With markets trading at all-time highs and valuations looking rich, we are frequently asked via our Q&A service how customers can best protect their portfolios. Customers are quick to ask about the appropriateness of inverse/leveraged ETFs. Others are interested in products that track the VIX – a trademarked ticker symbol for the CBOE Volatility Index, a popular measure of the implied volatility of S&P 500 index options.

In general we do not like these products and we will use this blog to discuss some of the pitfalls of these strategies.

Get In and Get Out

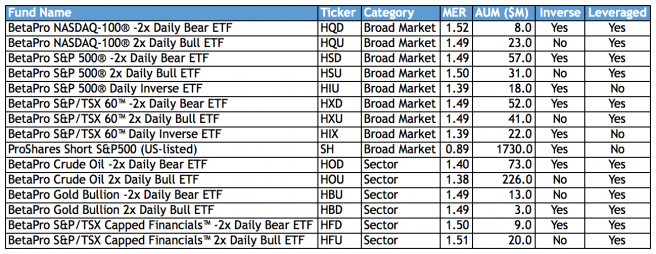

Investors who want a short-term trading strategy typically are well served by leveraged and inverse ETFs. A regular ETF will attempt to match the benchmark index's performance 1:1 but a leveraged ETF will usually match it 2:1 or 3:1. Inverse ETFs have the same daily goals but they aim to return the opposite moves of their benchmark (a nice feature in falling markets). These products can offer a simpler solution than using options, futures and trading on margin. An ETF like HOU is a convenient tool to gain magnified exposure to the energy sector if the investor believes oil prices have further to run, as an example. Below we show a sample list of TSX-listed leveraged and inverse ETFs:

However, these are highly specialized products and primarily intended for shorter-term traders. The ‘risk’ we speak of is that these strategies have a poor track record of accomplishing their objective over most holding periods. In fact, investors should not expect their position to provide the desired exposure over a period of more than a day, especially in volatile markets. The reason? Compounding of returns.

Let’s take a look at a hypothetical 2x inverse strategy with a starting value of 100.

Day 1: The index goes up 10%

- The index, with an initial value of 100, goes up to 110 (100 * 10.0%)

- The ETF, with an initial value of 100, goes down to 80 (100 * 10.0% * -2x)

Day 2: the index falls -10%

- The index, with an initial value of 110, goes down to 99 (110 * -10.0%)

- The ETF, with an initial value of 80, goes up to 96 (80 * -10.0% * -2x)

On any given day, the ETF performed as expected. However, over a holding period of two days, the investor gets burned. With the index falling from 100 to 99 over two days, this is a return of -1%. One would reasonably expect the ETF to return 2%. However, the ETF return is actually -4%, with an initial value of 100 and end value of 96 (Investment example courtesy of ETF.com).

This is the effect of daily rebalancing and compounding returns. With returns being based off the previous day’s closing price, initial losses are harder to recoup. In general, the longer investors hold these specialized ETFs, and the more volatile the underlying index the ETF tracks, the further away the ETF can get from its objective.

The VIX is a terrible ‘buy and hold’ investment

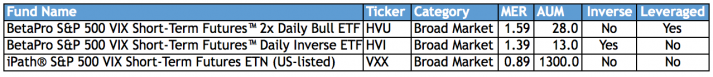

It is not possible to invest directly in the VIX. One has to invest in ETNs like the iPath® S&P 500 VIX Short-Term Futures™ ETN (VXX). Investing in VIX-indexed products is a useful solution for traders that have an excellent sense for market direction, and in times of market turmoil these funds can provide a nice hedge to losses across the broad portfolio. A sample period of volatility profitability would have been Fall of 2011 when VXX was up 142.0% from June 30, 2011 to September 30, 2011, as investors showed increasing concern over the European Sovereign Debt Crisis.

However, moves in the VIX are often short-term and extreme, and investors need to have a precise thesis on when volatility will spike. Being able to time your exit is important, as sustained gains in the VIX require markets to increasingly exhibit a ‘high fear mode’. VXX saw gains of 12.3% from June 23, 2016 to June 26, 2016 on the outcomes of the ‘Brexit’ vote. However, just a few days later VXX gave all of these gains back.

