Report Updates

We have posted report updates on Winpak (WPK) and Dye & Durham (DND). One's valuation continues to see compression due to negative sentiment in the markets, coupled with some negative press and uncertainty regarding a large acquisition scheduled for later this year. However, we think the risk-to-reward setup is attractive if things go as planned. The other company has seen improvements in its margins but continues to trade at a justified discount to peers in our view.

Read the latest updates by logging in here!

Market Update

Markets have been consolidating over the past couple of weeks, following a big run-up in the month of March. The Bank of Canada announced a 50 basis point hike this past Wednesday and is planning on starting its quantitative tightening program on April 25. Earnings season has officially kicked off, starting with the financial sector showing mostly positive results. Bond yields continue to rise, putting further pressure on equities. There is a lot of information to digest in the current investing environment, and we wanted to take a step back and look at signs of confidence through corporate insider buying.

Three Asset Classes, Few Places to Hide

The main asset classes in investing are cash, equities, commodities, and fixed income (bonds). Although, commodities can also be associated with equities since there are many commodities producers in the equities space. The current investing environment is challenging because inflation is running hot, which disincentivizes investors to hold cash, bonds are dropping in price because interest rates are rising, and equities are pricing in both high inflation and interest rates. There are not many places to hide in this current market environment, which can create turbulence and uncertainty in the markets. Below we are going to highlight the main asset classes and how their performances have been over the past year and more.

Cash Drag – Inflation

Historically, in other periods of rising interest rates and falling equity markets, investors have felt safe raising cash and holding for lower prices, however, in today’s environment, inflation puts a damper on this idea. Inflation erodes the pricing power of cash, and this is typically expressed in either one of two ways; goods and services rise in price against the dollar, or the dollar becomes worth less in terms of goods and services. Both expressions come to the same conclusion, that inflation erodes the pricing power of the dollar.

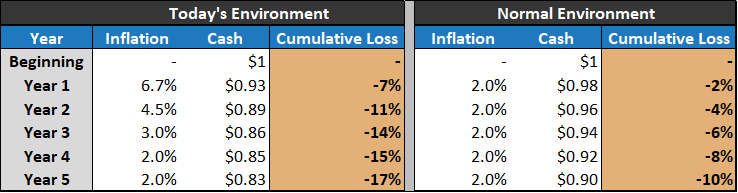

Inflation in Canada was recently announced as being 6.7% year-over-year, and expectations for inflation one year from now are 4.5%. Thereafter inflation is expected to normalize to its 2% to 3% range. We have modeled below the effects that today’s inflation environment can have on holding $1 in cash for the next five years, against $1 in a normal economic environment (inflation at 2%). After five years in today’s environment, cash will erode by a cumulative 17% five years from now. Alternatively, in a normal economic environment, cash would decline by a total of 10% five years from now. We use $1 as an example below, but we can also apply this to an investor holding $10,000 in cash ($1,700 loss), $50,000 ($8,500 loss), $100,000 ($17,000 loss) after five years, and so on and so forth.

Bonds – Fed Hawkish Positioning

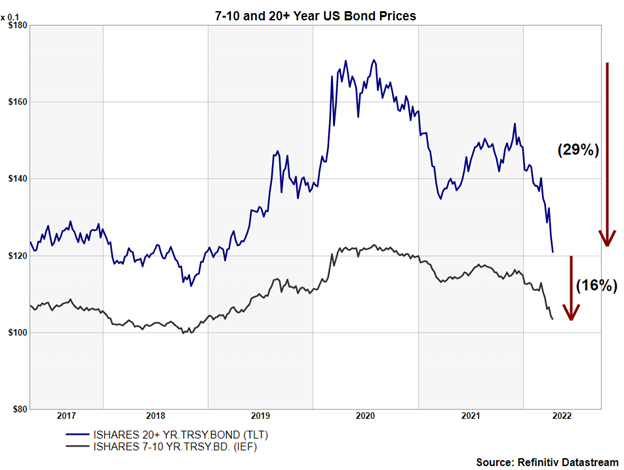

As a result of rising and persistent inflation, both the Bank of Canada and the Federal Reserve have positioned themselves for several rate hikes this year. As a result of this swift change in hawkishness from the Central Banks, bond yields have risen sharply, and bond prices have fallen dramatically. This has caused pain in bond investors’ portfolios over the past year or more and creates uncertainty in potential further declines.

From peak to trough over the past two years, the US 20+ Year Bond ETF (TLT) has fallen by 29%, and the US 7-10 Year Bond ETF (IEF) has fallen 16%.

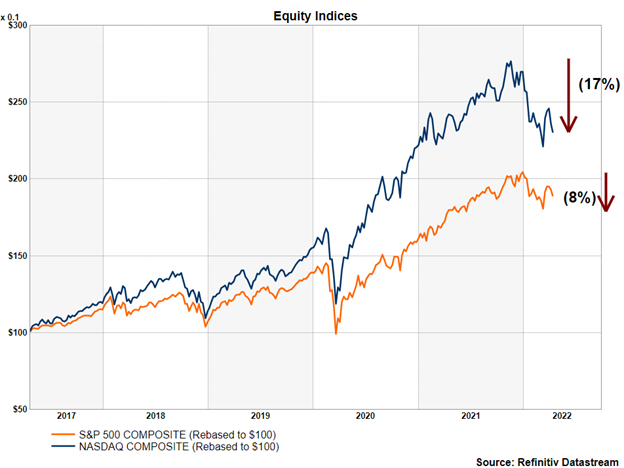

Equities – Inflation and Fed

Similar to bonds, equities have been declining recently, and for equities, the main cause is a reaction to high inflation and rising interest rates. High inflation creates weaker consumer sentiment and slows economic growth, and rising interest rates have a further dampening effect on growth. Both of which negatively impact stock prices, and this has caused the Nasdaq to decline by 17%, peak to trough, and the S&P 500 by 8%, peak to trough.

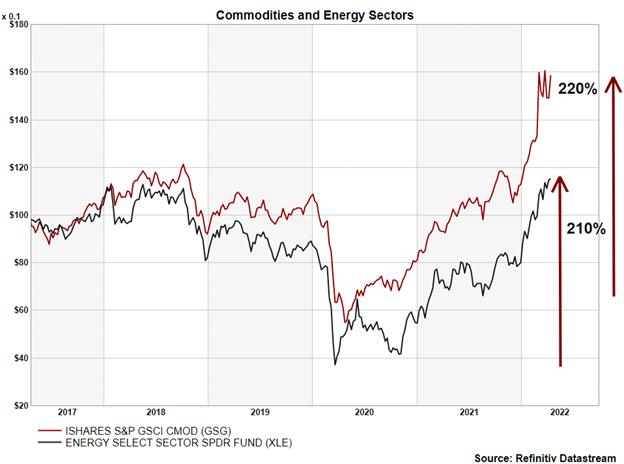

Commodities and Energy – The Trade That is Working

Commodities and energy are the two main sectors that we see performing well in today’s environment, having increased a total of 220% and 210% from trough to peak, respectively. Both sectors are supported by rising inflation and the current macroeconomic concerns of supply chain constraints and geopolitical issues.

Conclusion

We do not believe that simply because one asset class is performing well while another is not, does not mean that they will immediately reverse course, but we do believe that given enough time these roles may reverse. Bond prices have faced near-historic price declines, and the commodities and energy sectors have seen price rises that have not been seen for decades. It is a challenging market to allocate capital in, but we feel that having all of the data available helps to make a long-term decision, and we believe that given enough time, the market will become clearer.

Best wishes for your investing!

www.5iresearch.ca