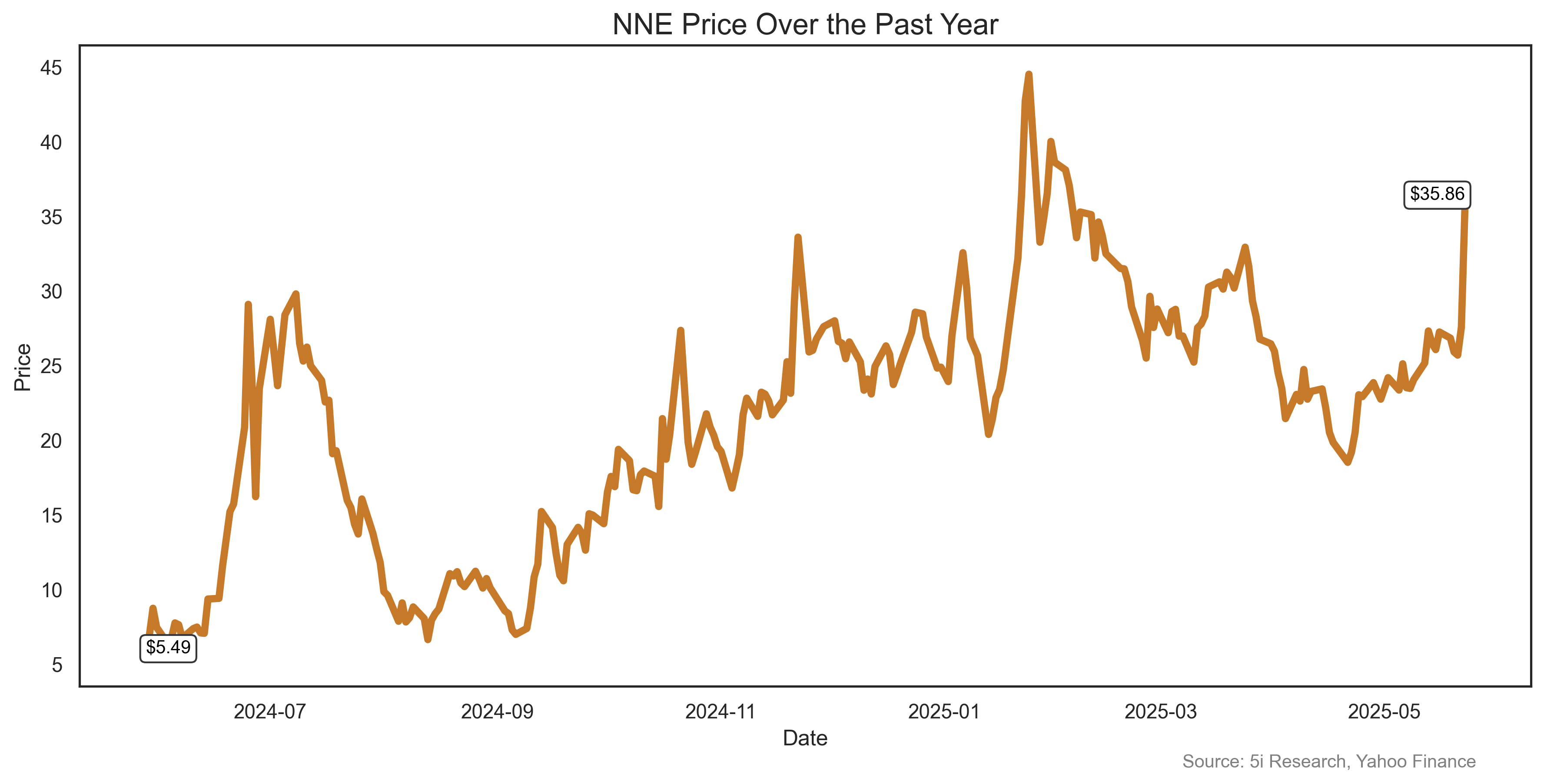

Wow, if you could just be a fly on the wall of Donald Trump's room when he is composing his Truth Social posts it wouldn't take long to be a millionaire. Nuclear stocks soared as Trump signed executive order focused on speeding up the regulatory procedure for new reactor approvals and strengthening fuel supply chains. Nano is a small nuclear energy company, with no reported revenue yet. But that has not stopped the stock from rising 715% in the past year.

