Report Updates

We have posted report updates on Magna (MG) and Chartwell Retirement Residences (CSH.UN). MG is one of the world's largest Tier 1 suppliers within the automotive space and CSH.UN is one of the largest open-ended trusts that own and manage a range of senior residences. MG is focusing on positioning itself for the 'car of the future' and CSH.UN aims for growth through acquisitions of new properties. One company has a track record of being shareholder friendly and is targeting an improvement in operational efficiency, whereas the other has faced a challenging year and has seen some levels of deterioration. We have downgraded our rating on one of these companies.

Read the latest updates by logging in here!

Investor Sentiment Survey - RESULTS!

Thank you to all those that participated in this past market update's Investor Sentiment Survey. We have published the results from the survey in a report in the link below. Please note that the weightings and categorization of these results are still a work in progress, and the model(s) used to analyze the results may change over time as more data comes in.

Investor sentiment has slightly weakened against the prior month, with an overall survey reading of 42/100, signaling a bearish tilt. Markets have declined over the past month and volatility and fears have certainly heightened. In these survey results, we noticed an emerging trend of participants expecting near-term downside, but members are largely unfazed by the long-term expectations of the market. There was a marginal increase in the number of members expecting higher rates over the next 6-12 months and an increased expectation for flat to higher inflation over the next year.

Survey Results

We look forward to releasing another round of the Investor Sentiment Survey at the next market update!

Market Update

The events of the past couple of weeks have cemented themselves as historic events in the financial markets timeline, and we have seen moves in bond yields and the financial sector that have not been experienced since the Great Financial Crisis. The markets have been mostly down over the past couple of weeks, but given the high pace that new information is being revealed, the markets have a lot to digest. Silicon Valley Bank, a top 20 bank in the US by asset size, collapsed in a matter of days following its announcement of a share issuance and sale of some of its bonds at a significant loss. This sparked a bank run in the days that followed, creating issues for other small regional US banks, and expectations for rate hikes in the US have turned into expectations of rate cuts. A new facility was created by the Treasury and Federal Reserve to stem any systemic risks, and the intermediate impacts of this are yet to be properly assessed. Bond yields are gyrating at volatility levels of historic proportions, and in this market update we want to focus on an area that we feel has high risk/reward, the bond market.

Buy Bonds, Wear Diamonds

There’s an old market saying from the late 1980s and early 1990s of ‘buy bonds, wear diamonds’. This may not come as a surprise, as the Canadian 10-year Government bond yields declined from ~9% in the 1990s to ~1% by 2015, sparking a multi-decade long run in bond prices. A similar trajectory was seen in the US bond markets in that timeframe.

A simple framework to understanding bonds is that as bond yields increase, bond prices decrease, and vice versa. Bond yields and bond prices are known to have an inverse correlation, and bond yields are driven by central bank interest rates.

As some of us may have heard, bonds posted one of their worst years ever in 2022. Bond prices declined significantly alongside the rapid pace of interest rate hikes, and with this swift change in both rates and bond prices, we have just in the past week begun to see some of the collateral damage of a high rate of change in asset prices, notably bonds.

There Is Always an Opportunity Somewhere

There is always an opportunity in the market somewhere, and right now we feel that bonds are setting the stage for an attractive setup.

