In this edition of Invest like a Fund Manager, we take a look at Canada’s largest pension plan, CPPIB.

Canada Pension Plan (CPP) was created to ensure a basic income for Canadian citizens after retirement. CPPIB (Canada Pension Plan Investment Board) handles CPP’s assets to ensure an appropriate return is generated on the CPP assets over time. It is the eighth-largest pension plan in the world, managing over $434.4 billion in assets. Given the very deep team and history of success, CPPIB can be a great resource for investment ideas for investors. On an ongoing basis, the CPPIB updates its portfolio holdings on their website which can be found here.

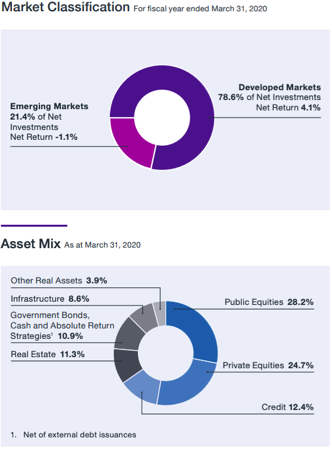

The current asset mix, as shown below, at the CPPIB includes 28.2% in public equities, 24.7% in private equities, 12.4% in credit/fixed income, 11.3% in real estate, 10.9% in government bonds, 8.6% in infrastructure, and 3.9% in other real assets.

Source: CPPIB Annual Report 2020

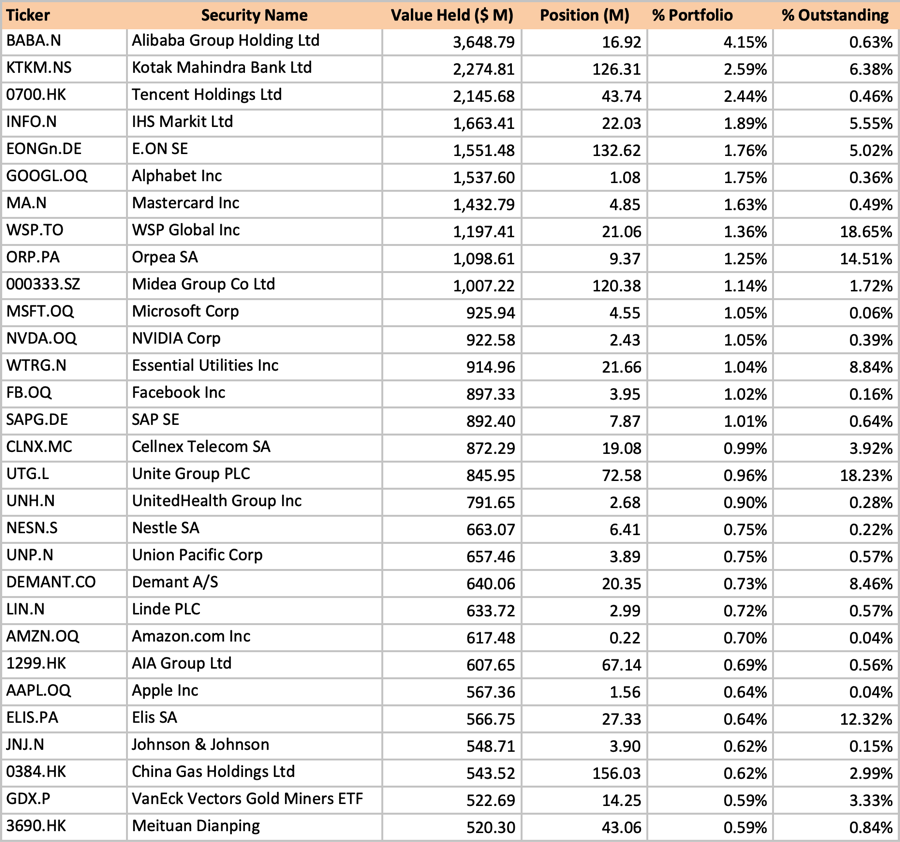

Public Investments (Top 30 holdings)

Source: Refinitiv Eikon. As of August 19, 2020

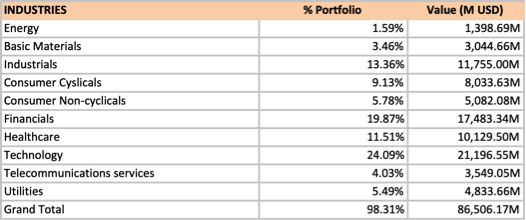

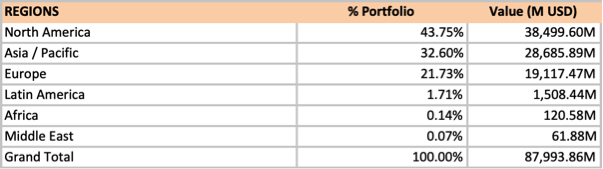

Sector Breakdown

Source: Refinitiv Eikon. As of August 19, 2020

CPPIB holds over 5500 securities within its equity investments, and the top ten represent ~20% of the portfolio. The portfolio is well-diversified with higher weights in the Technology and Financial sectors. This is interesting as CPPIB has somewhat mirrored the interest in these two sectors with its private investments as well, including a heavier focus on healthcare.

Source: Refinitiv Eikon. As of August 19, 2020

For a DIY investor, we like that the holdings are readily accessible to anyone, making it easy to peruse the portfolios to see what the managers at the CPPIB are holding. While the end investor still needs to perform their own due diligence when making an investment decision, piggy-backing off of one of the best investment organizations in the world certainly is not a bad idea and can be a great tool to generate additional investment ideas or at worst, to help aid in understanding how all of our retirements are being invested!

Happy Investing!

Thinking about becoming a 5i Research Member? There is no better time to join but don't just take our word for it. Try it for free for the next month and experience all the benefits of the 5i Research membership. (And don't worry. We won't ask for your credit card upfront)

Disclosure: Please note that the author does not hold a financial or other interest in stocks or funds mentioned at the time of publishing.

Comments

Login to post a comment.

I have been collecting CPP for many years and have faith in their thinking.

A lot of stocks and a lot of money but seems poor pay in ROE compared to Canadian small cap growth companies. Not to mention US growth names! Everybody to their percentage of that poison but I know where you have made me money!

And I love the Q section. Should start a market.

A bloated organisation is a term which springs to mind.

Surely the smallest 1000 (or 2000 or 3000) positions can have no significant influence on the portfolio.

I wonder what the incremental cost benefit ratios are with respect to holding size.