Fear around the Coronavirus (COVID-19) is building and if you cannot feel the sentiment you can certainly see it today with US markets being down in excess of 3% and Canadian markets being down over 2%. As the fear and panic builds, we wanted to post a bit of an analysis on the facts we know and what it might mean. Please bear in mind, we are not epidemiologists and we are leaning heavily on the data we have access to (via Refinitiv Eikon largely). It is also important to keep in mind that this issue has been particularly tough to track due to conflicting reports and questions on data integrity. From a market perspective, it is a tough issue to gauge because there is, again, a lot of large question marks. Markets have sold off already but a lot of this selloff is in anticipation of the virus spreading (rightly or wrongly), so the question then becomes, is it a severe overreaction already, and what degree of a ‘spread’ does the market imply? These are questions that simply don’t have an answer and is often why markets go into 'sell now and ask later' types of responses.

A final and important point is that this is why keeping a portfolio allocation that is right for ‘you’ is important. This allows you to largely stay the course without having to make wild changes to a portfolio when events like this occur. Perhaps even more powerful, having the right setup allows for rebalancing and adding to beaten up names from the more stable ones in selloffs such as this. But we digress, here are some of the facts we have as of February 23:

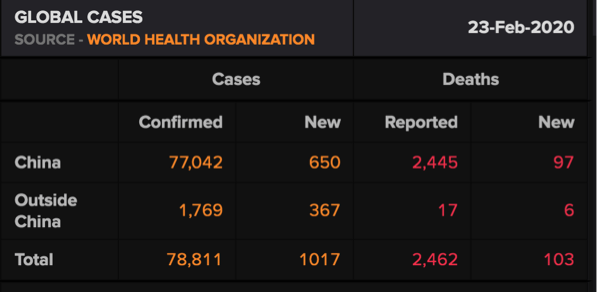

Breakdown of Coronavirus Cases

(Source: WorldHealth Org. via Refinitiv Eikon)

Diving a bit deeper into these numbers, the high majority of cases still reside in Hubei, at 64,287. In other words, 83% of cases are in one city. These, of course are large numbers. Context is always important though, especially given the sheer population size of China. The population of Hubei is 58.5 million. So, it appears as though 0.11% of this population has been impacted. The population of Ontario is 14.6 million and all of Canada is 37.6 million.

Another factor to look at is how lethal is this? Within China, sadly, it appears 3% of those who contract the virus pass away. Outside of China, it so far looks like just under 1%. Many will point out that the numbers on China might be ‘smoothed’. This may or may not be the case, we are not going to comment on the reliability of the data but instead simply want to work with the data we have, because it’s all we have to go on.

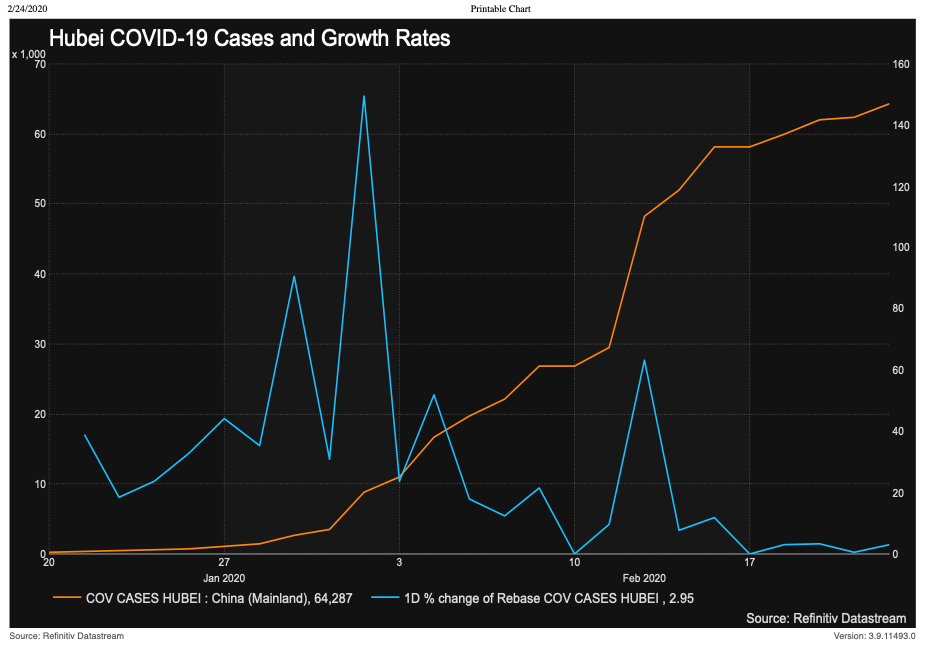

Finally, the below chart shows the number of cases in Hubei (left hand side of chart) and the rate at which they are growing (right hand side of chart). The takeaway here is that reported growth in cases does appear to be slowing.

COVID-19 Vaccines:

Developing vaccines do take time and pharma companies are already racing to develop a vaccine. However, these can take 12 to 18 months to develop.

Why are markets worried ‘all of a sudden’:

Over the weekend, reports of the virus moving into other regions such as Italy and additional cases in Canada (among other areas) have worried global markets that the virus will not be contained and will spread quickly like it has in China. The one area we might find solace in, as outlined in some population numbers, is that we think China is probably a bit of a different animal in terms of how quickly things like this might spread, especially given population concentration in China.

The other market worry here is what are the second-order impacts going to be? Do countries effectively shutting borders down tip a slow-growth economy into recession? What and when are supply chain impacts felt from plants that shutdown in China that supply inputs to company X, Y, and Z? These are answers markets just do not know yet, and for better or worse, are items that feed the fear trade. One potential mitigating factor here could actually be the trade war, as it gave companies a headstart on diversifying suppliers and supply chains. We are speculating a little on this but is a factor that might lighten the blow for some companies or at least allow them to move just a bit faster than they would have before all of the trade drama started.

Reports like this likely raise even more questions for readers but we have found a lack of coherent and objective information on this topic to only muddle things more and give way to further fears. Certainly, these are serious events that should not be ignored or taken lightly. The optimist in us has to say that we will get through this, and from a portfolio perspective, to continue to do what has tended to work in the past, which is staying diversified and thinking long-term.

Comments are disabled on this post.