New Report

We have posted a new report on Tecsys Inc. (TCS). The company is a cloud-based SaaS supply-chain solutions company that has a solid track record of revenue growth, is actively reinvesting in its operations and benefits from the tailwinds of the adoption of e-commerce. Management has done an excellent job of adapting to an evolving landscape and has become a dominant player in the healthcare supply-chain industry.

Read the latest updates by logging in here!

Market Update

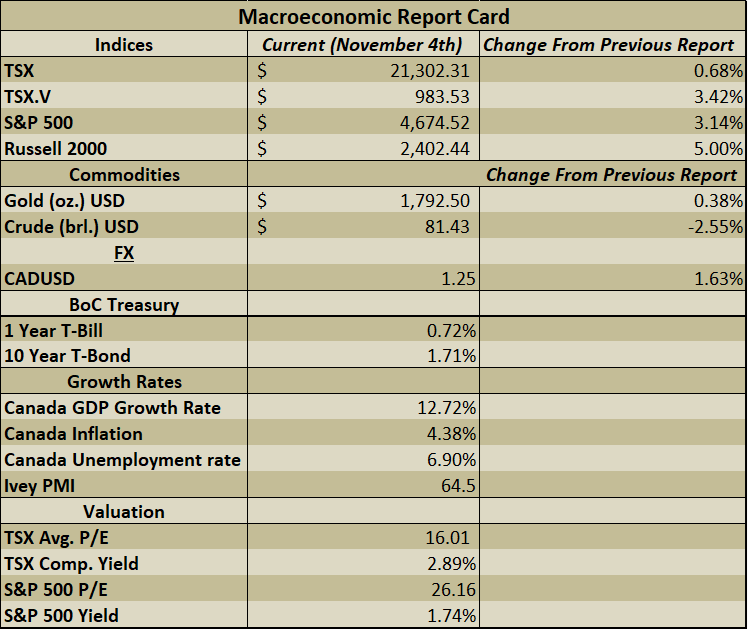

Markets have shown strength over the past two weeks, with all indices making fresh all-time highs. Most companies have reported strong earnings results and have beat analysts estimates. The one-year Canada Treasury Bond yields have been spiking after the Bank of Canada announced that it will be ending its quantitative easing and bond tapering programs, and it plans to advance its first rate hike three months earlier than initially planned. The BoC cited that strong economic growth has resumed in Canada and that the economy should grow by 5% this year before moderating in 2022. The Federal Reserve noted on Wednesday that it will begin tapering its bond-buying program by $15 billion a month, with projections for its quantitative easing program to end by July 2022. From supply chain woes to bond-buying tapering and a commodities boom, 2021 has certainly not been a boring market, and below we investigate what we believe is in store for the fourth quarter of 2021.

Historical Fourth Quarter Stock Market Performance

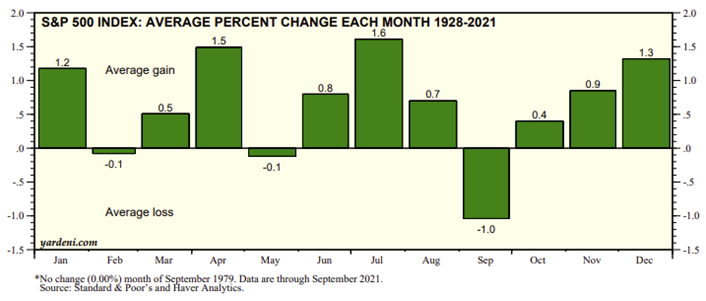

History does not repeat, but it does often rhyme, and we believe that the historical cyclicality of positive returns in the fourth quarter will once again return for 2021. While in a perfect world the stock market would be completely rational and based solely on numbers and logic, part of the dynamics of stock market prices are dependent on human emotion and a collective thought process. In the chart below we can see the average gain or loss by month for the S&P 500 index dating back to 1928 through 2021. While the majority of the monthly gains and losses appear random, the fourth quarter shows a gradual increase in monthly gains. There can be many psychological reasons as to why the fourth quarter is typically positive; investors increasing their exposure to winning stocks which would likely be the stocks that make up the majority of the index or simply ending the year on a positive note. Whichever the reason may be, history points us towards the fourth quarter typically being a positive one.