Wow, if you could just be a fly on the wall of Donald Trump's room when he is composing his Truth Social posts it wouldn't take long to be a millionaire. Nuclear stocks soared as Trump signed executive order focused on speeding up the regulatory procedure for new reactor approvals and strengthening fuel supply chains. Nano is a small nuclear energy company, with no reported revenue yet. But that has not stopped the stock from rising 715% in the past year.

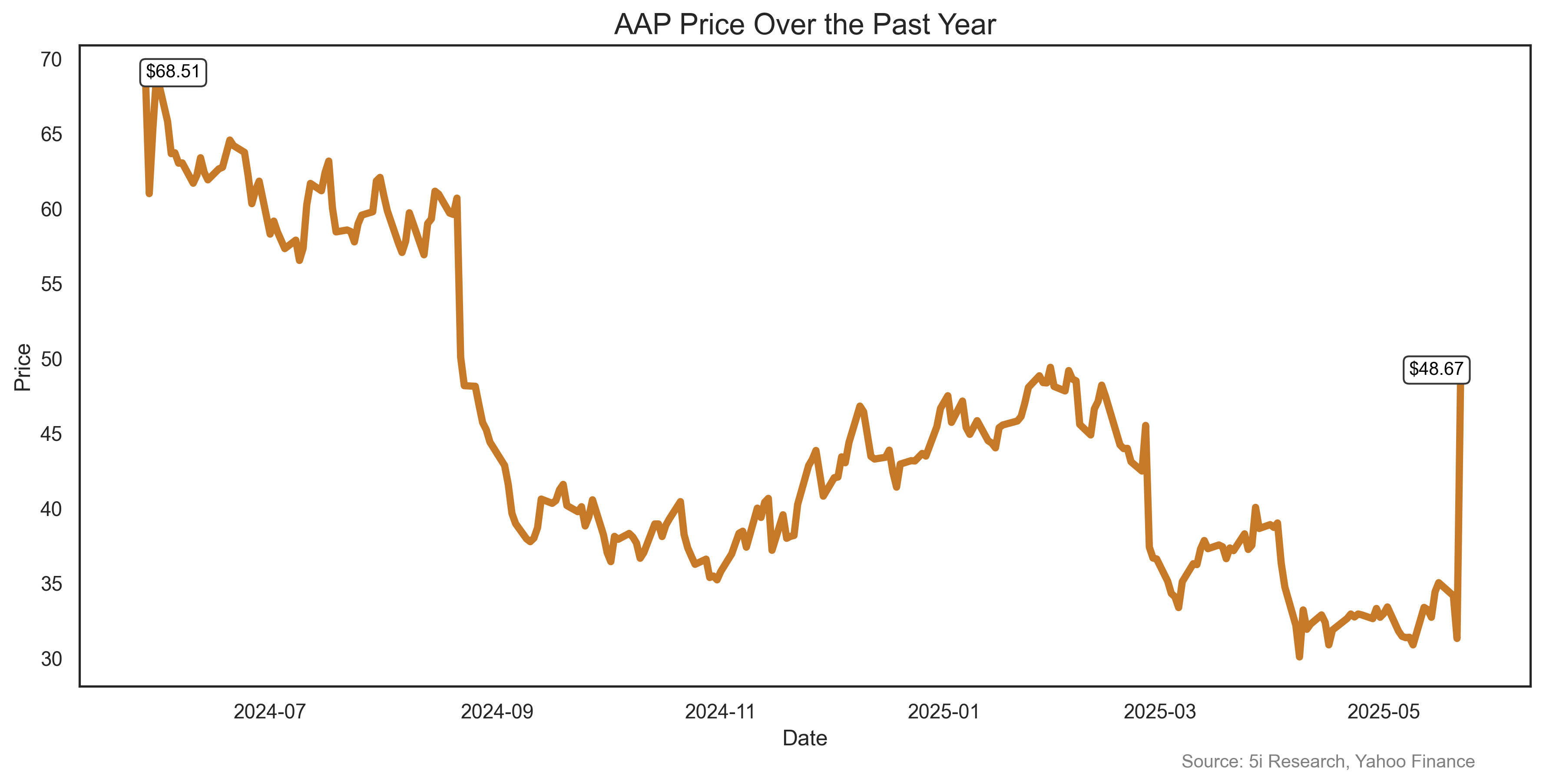

When is bad news good news? AAP soared 32% last week as it reported same store sales growth of negative 0.6% and discussed the closing of 500 locations. The automotive aftermarket parts provider has struggled somewhat in the past, but investors loved this recent news, since analysts were expected a same store sales decline of 2%. The big move brought the shares to a 2% gain for the year so far, but remain down 28% over 52 weeks.

When is bad news good news? AAP soared 32% last week as it reported same store sales growth of negative 0.6% and discussed the closing of 500 locations. The automotive aftermarket parts provider has struggled somewhat in the past, but investors loved this recent news, since analysts were expected a same store sales decline of 2%. The big move brought the shares to a 2% gain for the year so far, but remain down 28% over 52 weeks.

