Upgrades to Portfolio Analytics!

We are excited to be releasing a number of updates to Portfolio Analytics. You can experience the updates by logging in and upgrading to Portfolio Analytics now!

These upgrades help to put more power in the hands of members, increasing the customizability, reporting, and flexibility of the service. These changes make this tool a must-have service in order to be able to track and understand what an investor holds in their portfolio. Below we highlight the range of updates and enhancements to this service:

- CSE Prices now available

- Top 10 Allocations by account

- Customizable target allocations

- Investor Style Toggles

- Portfolio Account Names

- Flexible data entry

Report Updates

We have posted report updates on Kinaxis (KXS). The company provides cloud-based SaaS solutions that combine human intelligence with artificial intelligence to assist companies with supply chain management. Management has proven its ability to win contracts and new customers, particularly in the mid-market space. There are a few headwinds that it faces, so it is not entirely without its risks. This name has been on our radar for a while, and we feel this update can shed some light on its recent developments.

Read the latest updates by logging in here!

Dropping Company Coverage

We are dropping coverage on two companies this month; Summit Industrial Real Estate Investment Trust (SMU.UN) and Xebec Adsorption (XBC).

SMU.UN announced on November 7th, 2022, that it will be acquired by GIC and Dream Industrial REIT in an all-cash transaction. SMU.UN shareholders will receive $23.50 per unit via a special distribution and redemption of units. Due to this acquisition, we are dropping coverage on SMU.UN.

Xebec Adsorption (XBC) was downgraded two notches to a 'B-' in our latest report on the company in December 2021. Since then, the negative momentum on share price continued with below-average earnings reports. In September 2022, XBC announced filing for creditor protection under the companies' creditors arrangement act. Given its deteriorating fundamentals, debt profile, and filing for creditor protection, we are dropping coverage on XBC.

Read the latest updates by logging in here!

Investor Sentiment Survey - RESULTS!

Thank you to all those that participated in this past market update's Investor Sentiment Survey. We have published the results from the survey in a report in the link below. Please note that the weightings and categorization of these results are still a work in progress, and the model(s) used to analyze the results may change over time as more data comes in.

It appears that investor sentiment is beginning to improve, and the sentiment is nearing a 'neutral' sentiment. Notable results include a 50/50 split between the Canadian markets moving higher or lower over the next 30 days, and a gradual shift towards expecting interest rates to be flat over the next 6-12 months.

Survey Results - Nov 1

We look forward to releasing another round of the Investor Sentiment Survey at the next market update!

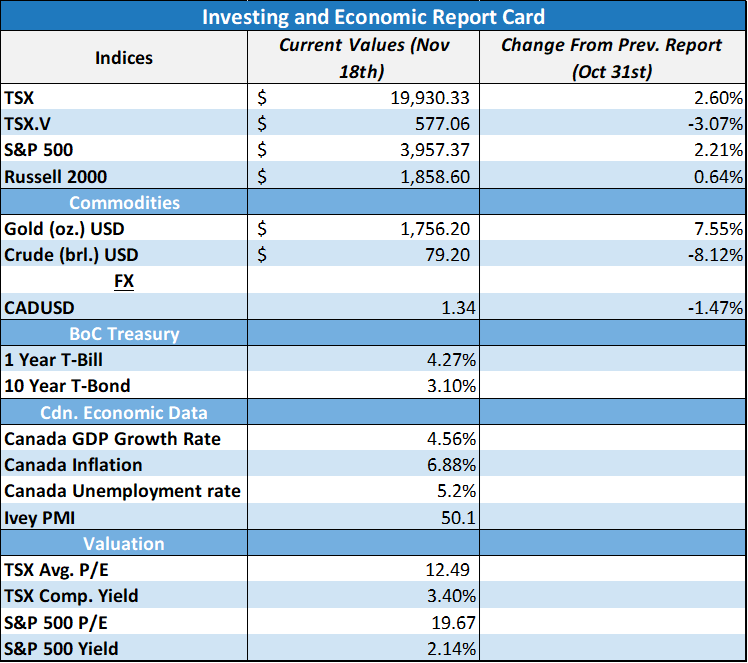

Market Update

The markets have moved higher over the past few weeks, following an encouraging inflation report from the US and inflation data that met expectations in Canada. Earnings season is nearing a close and so far there have not been many major surprises or significant downgrades. Following the release of the improved US inflation data, the US dollar has fallen and bond yields have seen some downward pressures. Oil has dropped to levels not seen since January 2022, and this may bode well for future inflation. In this market update, we discuss the valuations across small-cap, mid-cap, and large-cap equities.

Encouraging Inflation Report - Boosting Asset Prices

Two weeks ago, a lower-than-expected US inflation report helped to boost equities higher. The inflation report provided investors with a sense of optimism because for one of the first times this year, the decline in inflation was not caused by a drop in energy prices. The inflation report showed a deceleration across a broad spectrum of areas, including food prices, medical care services, new and used vehicles, and transportation services. There is a long way to go in bringing inflation down to the target rate of 2% to 3%, but the latest US report spurred hope in investors and the markets rallied on the news.

The Canadian inflation report was less optimistic than the US, with an annual inflation reading of 6.9%, coming in at the same reading as the prior month. An increase in the price of gasoline helped support an elevated inflation reading, but investors were encouraged by the deceleration in food costs.

