Report Updates

We have posted report updates on Sylogist (SYZ) and Premium Brands Holdings (PBH). Both companies' ratings have been maintained from previous reports. One company targets and acquires food businesses across its two main platforms, while the other company is a SaaS-based business that serves over 1,950 customers globally. Market expansions, ability to pass on inflation, sticky customer base, and a lot of accretive acquisitions. We think that both companies have a bright future ahead.

Read the latest updates by logging in here!

Market Update

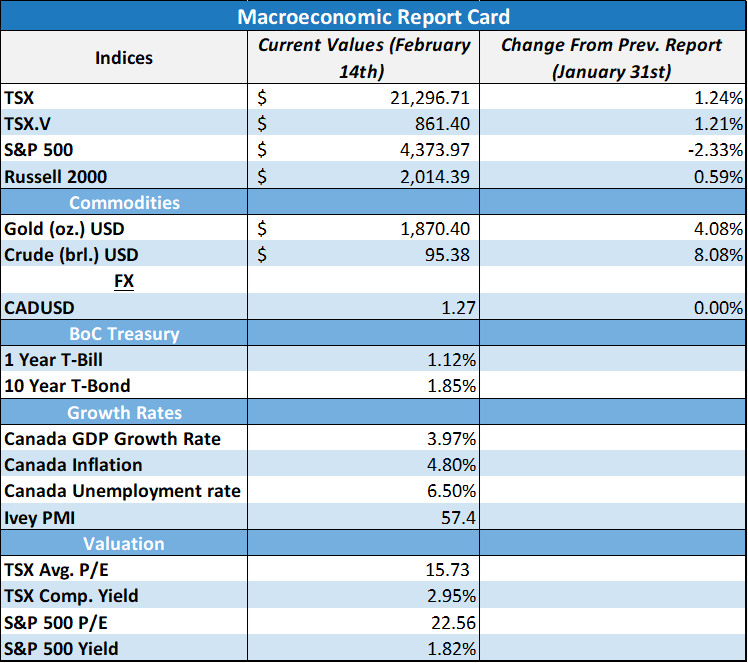

The financial markets have mostly traded sideways over the past couple of weeks, as several concerns have begun to surface. The latest US inflation print for January came in at a staggering 7.5% annual pace, which sparked Federal Reserve’s James Bullard to urge the Fed to raise rates 1.0% by July. Geopolitical tensions between Ukraine, Russia, and the US roiled the markets, until most recently when the tensions began to ease. If there is one thing that the financial markets do not like it is uncertainty, and the current levels of uncertainty are quite high. Most of these uncertainties have been brought on by high levels of inflation, and in this market update we aim to gather more insights into a bit of how inflation became this elevated.

Broader Market Weakness and The Root Cause - Inflation

The past few months for the financial markets have been quite tough for most high-growth stock names and even a few blue-chip stocks. We attribute most of this broader market weakness to worries of increasing interest rates and the potential for quantitative tightening. While these concerns and uncertainties revolving around them are the primary reason for the sell-off in stocks, the underlying issue behind these worries is inflation. The rapid rise in inflation has caused the central banks to begin discussing raising interest rates well before originally anticipated. Higher interest rates help to combat high inflation, but the results of higher interest rates can also be worsening economic growth.

Knowing this, if we can assess the historical and potential future path for inflation, we can perhaps gain some clues as to what actions the Federal Reserve will take in 2022. Inflation is the year-over-year change in consumer goods and services, and at its core, it is a simple function of supply and demand. The higher the demand, the higher inflation, and the lower the supply of goods and services, the higher inflation reaches.