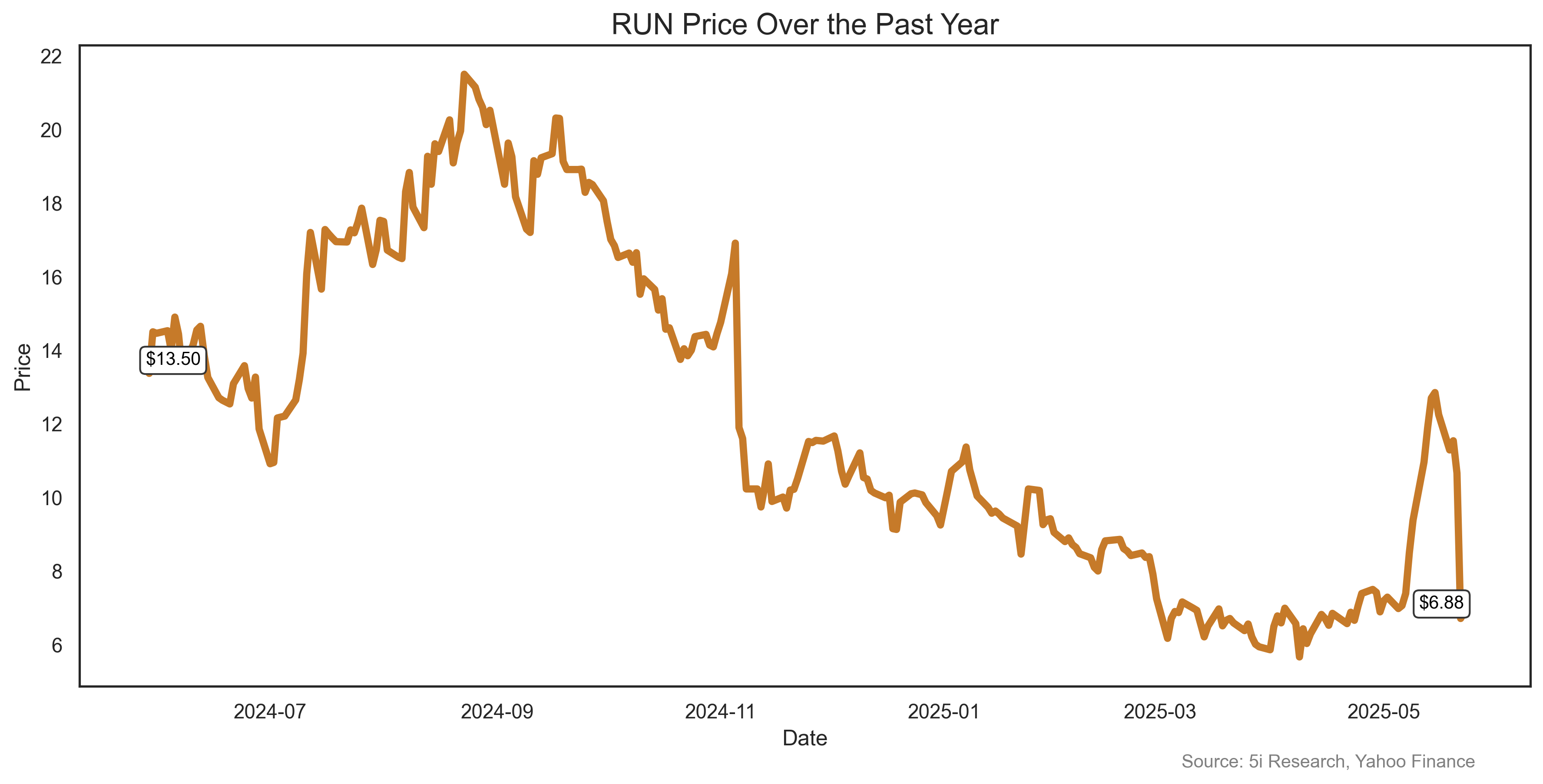

All Nukes, all the time. As noted above, the US government set off a wave of buying in the nuclear sector last week with proposals to make it easier and faster to get regulatory approval for new nuclear facilities. Who loses though? The solar industry, which is also going to see the reduction of tax credits for buyers. Trump's Big Beautiful Bill, according to one industry insider, 'is basically going to shut down the whole industry'. Sunrun took the biggest hit of the sector, down 44% on the week.

All Nukes, all the time. As noted above, the US government set off a wave of buying in the nuclear sector last week with proposals to make it easier and faster to get regulatory approval for new nuclear facilities. Who loses though? The solar industry, which is also going to see the reduction of tax credits for buyers. Trump's Big Beautiful Bill, according to one industry insider, 'is basically going to shut down the whole industry'. Sunrun took the biggest hit of the sector, down 44% on the week.

