Report Updates

We have posted report updates on Acadian Timber (ADN) and Shopify (SHOP). ADN is a large player in the timberland industry with a history of strong free cash flow and a high dividend yield, and SHOP is a leading global e-commerce software company with a strong market position. We believe that both companies can be considered industry leaders and both management teams are actively engaged in diversifying their operations. One is exploring a new market in carbon credits and the other has a bright future in growing its market share.

Read the latest updates by logging in here!

Market Update

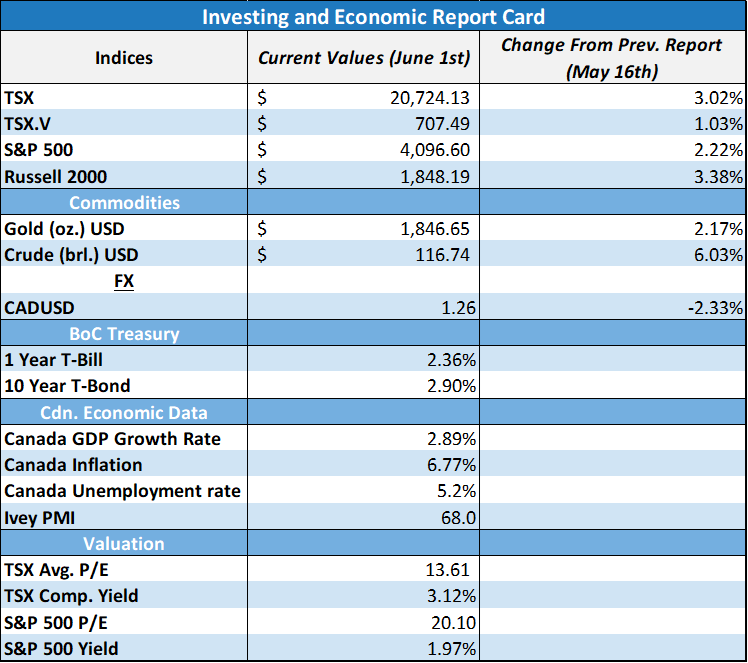

The markets have rebounded slightly over the past couple of weeks, and part of this can be attributed to new US economic data that have pointed to potentially slowing inflation and a greater focus on recession risks rather than inflation risks. The Bank of Canada announced a 50 bps rate hike on Wednesday, bringing the interest rate to 1.5%. The next inflation print from the US is expected next week, and an interest rate announcement from the Fed is expected two weeks from now. In this market update, we aim to highlight some general North American economic data points, and where the strengths and weaknesses lie.

The Canadian Labour Market

One of the most fundamental underpinnings in any economy is the labour market. If consumers are employed, this is conducive to increased savings and spending, and both of those activities lend themselves to further business activity, and thus employment. The Canadian labour market has become increasingly strong since the beginning of the 2020 recession, and this has been fueled by job openings and robust economic growth. The Canadian unemployment rate has never dropped below 5%, and currently, it is hovering around 5.2%, this is about the closest it has ever been to 5%.

We can see in the chart below the previous instances of low unemployment rates, 2008 and 2019. This is not necessarily a precursor to a recession, but when the labour market is strong, the Central Bank tends to tighten monetary conditions to keep the economy from overheating, and this has historically been associated with recessionary periods. We can see the annual employment growth rate has been hovering around 5%, indicating the strongest growth rate we have seen in over 20 years.

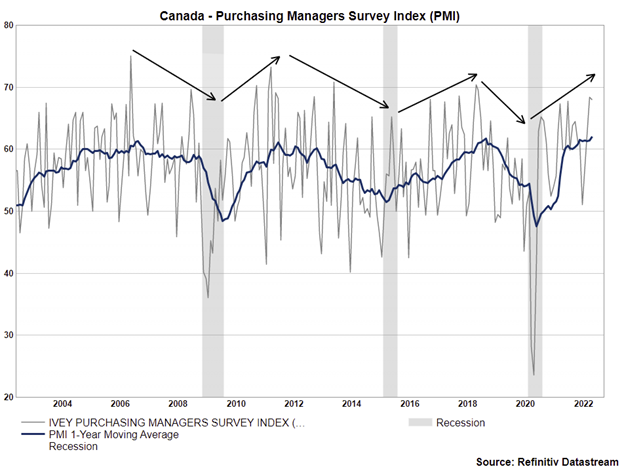

Purchasing Managers Index (PMI)

The Purchasing Managers Survey Index (PMI) measures the activity of expansion or contraction in the manufacturing sector through purchase orders. A reading above 50 typically indicates an economic expansion, and below 50 represents economic contraction.