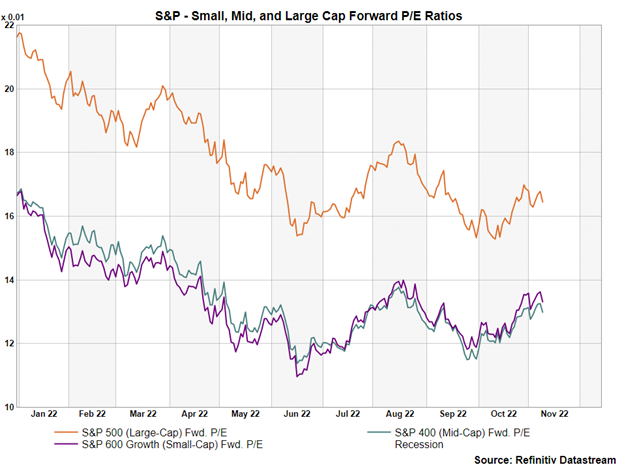

Nonetheless, the markets march on in the face of persistently high inflation, and as always, they attempt to forecast future economic expectations. Over the past couple of weeks, we have seen the valuations (measured by P/E) of the US small-cap (purple line), mid-cap (teal line), and large-cap (orange line) groups advance higher. On a valuation basis, large, mid, and small-caps all reached a low in June of 15X, 12X, and 11X, respectively.

Year-To-Date Equities Performance

Taking a look at the year-to-date performance of the US small-cap, mid-cap, and large-cap stocks, they largely reached their peak drawdowns in both June and September. With the recently encouraging inflation report, markets have bounced back, and are nearing the high from mid-August. Time will tell if the positive trend in inflation will continue, and if it will be enough to force a change in momentum for stocks.

Historic Valuations

While looking at the year-to-date valuations of small, mid, and large-caps may provide little context to the overall picture, looking at the 10+ year trend in P/E ratios demonstrates the historic levels that these stocks have reached. The P/E ratios that small-cap and mid-cap stocks have reached this year was last seen in 2009. This speaks volumes to the severity of the drawdown that we have seen in asset prices this year, and is a true measure of how much work there is left to do on bringing inflation down and regaining some of that lost ground in valuations.

Conclusion

In summary, this year has been nothing short of historic in contracting valuations across almost all stocks, persistently high inflation readings, and a rapid rise in interest rates. Where we end the year, and how we start 2023 is still unclear, but we are encouraged by the deceleration in inflation, supported by the restrictive actions of central banks, as well as historically cheap valuations in small and mid-caps, in particular. As asset prices have declined significantly, we see the opportunity for future wealth creation growing exponentially. We feel that we are currently in a sweet spot between a light at the end of the tunnel for inflation and historically cheap asset prices. For investors with a long-term horizon, small-caps and mid-caps are presenting investors with a roughly once-in-a-decade opportunity.

Model Portfolio Changes

Income Model Portfolio

Sell Full Position in Sylogist (SYZ)

Trade Rationale - Sylogist has recently cut its dividend to $0.01 from $0.125, and as a result, we no longer feel that it is appropriate in the income model portfolio. With debt increasing, the company decided to 'self-fund' its planned growth by cutting the dividend. We feel it is time to move on from this name in the income model portfolio.

Initiate a 2.0% Position in Acadian Timber (ADN)

Trade Rationale - Acadian Timber is a Canada-based supplier of primary forest products in Eastern Canada and the Northeastern United States. It pays slightly more than its annual free cash flows in the form of dividends and currently has a dividend yield of ~7.9%. It is a smaller name and there are some size risks associated, but we feel it has done an excellent job of diversifying its revenues through the carbon credits market and has strong margins.

Sell Full Position in Primo Water (PRMW)

Trade Rationale - We feel that PRMW continues to have potential, but at a low dividend yield of ~1.4%, we feel comfortable removing this from the income model portfolio. The company has shown good revenue growth, but its debt levels are creeping higher and its profit margins are thinning out. We view the sale of this name as an opportunity to initiate a new position with a higher yield.

Initiate a 3.0% Position in Dream Industrial REIT (DIR.UN)

Trade Rationale - Following our recent coverage initiation on DIR.UN, we are initiating a position due to its strong dividend yield and industry tailwinds in the industrial REIT space. We like DIR.UN for its balance sheet, sustainable payout ratio, industry tailwinds, and robust rent growth potential within the market that it operates. We feel that this name will help to boost the overall yield in the model portfolio.

Increase BMO Equal Weight REIT (ZRE) to a 4.0% Weighting

Trade Rationale - The real estate market has witnessed a substantial fall this past year as interest rates have risen at a historically rapid pace. There are signs of a deceleration in central bank interest rates, and we feel that this slowdown in the pace of rate hikes will bode well for mortgage rates in 2023 and into 2024. To capitalize on the depressed real estate market and the potential for a bottoming process in the real estate market, we are increasing our exposure to the BMO Equal Weight REIT ETF.

Growth Model Portfolio

Sell Full Position in Anaergia (ANRG)

Trade Rationale - ANRG has been a disappointing name so far, and its recent guidance cut has worked against its share price. We feel that future growth in this name is still possible, but at this time its negative free cash flows, profit margins, and rising debt levels are putting downward pressure on the company. At this time, we prefer to increase the portfolio's cash position, and near the end of the year initiate positions in companies with solid growth potential as well as positive free cash flows.

Sell Full Position in Lightspeed (LSPD)

Trade Rationale - LSPD recently reported disappointing results, and while its revenue growth remains strong, it needs to address its declining gross profit margins and develop into a profitable company. We prefer to use this as an opportunity to build the portfolio's cash position to put to use later this year.

Best wishes for your investing!

www.5iresearch.ca

Comments

Login to post a comment.