Report Updates

We have posted report updates on Sylogist (SYZ), Real Matters (REAL), and Magellan Aerospace (MAL). SYZ is a public sector SaaS company that provides Enterprise Resource Planning (ERP) solutions in Canada, the US, the UK, and internationally. REAL is an industry leader in real estate appraisal and title services, and MAL operates as a diversified supplier of parts and components to the aerospace market. One company has demonstrated solid ARR growth, although it recently made a material change to its business strategy. Another company has faced some challenges as the industry it operates in faces a cyclical downturn, and the other company is expecting to return to pre-pandemic levels within the year. We feel that there are lots of interesting insights to glean from these reports.

Read the latest updates by logging in here!

Investor Sentiment Survey

Thank you to all of those that have participated in our investor sentiment surveys thus far. We feel that these surveys have added value to our thought process on the current investment landscape, and we hope that you all have felt the same.

The survey shouldn't take more than 5 minutes and no personal details are required.

Let us know how you are feeling about markets and the economy by following the link below! We will let you know the results in our next market update.

Investor Sentiment Survey

Market Update

The markets have been heading lower over the past few weeks as signs of persistent inflation and cost pressures remain in the economy. The potential for elevated inflation has left most analysts forecasting higher rates, and this has recently put a damper on equities. Earnings so far have been mixed, with most companies citing caution for the 2023 economic outlook, and as moderating demand and higher costs impact earnings growth. Oil has been mostly flat, as signs of an economic rebound in China have acted as tailwinds while more rate hikes in Europe have counterbalanced this. Much of the direction of the markets continues to rest on the persistence of labour market tightness, inflationary pressures, and the potential for future rate hikes, resulting in higher bond yields. While there is always something to worry about, in this market update we look to ignore the short-term noise and instead, depend on the encouraging stats of long-term investing.

Past Opportunities and Future Risks

We want to start off this week’s market update with a quote:

“All past declines look like an opportunity, all future declines look like a risk” – Morgan Housel

This is where we believe we are at today. The current market decline has sidelined some investors, concerned most investors, and swept the market with uncertainty. We gather that most investors today see more risks than opportunities. Risks are present everywhere in the news – a tight labour market leading to sticky inflation, the potential for never-ending rising interest rates, earnings declines, and margin compressions, everything can be seen as a risk. Although, the 100+ history of the stock market suggests that these risks should instead be viewed as opportunities.

Long-Term Rolling Market Returns

Unless an investor has a one-year time horizon, most investors are focused on achieving a return over the long term. The market is not designed to increase by a pre-programmed 5% to 10% per year, but rather, the market moves up or down based on growth of the overall economy, and more times often than not, the economy is expanding. This is why long-term investing is important, no one knows for sure when or if the market will move up or down, but statistics and probabilities show that the market increases more than it decreases, and over a long period of time, the market moves in favour of a long-term investor.

Let’s take a look at a chart of the rolling 10-year annualized returns of the US stock market since 1926. Rolling 10-year annual returns means that over the past 10-year period, the total returns were either positive or negative. For example, the latest data point shows that the last 10-year annual returns were roughly 13%, indicating that the total return over the past 10 years was about 240%. What is most astonishing is that there have only been two instances over the past ~100 years where the 10-year rolling returns were negative; the late 1930s and 2009. This means that if an investor had bought the S&P 500 and held for any 10-year period, there were very few instances over the past 100 years where the returns over any 10-year period were negative. This is an encouraging stat for long-term investors.

Source: awealthofcommonsense.com

Let’s stretch this out to investing for a period of 30 years. The lowest 30-year annual returns over the past ~100 years was 7.8%. This works out to a total gain of ~850% over 30 years, if an investor bought at the worst possible time, which was in the late 1920s. This demonstrates that over long timeframes, the market is skewed toward the investor's favour. An investor could have tried to time the market during those 30 years by attempting to buy and sell at opportunistic times, but what we can see is that by simply buying and holding and ignoring the noise, investors can generate significant returns over the long term.

Source: awealthofcommonsense.com

More Opportunities than Risks

Since 1928, the US stock market has risen by roughly 9.8% per year, and in those ~100 years, the market sees several periods of market declines. Simply holding throughout this time would have yielded impressive results, but an investor would need to experience turbulent and choppy times. Looking back, these market declines would have represented significant buying opportunities.

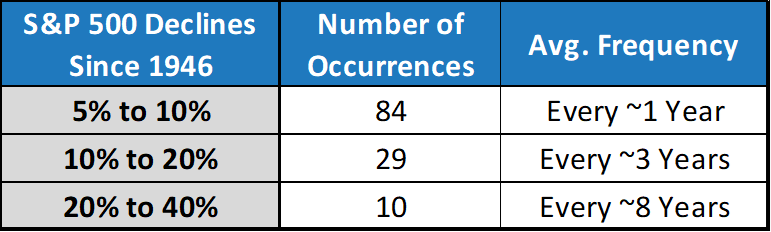

Almost all investors can withstand a 5% to 10% decline in the markets, these happen roughly once a year. Most investors can withstand 10% to 20% declines in the market, these occur about every three years, however, larger declines of 20% to 40% shake most investors’ confidence and these occur about only once every eight years. While investors’ confidence seems to wane with each magnitude of market decline, the history of the stock market tells us that it should be the opposite – confidence in future returns should increase as the market decreases further.

Source: CNBC

If the markets were easy, most individuals would be long-term investors and would hold for the long term and buy with increasing confidence on market declines. But, the market is not easy, and most individuals do not like losing money and so fortifying one’s psyche around stock market ebbs and flows is vital to achieving long-term positive returns. In this sense, not only do we believe that holding onto positions during market downturns is important, but buying throughout downturns is equally as important.

We will end the market update with a quote from Peter Lynch:

“If you go to Minnesota in January, you should know that it’s gonna be cold. You don’t panic when the thermometer falls below zero” – Peter Lynch

Best wishes for your investing!

www.5iresearch.ca