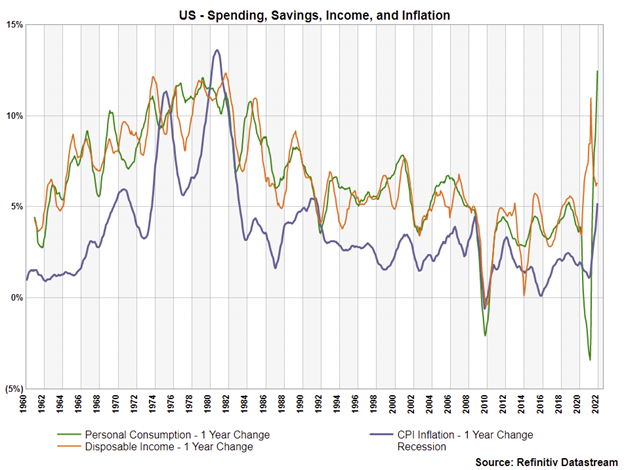

Covering the demand aspect, the simplest way to assess demand is through consumer expenditures (consumption). Over a long period of time, we can see a direct correlation between personal consumption and inflation. But what is it that causes personal consumption to rise? Individuals need to have higher amounts of disposable income to increase their consumption. As consumers’ incomes increase, so too does their disposable income and levels of savings, but when disposable incomes drop because of consumption above one’s earnings, savings need to be tapped into.

Personal Consumption, Disposable Income, and Inflation

Below we have charted the connection between personal consumption, disposable income, and inflation. Each metric is using the year-over-year percentage change and on a one-year moving average to smooth them out. We can see right away the interconnectedness of these three metrics. If one’s disposable income is increasing at a high-rate year-over-year, so too are their spending behaviours, and this leads to an equally high inflation rate. The elephant in the room here is the substantial recent one-year rate of change in consumption.

Personal Savings and Consumption

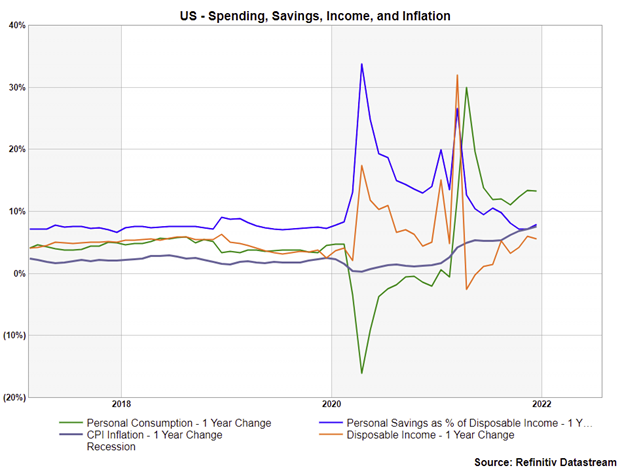

Adding in the component of personal savings (savings as a percentage of disposable income on a one-year moving average), we can see the mirroring effect that savings and consumption have had recently. This chart is displaying the relationship between consumption and savings over the past 60 years, and for 50 of those 60 years they have mostly moved in tandem, except over the past 10 years they have begun to diverge. Following 2008, consumers began to save more and consume less. In 2020, this trend became more exacerbated, and we saw consumption drop, savings skyrocket, and then the eventual reversal as savings are now falling and consumption is exploding higher. This implies that a large part of the recent increased trends in consumption has been due to consumers spending their excess savings.

Reviewing the last five years more closely and with inflation and disposable income added in, we can see that as consumption dropped in 2020, savings and disposable income rose (spend less and save more). As consumers began to increase their spending again in 2021, disposable income and savings have begun to decline as these amounts have gone into consumption, and inflation has begun its ascent.

Looking at the same graph as above but without the one-year moving averages (albeit more noise), we can see that disposable income and savings are right back at the levels seen prior to the pandemic (5% and 8%, respectively). The only difference is that consumption has remained elevated at roughly 12%, whereas it averaged 5% prior to the pandemic.

Concluding Thoughts

We believe that this means most consumers' savings have been tapped into for excess consumption, and unless we see a meaningful rise in disposable income, consumption should begin to fall. A fall in consumption would likely lead to a fall in inflation, but the effects of this are lagging, and are likely to take place over the next several months. We view this as the process of normalization following the increase of money supply and fiscal spending throughout the pandemic. Based on the chart above, disposable income and savings seemed to have normalized, and now we are just waiting for the next shoe to drop (consumption to normalize).

Best wishes for your investing!

www.5iresearch.ca