Report Updates

We have posted report updates on Kinaxis (KXS), Badger Infrastructure Solutions (BDGI), and CAE Inc. (CAE). The ratings for two companies were maintained, while one was downgraded from the previous report. One company is a leading supplier of supply chain management software and concurrent planning platforms, another is involved in excavating services and provides services for contractors, while the third company provides civil aviation training services. Between these three various sectors, there is a mix of economic headwinds and tailwinds. We feel that continued strength, a multiyear cyclical market recovery, and increased growth expectations due to infrastructure spending are in store for these three names.

Read the latest updates by logging in here!

Market Update

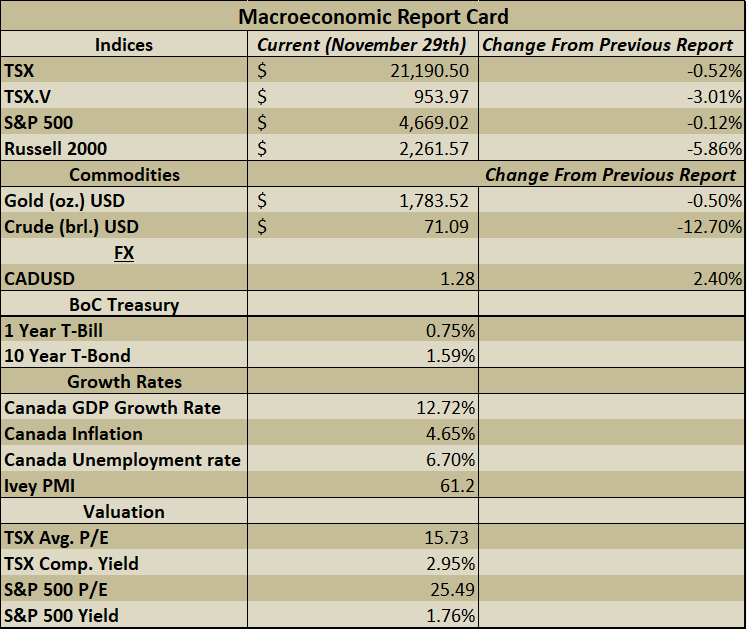

Markets have encountered some volatility recently with the discovery of a new COVID-19 variant over the past week. Large-caps have performed quite well over the past few weeks, while small to mid-cap growth tech stocks have been hit hard. Persistent inflation continues to be a concern for the markets, as treasury-bond yields and the US dollar surge higher. The Bank of Canada warned that there is a risk of a sudden price drop in housing prices, and at the same time, Canadians can be seen looking to purchase homes before interest rates rise. The price of oil has been correcting over the past several weeks as the US seeks to release oil stockpiles and China is also said to be tapping into emergency reserves. As the year draws to a close, we thought it would be appropriate to discuss tax-loss selling guidelines and important dates.

Utilizing Tax-Loss Harvesting Techniques

As we near the end of the year, investors may be considering rebalancing or making adjustments to their investment portfolios. Investors that have unrealized losses in their non-registered accounts may look to utilize tax-loss selling techniques to reduce any capital gains incurred throughout the year. This technique known as tax-loss selling or tax-loss harvesting is only applicable for non-registered accounts and does not apply to tax-sheltered accounts such as RRSPs or TFSAs.

In our recent 5i Stock Screener, we outlined some of our general thoughts on tax-loss selling as well as a stock screen for various stocks that we felt were primed for tax-loss selling due to their weakness throughout 2021. We feel that small-cap stocks, being more volatile than other stocks and having a larger retail ownership base, are ideal candidates for tax-loss selling. Large-cap stocks are less affected by tax-loss selling since they are typically more stable than small-cap stocks. With many retail investors having taken on more risks in 2020 and early 2021 in high-growth small-cap names, many of those names have seen sharp corrections since leaving many investors ‘holding the bag’. However, there are likely still legitimate growth prospects for some of these companies. As we approach the end of the year, it may be worth considering realizing a loss to cut one’s tax bill and start fresh with a few high conviction names at a low price.

Superficial Loss Rule

It is important for investors to be aware of the ‘superficial loss rule’ that applies when looking to harvest tax losses. An investor, their spouse, or a company that they control, cannot repurchase the stock or fund within 30 days of selling it, or else this will disqualify the capital losses as being used for tax purposes. Although, if an investor decides to sell a stock for the purpose of harvesting tax losses, they can purchase a similar stock or fund to maintain exposure to that particular sector. As an example, an investor could sell Suncor (SU) to harvest capital losses and purchase Imperial Oil (IMO), or an oil company ETF like iShares S&P/TSX Capped Energy Index ETF (XEG) for 30 days (or more).

An investor cannot repurchase the stock or fund within 30 days of selling it in order to qualify for capital losses in the following year, however, if the investor does repurchase the stock or fund within 30 days (and therefore triggering a superficial loss), the investor may be able to reduce their adjusted cost base on any existing shares of that security that is owned. For more information, we have linked an article on superficial losses here.

Important Dates

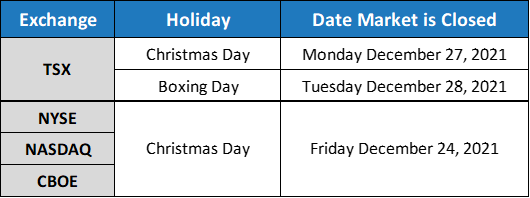

The last trading date for 2021 for publicly traded stocks will be Wednesday, December 29th, 2021. Any stocks purchased or sold after this date will be settled in January 2022 and will therefore apply to the 2022 tax year instead of 2021. The dates for stock closures for major exchanges are listed below:

Benefits and Downfalls of Tax-Loss Selling

Each year we make a point to remind our members that tax-loss selling is of secondary importance when compared to the long-term benefits of investing in a company with sound fundamentals. Tax-loss selling should not form the basis of major investment decisions and should not fundamentally change an investors’ asset allocation. Being aware of how much tax savings one could get from selling at a loss is also a consideration. While the benefits of harvesting losses may prove to be a savvy financial decision for an investor, we continue to hold the mentality that maintaining a long-term thesis on sound companies has proven to yield the highest returns to investors.

Best wishes for your investing!

www.5iresearch.ca