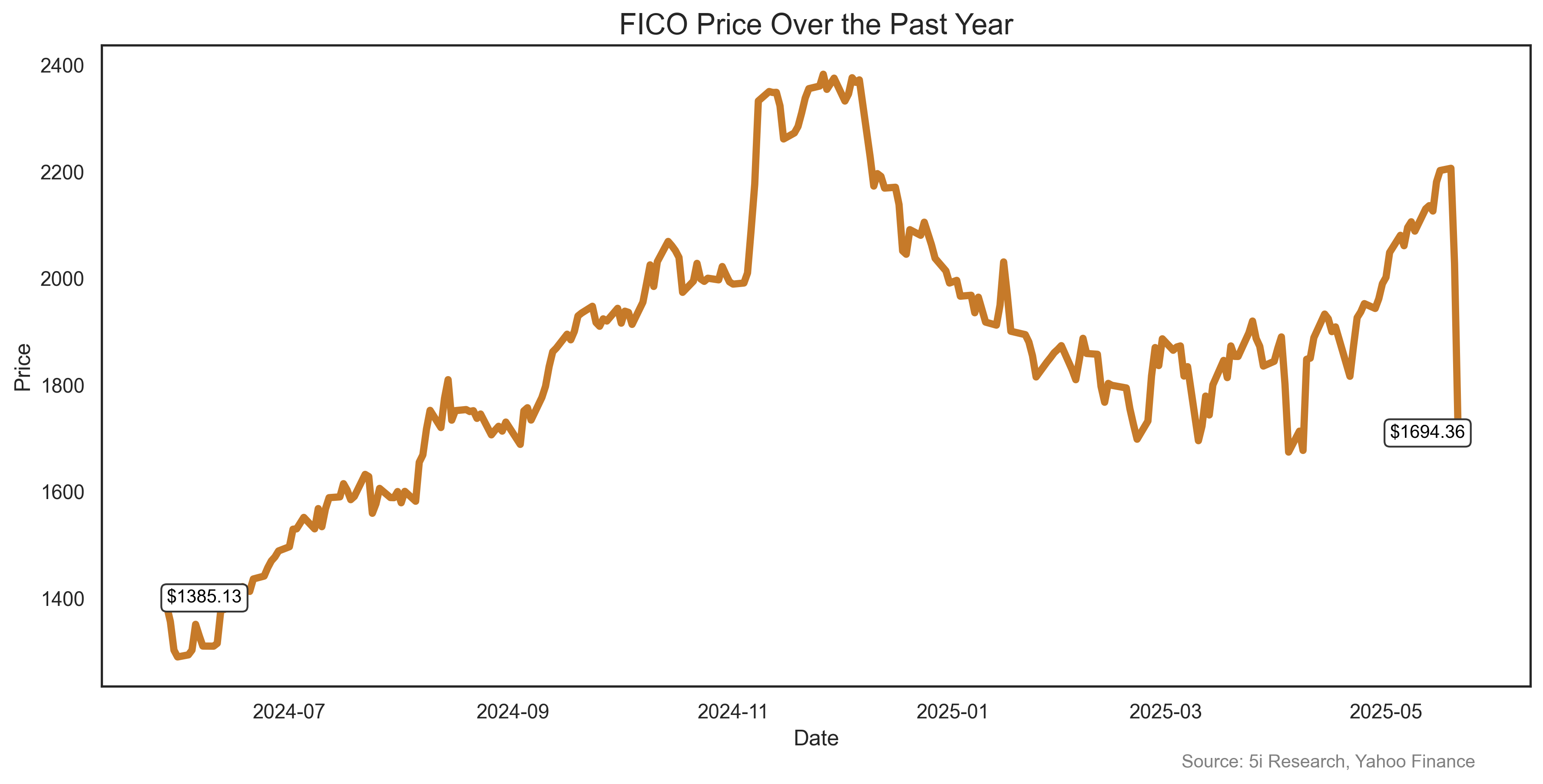

Psst..hey Mister...want to borrow some money? Before you sign up with Louie the Loan Shark, keep in mind that borrowing money might get a whole lot easier--or at least cheaper--under some newly proposed rules. Last week FICO fell 23% after a director at the Federal Housing Finance Agency spoke at banking conference, and indicated his agency might aim to reduce the need for three credit scores and move to just two credit scores, when consumers are applying for loans. FICO's main business is providing these scores, so investors panicked and sold FICO shares down sharply. There's a Catch-22 here. A homebuyer benefits from the proposal, but only of course if they didn't see their net worth decline because they owned FICO shares.

Psst..hey Mister...want to borrow some money? Before you sign up with Louie the Loan Shark, keep in mind that borrowing money might get a whole lot easier--or at least cheaper--under some newly proposed rules. Last week FICO fell 23% after a director at the Federal Housing Finance Agency spoke at banking conference, and indicated his agency might aim to reduce the need for three credit scores and move to just two credit scores, when consumers are applying for loans. FICO's main business is providing these scores, so investors panicked and sold FICO shares down sharply. There's a Catch-22 here. A homebuyer benefits from the proposal, but only of course if they didn't see their net worth decline because they owned FICO shares.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Analysts of 5i Research responsible for this report do not have a financial or other interest in securities mentioned. The i2i Fund does not have a financial or other interest in securities mentioned.

Comments

Login to post a comment.