Report Updates

We have posted report updates on Spin Master (TOY) and Constellation Software (CSU). We have upgraded the rating for one company while maintaining the other company's rating. One company is a software provider for various businesses operating in distinct vertical markets, while the other company creates and manufactures digital games and toys across the globe. Both companies have a very diverse revenue mix and have demonstrated great financial results. We believe that TOY will benefit from tailwinds in the digital gaming space and will continue to grow internationally, and CSU will continue to be successful in acquiring and integrating various vertical market software companies.

Read the latest updates by logging in here!

Happy Holidays!

We wanted to wish all members a safe, healthy, and happy holiday season and New Year! These past couple of years have been outside of the norm, in both a personal and markets-related manner. As always, don’t forget to take some time to catch your breath, step back from the markets, and surround yourself with family and friends, in any form, be it physical or virtual.

A reminder that we will not be answering questions between December 24th to 31st. We will be back and answering questions on January 3rd.

Market Update

Markets have experienced some volatility over the past few weeks as high valuation companies have seen large sell-off pressure, and the Federal Reserve has shown a more hawkish tone with its early tapering comments. The US inflation print came in slightly higher than expected, at an annual pace of 6.8%. Prices for food, energy, and shelter attributed to most of the price increases.

The broad markets have had a stellar year-to-date performance, and this follows a similar performance to 2020. Although both years experienced their own moments of volatility, 2021 had relatively muted volatility with very few drawdowns greater than 5%. This year, we experienced the looming pressures of an eventual interest rate increase announcement, as well as the beginning of the bond-buying tapering process. The Bank of Canada ended its quantitative easing (monetary stimulus) program in October of 2021, and the Federal Reserve is in its early days of the bond-buying tapering process, with indications of an eventual stop sometime in early to mid-2022. Overall, this means that economic policy continues to be more stimulative than restrictive, although, it appears we are nearing the onset of more tight economic policies. Tighter monetary policies are not necessarily a negative factor for the markets, as it implies that the economy is healthy enough to withstand higher interest rates, incur fewer liquidity injections, and hopefully, bring about more organic economic growth.

Year-to-Date Major Indices Returns

Looking at the year-to-date returns of the major indices, the S&P 500 continues to perform well, as it’s inclusive of the largest and most economically contributive stocks to North America. The Russel 2000, the small-cap index, performed quite well early into 2021 and then traded somewhat sideways into the end of the year. The TSX performed well, aided by the strong performance of the energy sector this past year. The Canadian dollar against the US dollar experienced some periods of volatility but mostly ended the year flat against the levels at which it started the year.

