Report Updates

We have posted report updates on Well Health Technologies (WELL) and Scotiabank (BNS). WELL is a top ranking digital healthcare company in Canada. The company has seen a rapid decline in its share price over the past year, but its valuation has improved significantly while the company continues to demonstrate strong growth. BNS is Canada's international bank and is one of the cornerstones to the Canadian banking system. It has seen some challenges recently with the decline in capital markets, but there are some positives for the long-term. We think both companies are worth keeping an eye on.

Read the latest updates by logging in here!

Investor Sentiment Survey

Following the initial launch of our investor sentiment survey and after posting the results from the first survey in the last market update, we are now releasing the second survey with a few additional questions and some revisions to the original questions.

We have created a brief investor sentiment survey that we hope to build on over the coming months that we also think our members will find value in. We will be starting out by sending this survey on a monthly basis and reporting back to members on the results! The survey shouldn't take more than 5 minutes and no personal details are required.

Let us know how you are feeling about markets and the economy by following the link below! We will let you know the results in our next market update.

Investor Sentiment Survey Link!

Market Update

The markets have slid over the past few weeks as the Federal Reserve made it clear that the job to squash inflation is not yet done. The US dollar has continued its strength as an energy crisis in Europe carries on, and global growth begins to slow. Both Canadian and US bank stocks are reporting weak results on the back of falling bond prices and the declining capital markets of 2022. The markets have endured severe volatility, and the reasons for this volatility may be warranted with unprecedented velocity in Central Bank rate hikes, quantitative tightening, and decade-high inflation. Nonetheless, we see a land of opportunity up ahead as nothing ever stays the same, and this too shall pass.

Annual S&P 500 Sector Performance

Near the beginning of the year, we mentioned that investors should be prepared to develop an ‘iron gut’ and to prepare for volatility. Then, close to the middle of the year, we noted that investors should focus on just surviving and staying the course, and now as we look to the back half of the year and into 2023, our focus is on the ‘land of opportunity’ ahead.

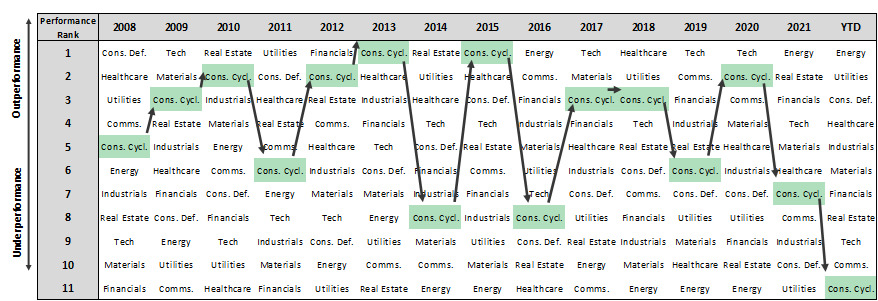

The stock market has roughly 11 broad sectors that define the whole universe of stocks; energy, utilities, consumer defensive, healthcare, industrials, materials, financials, real estate, technology, communications, and consumer cyclical. Each year is different, and certain sectors outperform others in any given year, but there is always a narrative behind each outperformance, and in this market update we aim to uncover the reason for sector outperformances and what we might expect going forward.

We have analyzed the 11 sectors’ performance over the past 14 years for the S&P 500 below. Here we are looking at each sectors’ relative performance for each year against all the other sectors. For example, in 2008, consumer cyclical ranked 5th out of 11 sectors for performance. Note that in any given year the returns could be either positive or negative, but here we are looking at performance relative to the other sectors. We have outlined the consumer cyclical sector as an example to follow along each year as it moved from outperforming to underperforming other sectors. We can see that it has a lot of year-over-year swings in performance, and there is no one sector that consistently outperforms or underperforms in all years.