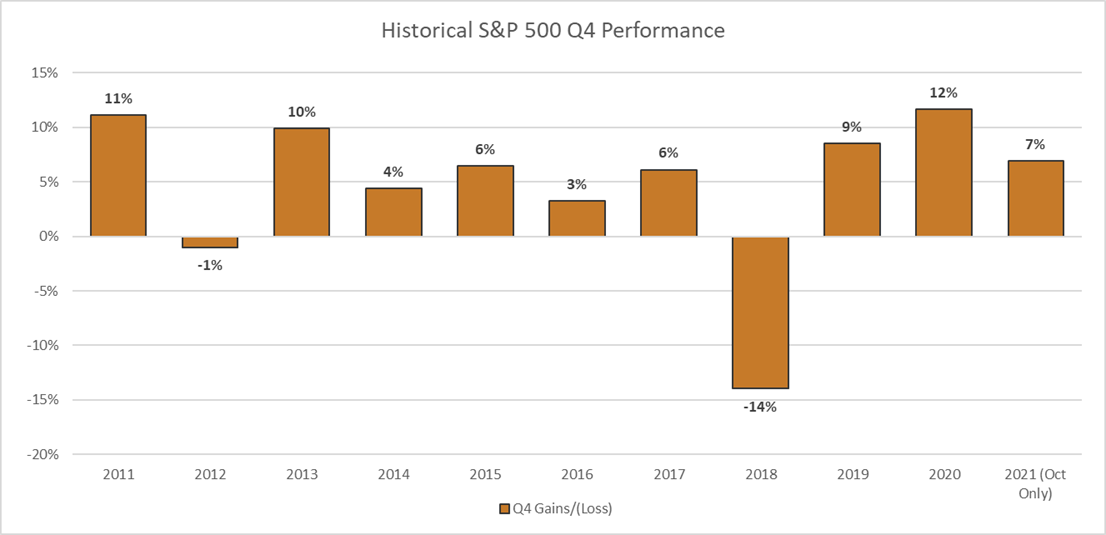

In the chart below we have analyzed the S&P 500 index fourth quarter returns over the past 10 years, including the performance for October 2021. In eight out the past 10 years, the fourth quarter returns have been positive, with an average return of 5%. The fourth quarter of 2021 has been positive so far, with a 7% return in October alone.

Source: https://www.marketwatch.com/investing/index/spx/download-data?startDate=9/30/2021&endDate=10/29/2021

Investor Sentiment Fueling the Rally

Now that we have seen the historical data for the average fourth-quarter returns, we can look to some investor sentiment details for 2021 specifically. As we have mentioned earlier, we believe that part of the movements in stock prices can be attributed to human behaviour, and this is most evident through two primary instincts – fear and greed. Fear is helpful in that it stops us from taking on excessive risk and greed can often hurt us by pushing ourselves beyond our limitations. Although, we believe that in the long-term the financial markets are a net positive to funding companies that we believe are beneficial to the world and will therefore generate revenue and profits, and as a result, the overall trend should be up and to the right. As a result of this, the most logical conclusion would be to take on risk when the markets are trending down and reduce risk when the markets trend up, however, the human emotion of fear kicks in when markets decrease and greed steps in when markets increase.