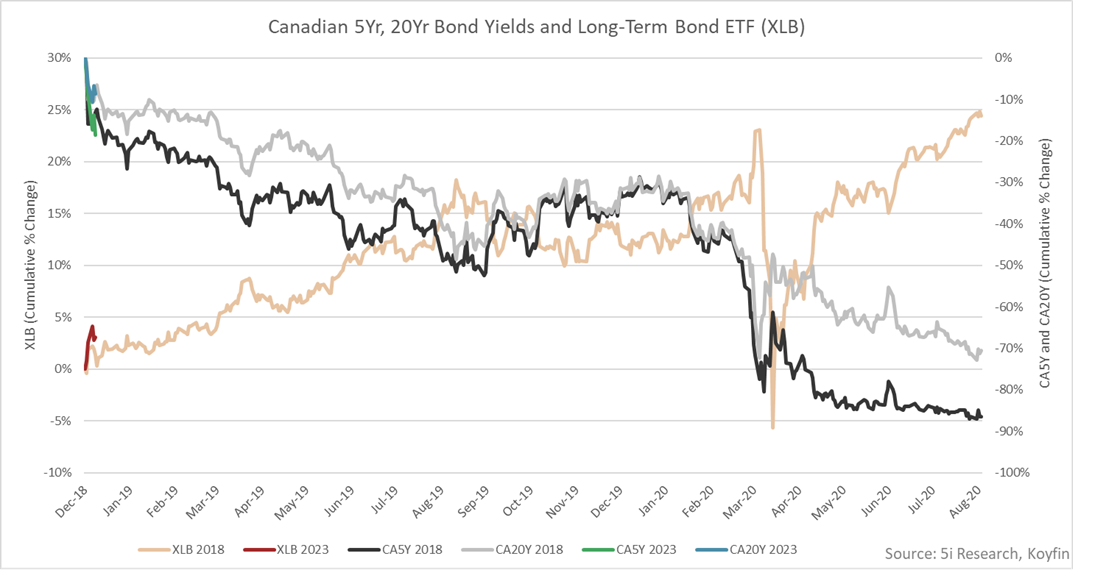

Let’s look at how the Canadian 5-year and 20-year government bond yields have traded over the past 15 years against the iShares Core Canadian Long-Term Bond ETF (XLB). As a side note, while the 5-year and 20-year yields will largely trade in tandem, the XLB ETF price will respond more to the 20-year yield. We have included the 5-year yield to demonstrate that all yields will follow a similar trend.

We can see that over the past 15 years, bond yields have largely trended down, with some periods of volatility where the Bank of Canada (BoC) hiked and decreased interest rates. The recent move higher in bond yields from a low of ~0.5% for 5-year yields and ~1% for 20-year yields to their current levels of ~3% has caused a large sell-off in long-term bonds (XLB). In late 2022, we saw XLB decline as much as 24% on a year-over-year basis. To add to this, a 20%+ decline in bonds is quite atypical in the markets.

What Goes Up, Must Come Down

Rates have risen in response to elevated inflation, but recently the BoC has paused interest rate hikes. Historically, a pause in interest rates is followed by a decline in interest rates in order to stimulate economic growth and restore consumer confidence. It is important to note that while bond yields move in tandem with the central bank interest rates, they also move in anticipation of where interest rates are heading.

For example, in the below graph we have mapped out the relationship between Canadian 5-year and 20-year bond yields against the central bank interest rate. We can see that when interest rates rise (2017 and 2022), yields have already begun rising in anticipation of rate hikes. Conversely, when interest rates fall (2007 and 2020), bond yields are falling alongside rates or dropping in advance of rate declines. This creates opportunity, in that we do not need to wait for rates to decline to benefit from bonds – bond yields will often decline in advance of rate decreases, thus bond prices will increase in advance of rate decreases.

Where Do We Go from Here?

So, where do we go with this information. We know now that bond yields are inversely correlated with bond prices, and that bond yields move in advance of changes by the Bank of Canada. We also know that the BoC has recently paused interest rates, and the next move has historically been to decrease interest rates following a pause. This means that bond yields should begin moving lower soon, and bond prices can begin to increase. These actions of the BoC to cut rates is supported by recent events in the US financial system as well as continued progress on the inflation front.

Here we have analyzed how the 5-year and 20-year Canadian bond yields traded following the last time the BoC paused interest rates (2018), against the long-term bond ETF, XLB. Immediately, we see the inverse correlation at hand. Bond yields (grey and black lines) decreased over the next two years following the BoC's decision to pause rates in 2018, and the long-term bond ETF, XLB, increased as much as 25% over the next two years.

We have also overlaid how the 5-year and 20-year bond yields (green and blue lines, respectively) and the XLB (red line) have traded since the BoC’s recent decision to pause interest rates last Wednesday, March 8. We can see a very similar movement in bond yields and prices so far, and while we do not expect this similar overlap to last forever, we do believe that the overall trend of declining yields and increasing bond prices to take hold.

Disclosure

Analysts of 5i Research responsible for this report do not have a financial or other interest in the iShares Core Canadian Long Term Bond ETF (XLB).

Best wishes for your investing!

www.5iresearch.ca