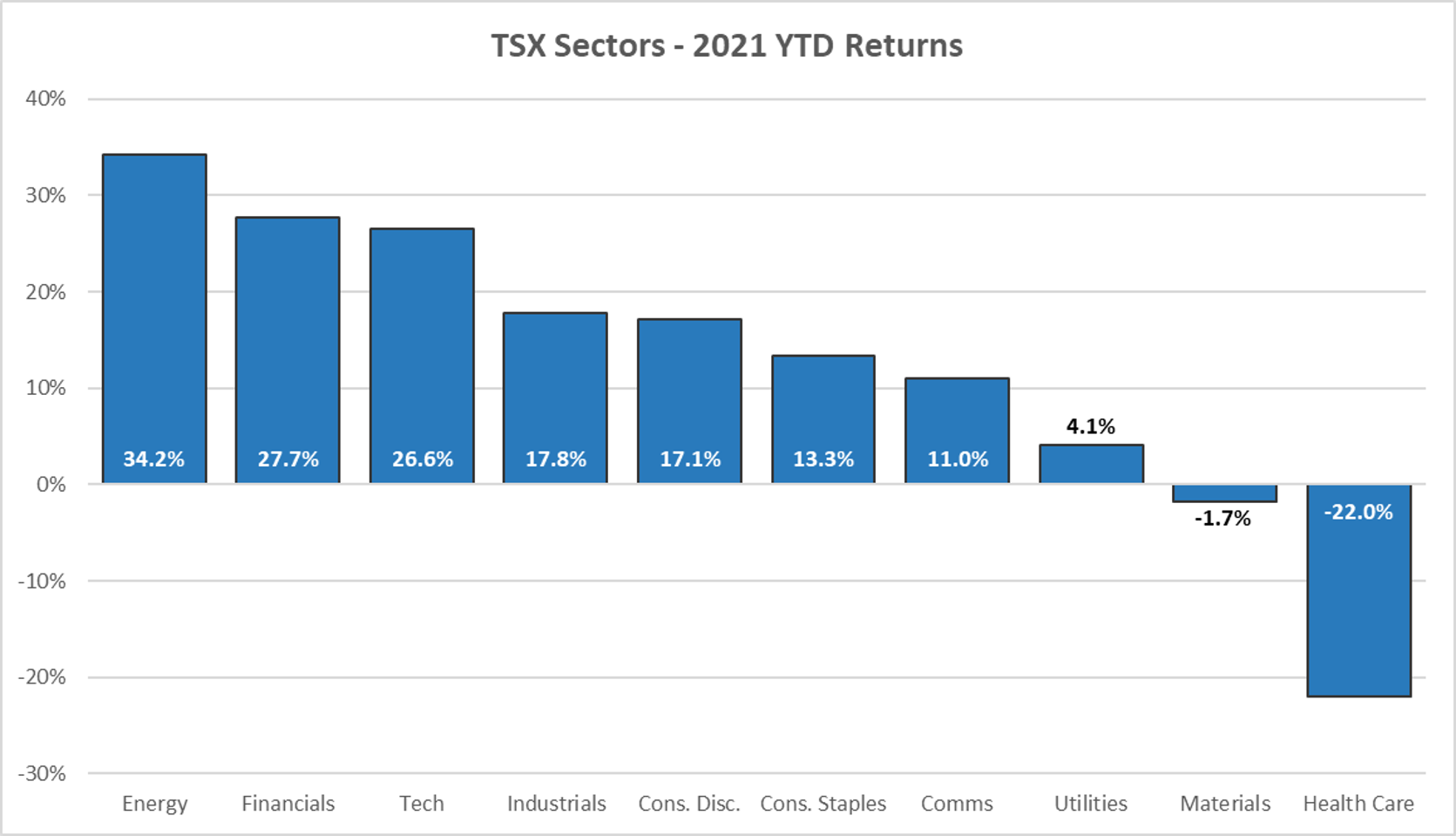

Year-to-Date TSX Sector Returns

Reviewing the year-to-date performance of the individual TSX sectors, energy, financials, and technology brought up the average return of the TSX index, while utilities, materials, and healthcare were significant underperformers.

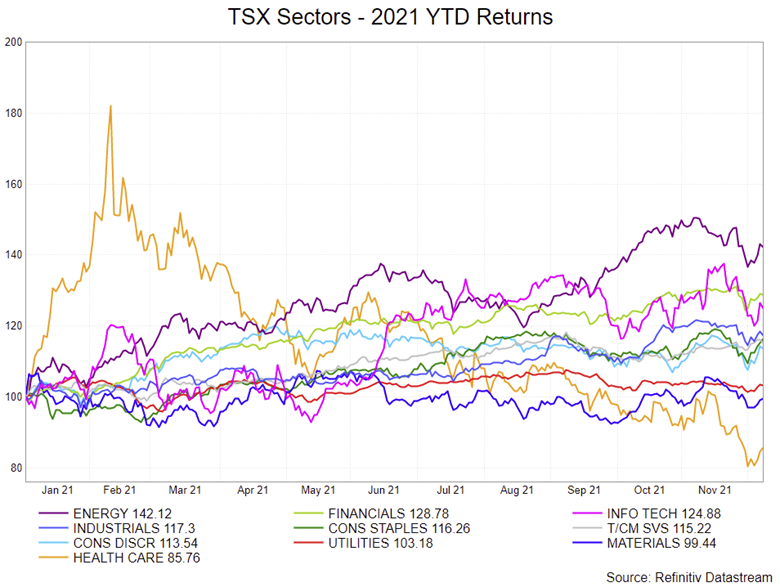

2021 TSX Sector Performance

In assessing how each sector performed throughout the year and their relative performances, we can see that healthcare started the year strong, and then lagged significantly throughout the year, whereas the energy sector made strong higher lows and higher highs. Financials and the tech sector also had strong performances throughout the year.

2022 Outlook

While underperforming sectors can certainly be a place to look for opportunities for recovery and outperformance in the next year, we would not consider that to be an absolute rule. Typically, there are very logical reasons for these underperformances, and they can carry on for longer than one year.

We believe that equities will continue to perform well into 2022, and while we may not see annual returns of 20% to 30% like we have seen this year, the macro-economic backdrop remains positive for equities, with a low-interest rate environment, continued quantitative easing by the Federal Reserve, and the mounting global pressures on central banks and governments to continue to drive economic growth.

We might expect to experience more volatility in 2022 than we have in 2021, as investors have not seen a 10% to 15% decline in equities in over a year, and fears of increased interest rates tend to heighten market volatility. In the long run, these periods of volatility and market downturns have had a 100% success rate in being good buying opportunities. We think the best way to allocate capital is by investing in a mix of quality companies that show growth and staying focused on the fundamentals of each company.

Best wishes for your investing!

www.5iresearch.ca