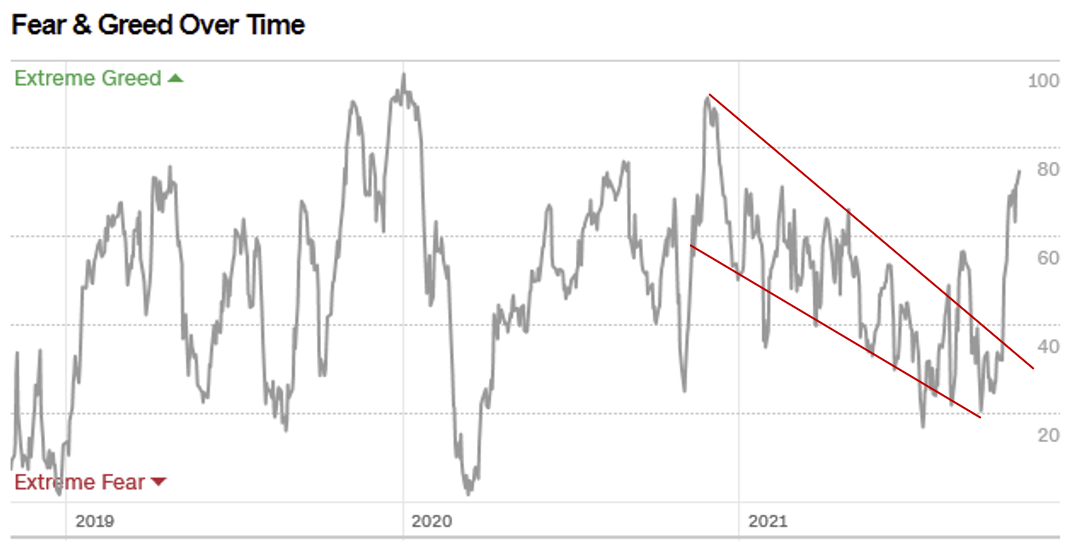

Below we can see a chart that analyzes investor sentiment between fear and greed over the past three years. This is a fear and greed index created by CNN which uses a combination of factors, such as recent stock and bond returns, the put/call ratio, yield spreads, the S&P 500 index value, volume, the VIX, and stock price strength. What we find most interesting is that going into 2021, investors became increasingly fearful as the market continued to soar higher, likely due to the recency of the market crash in 2020 weighing on investors’ emotions. The fear of a market correction continued up until September 2021, and then following the strong rebound in October, investors became increasingly less fearful. This signals to us that investors were likely not taking as much risk throughout 2021 until most recently when investor sentiment has turned around. Investor sentiment turning positive indicates that more cash will be deployed into equities and this can act as a tailwind for the stock market.

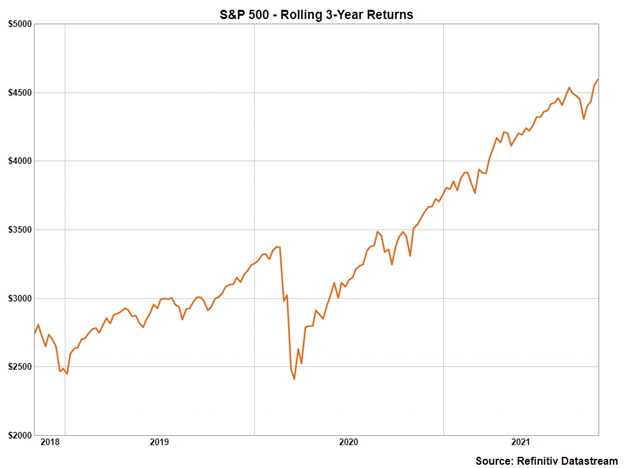

What is even more interesting, is that by looking at the price of the S&P 500 over the same time period as above, we can see that the market continued to increase even as investors became increasingly fearful. This to us signals that the market was being priced off of fundamentals, while investors were becoming increasingly worried about another market correction. As a result of investors’ sentiment turning around, we believe that further capital will be deployed into the market as there are lower odds that another large correction is to occur anytime soon.

Fundamental Reasons for a Bullish Fourth Quarter

We have now covered the historical data without context which points to a positive fourth quarter and the investor sentiment portion which can fuel the rally into Q4, now we are going to look at the economic and global financial reasons for a positive fourth quarter.

The central bank interest rates remain at sustained low levels and this acts as a tailwind for equities. Sustained low interest rates allow companies to borrow funds at a low cost and also causes investors to seek out higher returns away from assets that generate yield and towards equities. Continued fiscal stimulus and government spending bolster the economy and provide both investors and companies with cash. Although the supply chain issues continue to impose problems for companies around the world, the underlying theme that we are seeing is that demand for goods is not the issue, it is the supplying of those goods which is the issue. Consumer demand has only increased throughout the pandemic and this further supports the thesis for a robust economy. Now with the uncertainty of whether the Federal Reserve will begin its bond-buying tapering process out of the way, we believe the market is able to move forward more decisively. For supply chain issues, the market is aware that inflation may persist longer than expected and that supply chain issues may last into 2022, however, we believe the area of focus should be on this pointing to robust consumer demand.

Best wishes for your investing!

www.5iresearch.ca