Timing the market aside, our concern with strategies like VXX is that they suffer from time decay, and this erodes the value of your investment. The longer you hold VXX, the worse the decay factor becomes. Compounding the concern is that you also pay a 0.89% MER to hold VXX. Understanding the decay factor is complicated but stick with us and you will see why investing in the VIX is almost always a guaranteed way to lose capital.

Lets look at a simplified example: assume on February 29, we have $100,000 and want to start our own VIX ETN. To do so, we need to purchase a futures contract on the VIX that will settle in 30-days. VIX futures are trading at the following prices:

- March 31 contract: $100

- April 30 contract: $110

Our ETN purchases 1,000 March contracts. One trading day comes and goes, which is a problem because we want to maintain a 30-day exposure with our contract. Therefore, we must sell 1/30 of our March contract and buy 1/30 of an April contract. We do this everyday. This makes sense because when March comes to an end, we are left with 100.0% exposure to the April contract (30 days out).

After the first day, our ETN sells 33.33 March contracts (1,000 contracts * 1/30) at $100. With proceeds of $3,333, we then buy 30.30 April contracts ($3,333/$110). The net effect is we now have 996.97 contracts (1000 – 33.33 + 30.30), or 3.03 less than the previous day. Repeat this exercise 30 times and we end up with approximately 868 April contracts after one month.

This is exactly the source of decay from which funds like VXX suffer. If we close our ETN fund after one month on March 30, no matter where VIX prices are on April 30 when we settle our contract, we will end up with less money than we had February 29 because we have lost 132 contracts.

We will not get into further detail but this type of scenario occurs when the futures curve is upward sloping, with contracts further out costing more. This is frequently the case, as investors typically expect volatility to increase in the future (the future is unknown). Therefore, when the VIX futures curve is upward sloping, ETNs will experience a decay factor that erodes its value.

With an understanding of decay in mind, we think VXX is only appropriate for professional traders who are speculating on the direction of the market over a few trading days.

Look Elsewhere

For the average ‘buy and hold’ investor, volatility and leverage/inverse funds can at first glance be an attractive strategy to hedge the portfolio or boost returns. However, one needs to have an ability to time these events properly and understand that the structure of these products is likely working against you in most environments (time decay, diverging returns from the stated objective, etc.). The behaviour and portfolio construction methodology of products like VXX are also convoluted and we are reminded of the quote "Risk comes from not knowing what you're doing." If you cannot understand the complexity of these products, then it is likely best to move on to something else.

In our opinion, the best way to protect the portfolio is a combination of things. Certainly increasing cash is a fine choice. This will allow you to stay mostly invested in the market and take advantage of pullbacks and ‘buy the dips’. Cash-like strategies also are a worthwhile consideration. United States (US) Treasury Inflation-Protected Securities (TIPS) are considered an extremely low-risk investment since they are backed by the US government. A sample ETF would be the iShares TIPS Bond ETF (TIP). From June 23, 2016 – June 30, 2016, a period defined by the ‘Brexit’ events, TIP returned 1.5% while global markets seesawed.

For those less interested in timing markets via a cash position and want to stay invested, a low volatility ETF will work as well. These strategies provide some downside protection in a pullback scenario but do so at the expense of full upside appreciation when markets are strong. Two example funds would be the BMO Low Volatility Canadian Equity ETF (ZLB) and BMO Low Volatility US Equity ETF (ZLU).

One could as well have a modest exposure to gold to benefit from heightened fear/flight to safety. Of course, staying diversified is a proven strategy. In more typical market pullback scenarios, some sectors will perform better than others and tilting the portfolio to defensive equity (telecoms, utilities, consumer staples) could minimize losses. Of course, in high panic ‘black swan’ environments such as 2009, no equity is immune from a market sell-off.

Get more articles like this through the ETF Fund Update Newsletter or sign up for the blog below.

Comments

Login to post a comment.

Thanks for the overview and strategies to consider when an investor is concerned about a market downturn. I have been investing for many years, and keep some investment statements from bear market years (like 2009) just to remind myself that panicking is not a good investing option for long term results!