Source: Novelinvestor.com

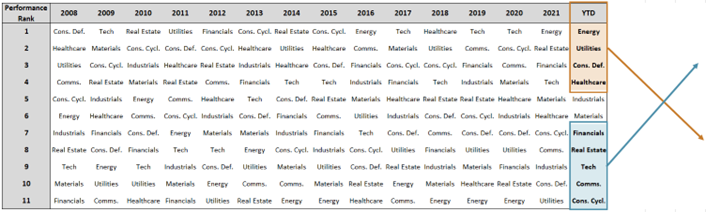

Top Sector Performances in a Bull and Bear Market

On this next chart we look at the same table of sector relative outperformance/underperformance, but we have highlighted the years that we felt were defensive/bear market years (in red) and which years were bull cycle years (in green). What we have identified is that in the defensive/bear market years, there are three main sectors that outperform: consumer defensive, healthcare, and utilities. These three sectors outperform in bear market years for a good reason, they are all lower growth, less interest-rate sensitive, and are considered defensive stocks since consumers ‘need’ to purchase their goods/services.

The years with a green outline are what we identified as bull cycle years. There are five main sectors that we noticed consistently outperformed in these years – tech, materials, consumer cyclical, financials, and communications. These are the more interest-rate sensitive sectors and are often dependent on a strong consumer, and so they perform well in years where interest rates are flat or falling, and economic growth is strong.

Source: Novelinvestor.com

These top four sectors for each year represent the top 67th percentile of performance each year, and to demonstrate the consistency in these specific sectors outperforming in a given bear market/bull cycle year, we have looked at the number of occurrences that each sector outperformed in a bull/bear market.

For example, consumer defensive has outperformed four times out of a total six bear markets in the past 14 years. Phrased another way, in each bear market over the past 14 years, consumer defensive stocks have a high likelihood of being a top performer. Looking at the table we can see that healthcare and utilities have the strongest relationship with being a top performer in a bear market, and tech, consumer cyclical, and financials have a strong relationship with outperforming in a bull cycle.

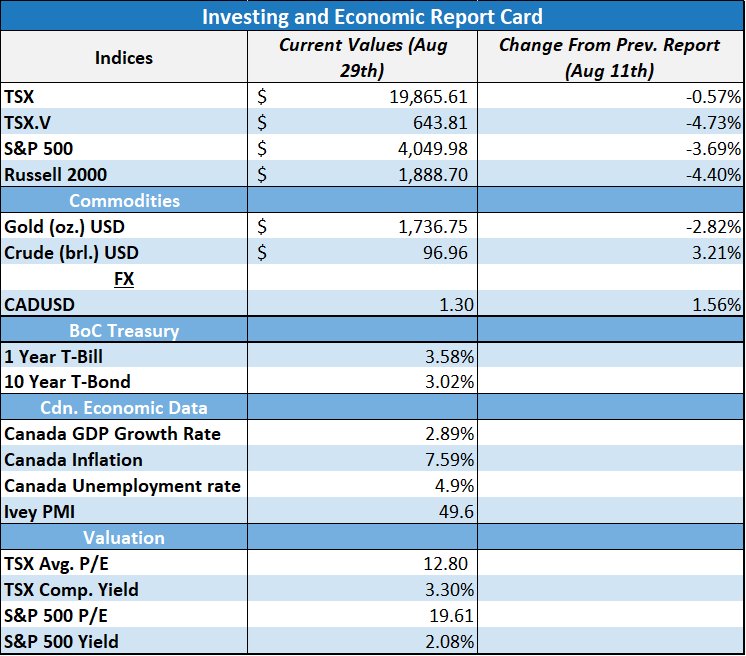

2H 2022 and 2023 Outlook

When looking at the table of sector performances for this year, we can see that real estate, tech, communications, and consumer cyclical are the bottom four performers for 2022 year-to-date. This does not necessarily imply that their respective performances will improve next year, but what history has shown us is that there is a great deal of sector rotation that happens from year to year, and if we end up in a cyclically bull setup for 2022, that on average, tech, materials, consumer cyclical, financials, and communications have been outperformers. In looking at the ‘land of opportunity’, we see the opportunity for financials, real estate, tech, communications, and consumer cyclical to be relative outperformers going into 2023 and 2024, and we feel that these are attractive sectors that might provide investors with a source of good returns.

Source: Novelinvestor.com

Check Out our ETF & Mutual Fund Update

If you haven't already, check out our ETF & Mutual Fund monthly letter that helps investors through an abundance of fund choices and investment products. Our monthly newsletter provides an in-depth report on a single ETF that we have hand-selected each month, a theme of different funds, and an ETF and Mutual Fund recommendation list.

Take a look at the ETF Update Here!

Best wishes for your investing!

www.5iresearch.ca

Comments

Login to post a comment.