Below we have a chart of the Canadian PMI over the past 20 years, overlayed with recessionary periods and a one-year moving average of the PMI. What we can see is that the PMI readings fluctuate greatly month-month between 50 and 70, however, the one-year moving average depicts periods of economic expansion and contraction. This oscillating one-year moving average of the PMI (blue line) is really showcasing the business cycles. The PMI rolled over into 2009, which led to a recession, and subsequently rebounded into 2013, creating an expansive period, and then rolled over into 2015, where Canada experienced a recession, and so on and so forth. Most recently, we have gone through an expansion from the trough of 2020, and how long this expansionary period will last is tough to gauge, but we would expect the PMI to begin moving from its peak to the next trough.

Similarly, we have performed the same exercise as above on the US PMI. We can see a very similar trend in the one-year moving average on the PMI, and the US one-year moving average has already begun to roll over from its peak. This is not necessarily implicative of a pending recession, as we saw the moving average oscillate from peak to trough between 2011 and 2018.

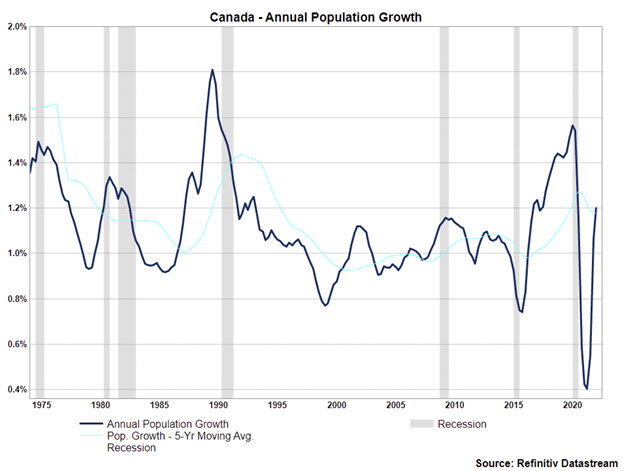

Canada Population Growth

The world is constantly growing, and the global population has grown from 3.7 billion in 1970 to 7.8 billion in 2020. Part of a strong economy is population growth - this helps to ensure demand for business activity grows, which leads to a growth in employment, therefore creating a positive feedback loop. In looking at Canada’s population growth since 1974, there have been many year-over-year swings in the growth rate, but it has largely fluctuated between 0.8% and 1.4%. The recent annual growth rate is 1.2% and this represents a strong rebound in Canadian population growth.

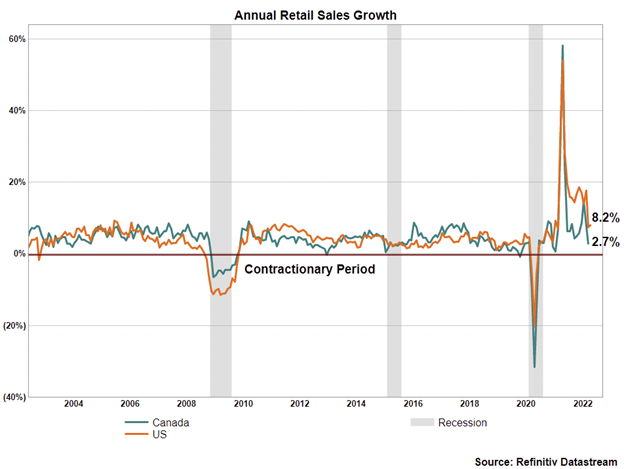

Retail Sales

Retail sales are the beating heart of consumerism, and consumerism (in moderation) leads to positive economic activity. Retail sales include the purchase of finished goods and services by both consumers and businesses. A rough analysis of goods and services is that they start at the beginning of the supply chain (raw materials extraction), then go through manufacturing and processing, and finally arrive at the end of the supply chain, the retailer. If consumers are spending less on finished goods and services year-over-year, this results in lower corporate profits, a higher unemployment rate, and thus a lower ability by consumers to increase their spending.

Canada witnessed a few periods of negative or zero year-over-year retail sales growth over the past 20 years, 2009, 2013, 2015, 2019, and 2020. Not all these periods were associated with a recession, but three of them were. The US experienced negative retail sales growth in 2009 and 2020. The latest data is as of April 2022, and it points to an 8.2% annual growth rate for the US and a 2.7% growth rate for Canada. The average growth rate over the past 20 years for both countries has been 4.3%. We can see that both growth rates are heading lower, however, the US is still above its historical average, whereas Canada is below its average. Ideally, we would like to see both growth rates stabilize above 0% and within the 2% to 6% range.

Major Takeaways

The major takeaways that we would like to provide readers with here are that the silver lining on worsening indicators (retail sales and PMI) can be seen as a positive for potentially decreasing the inflation rate, and the positive indicators (labour market and population growth) act as strong foundational supports in the event of an economic slowdown or recession. Not all is as rosy or gloomy as it seems, but somewhere in between.

Best wishes for your investing!

www.5iresearch.ca