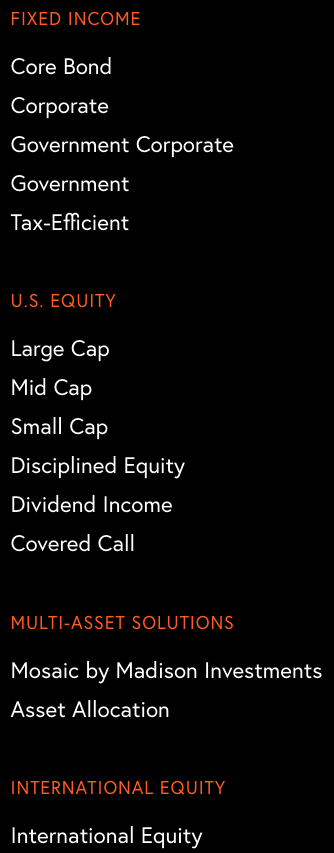

Founded in 1974, Madison Investments organization has grown from a local investment adviser to a multi-billion dollar investment organization servicing clients across the US and Canada. The firm manages just under $19.1 billion of assets under management with investments in domestic and international, fixed income, asset allocation, and covered call portfolios. The investment solutions offered service themes of capital preservation, income generation, global diversification, long-term growth, and tax-free income. Given the medium-size scale of this fund, we think it would be interesting to look at how Madison funds try to scale out their competitive moat through active management and equity selection. The following focus funds are offered:

Public Investments (Top 30 holdings)

Source: Refinitiv Eikon. As of April 12, 2020

Sector Breakdown

Source: Refinitiv Eikon. As of April 12, 2020

Given the focus on capital preservation and dividends, it is unsurprising that Financials is the heaviest sector amongst Madison funds. Consumer cyclical, technology and industrials come in next. Understandably energy and materials represent less than 5% in total. Nearly 3% of the total assets managed are held in a money-market fund, allocated to fixed-income government funds Madison offers. Refinitiv Eikon shows that Madison manages nearly $7.5 billion in equity assets with approximately 465 securities. Over the past two quarters, new positions in companies such as Nucor Corp, a steel producer, Dun & Bradstreet, a data analytics firm, and Aflac Inc, an insurance provider, were started in numerous funds.

Regional Breakdown

Source: Refinitiv Eikon. As of April 12, 2020

Recent Activity

Source: Refinitiv Eikon. As of April 12, 2020

As a medium-scale fund, Madison funds approach a more holistic view on investments rather than placing bets or taking overweight positions in a sector or equity. The holdings include all market-caps and sectors diversifying the fund assets. With the recent rotation between value and growth, and the exponential rally in growth-related funds have left value-focused funds in the dark. We think Madison offers a sufficient number of stock ideas for those who are looking to get into stable long-term positions.

Happy Investing!

Thinking about becoming a 5i Research Member? There is no better time to join but don't just take our word for it. Try it for free for the next month and experience all the benefits of the 5i Research membership. (And don't worry. We won't ask for your credit card upfront)

Disclosure: Authors, directors, partners and/or officers of 5i Research or related companies have a financial or other interest in GOOG at the time of publishing

Comments

Login to post a comment.