Flash Report

We have posted a flash report update on 10 of our coverage companies. In the reports, we see underlying themes of margin compression and guidance for higher margins in future quarters, attractive valuations, and sales resilience through different stages of the economic cycle. There are lots of important insights to be found in these reports, and we think that reports like these help to grasp a better understanding of the current investing environment.

Read the latest updates by logging in here!

Report Update

We have posted a report update on Richards Packaging Income Fund (RPI). Richards Packaging has been in operations for over 100 years, providing packaging solutions for small and mid-sized companies across North America. The company has grown its sales steadily and recently shifted its revenue mix towards the healthcare sector. It offers an attractive dividend yield, a strong balance sheet, and can withstand inflationary pressures. We think that this is a good name to keep at the top of investors' minds.

Read the latest updates by logging in here!

Visit us at the Toronto MoneyShow, September 16 to 17!

Visit us at the Toronto MoneyShow Conference, September 16 to 17 at the Metro Toronto Convention Centre. We will be at the conference on both Friday, September 16, and Saturday, September 17, and members can attend the Canadian MoneySaver Day conference on Saturday where we are bringing together a select group of our expert columnists for a day of gaining further insights from experts on the best money-saving and money-making opportunities.

Click Here to Register

Investor Sentiment Survey - RESULTS!

Thank you to all those that participated in this past market update's Investor Sentiment Survey. We have published the results from the survey in a report in the link below. Please note that the weightings and categorization of these results are still a work in progress, and the model(s) used to analyze the results may change over time as more data comes in.

Investor Sentiment Survey Results

We look forward to releasing another round of the Investor Sentiment Survey at the next market update!

Market Update

The markets have been climbing back over the past couple of weeks amid a slew of economic events. The Federal Reserve announced its interest rate decision in late July, hiking interest rates by 75 basis points, and preliminary numbers for the Q2 US GDP came in around (0.9%). The Q2 Canadian GDP preliminary growth numbers came in at 4.6%, demonstrating resilient economic growth in the face of inflation and monetary tightening. Oil continues to trade lower, and top executive comments about subsiding supply chain constraints and inflationary pressures provide investors with a glimmer of hope. The US inflation reading came in at 8.5%, lower than analyst forecasts of 8.7%, and this has fueled a risk-on rally. In this market update, we aim to break down the US inflation reading and what to expect going forward.

July Consumer and Producer Inflation

The US Consumer Price Index (CPI) and the Producer Price Index (PPI) data both came in below economist expectations for July, and this translated into renewed optimism that inflation has finally peaked. The CPI number, the best-known measure for inflation, came in at 8.5% for July against expectations of 8.7%, and the month-over-month change came in at 0.0%, against estimates for an increase of 0.2%. This was the first time in months that the US inflation reading came in below analyst expectations and it has provided investors with a sigh of relief that good news may be on the horizon.

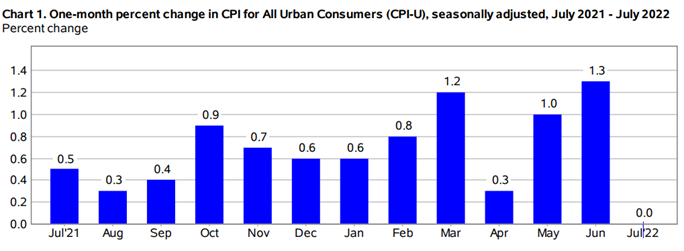

Below is a chart of the month-over-month changes in CPI over the past 12 months, and as we can see, July is the first month where inflation did not increase against the previous month. This is an important development in decelerating the pace of inflation on annual basis.

Source: U.S. Bureau of Labor Statistics

Viewed in a different context, we show the annual inflation figures charted over the past 12 months, split between the headline inflation number (‘All items’) and the core CPI number (‘All items less food and energy’).

Source: U.S. Bureau of Labor Statistics

The Producer Price Index (PPI) measures changes in prices of goods and services at the producer/manufacturer level, rather than the consumer level. The PPI is traditionally known to be a leading indicator for future inflation, as a softer increase in the PPI puts less pressure on producers to increase their prices to consumers. When producers face input cost inflation, they in turn raise the prices of their goods and services to keep pace with inflation, resulting in higher inflation. The US PPI month-over-month change for July came in below analyst expectations at (0.5%) vs 0.2%, and this represents the first monthly decline since April 2020. This decline in PPI is encouraging to investors in that it signals that the headwinds for higher inflation are easing.

Breaking Down the CPI Inflation Reading

The 0% month-over-month change against the prior month helped to alleviate the previously high inflation reading of 9.1% in June, and this was the result of the gasoline index declining by 7.7% in July, which offset increases from the food and shelter indexes. The food index rose 1.1% for July, which marks the seventh consecutive monthly increase of at least 0.9% or higher. The energy index declined by 4.6% in July after facing large increases in May and June. Shelter is seen to continue rising but at a decelerating pace.

Inflation Components and Future Expectations

Below we have created a rough outline of the CPI weightings towards each good and services component and our thoughts on what we can expect moving forward. Food represents about 1/6th of the total CPI weighting and has been a major source of stickiness in the recent elevated inflation readings. Energy represents about 1/10th of the inflation index and has been a major contributor to elevated inflation readings, however, this has recently been declining with the fall in oil and gasoline prices. Housing represents about 1/3rd of the index and often lags other asset prices. Just under half of the index is made up of vehicles (new and used), transportation, healthcare, and apparel, which have all been contributors to high inflation, but we consider these as much more elastic to fluctuating input costs (raw materials). While we note we expect some of these components to continue rising modestly, this would be at a lower annual rate of 2-4%, as opposed to the large increases of 5%+ that we have seen of late.

Source: U.S. Bureau of Labor Statistics

Although energy is one of the smaller components in the index and one that has declined the most, it permeates through other industries to impact their input costs, and thus their prices. For example, apparel manufacturers, transportation, and auto manufacturers all have seen their expenses rise because of rising energy costs, and thus they in turn increased their product prices to keep pace with inflation. We believe that energy will continue to see downward pressure in the coming year, and this will be reflected in lower producer costs, and in turn cause consumer prices to decline across vehicles, transportation, healthcare, apparel (43% of total CPI), and energy (9%) components. Housing, being a lagging indicator, will see headwinds as the Central Bank keeps interest rates elevated, and this can bring 1/3rd of the index lower in future months. Energy, we believe will remain suppressed and has the potential to decline further with government pressures to bring down inflation. Food, being the most sticky and major contributor to high inflation, we see as the wild card that has the potential to keep rising, but we feel will begin to decelerate as supply chain issues resolve.

Overall, we feel that the decline in inflation is an encouraging sign for investors that inflation may have peaked, headwinds of rising rates are subsiding, and market fears and uncertainty are being resolved. We expect inflation to remain at elevated levels throughout the remainder of the year but see a much higher probability of inflation moving lower as opposed to higher, thus sending the markets on an upwards trajectory.

Best wishes for your investing!

www.5iresearch.ca