We hope that you enjoyed the latest Chart Attack report, highlighting some of our key economic charts to keep an eye on. We have outlined below our thoughts on a few charts that stood out to us.

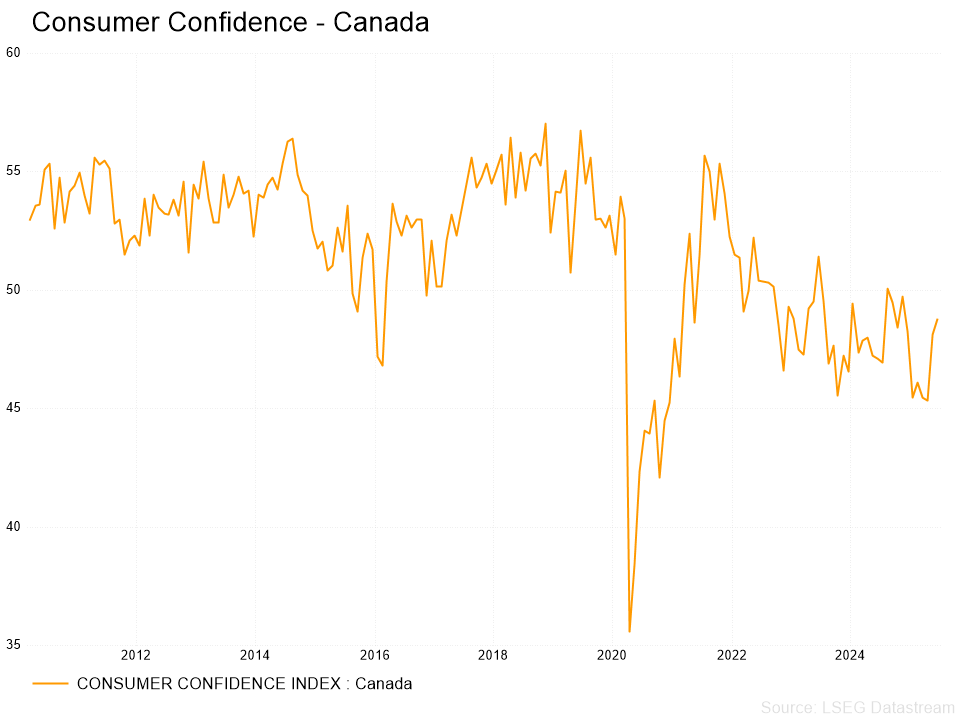

Consumer Confidence - Canada

Canadian consumer confidence measures the personal financial situation and forward six-month financial situation of Canadian consumers as it relates to household or other purchases, job security, ability to invest, and others. The consumer confidence index has recently hit a low that was last seen in 2020 and 2016. It is not yet clear if this is the bottom of the consumer confidence index, although it is at a level that has only occurred twice before in the past 10 years. An eventual return in consumer confidence would signal positive developments for the economy and financial markets.

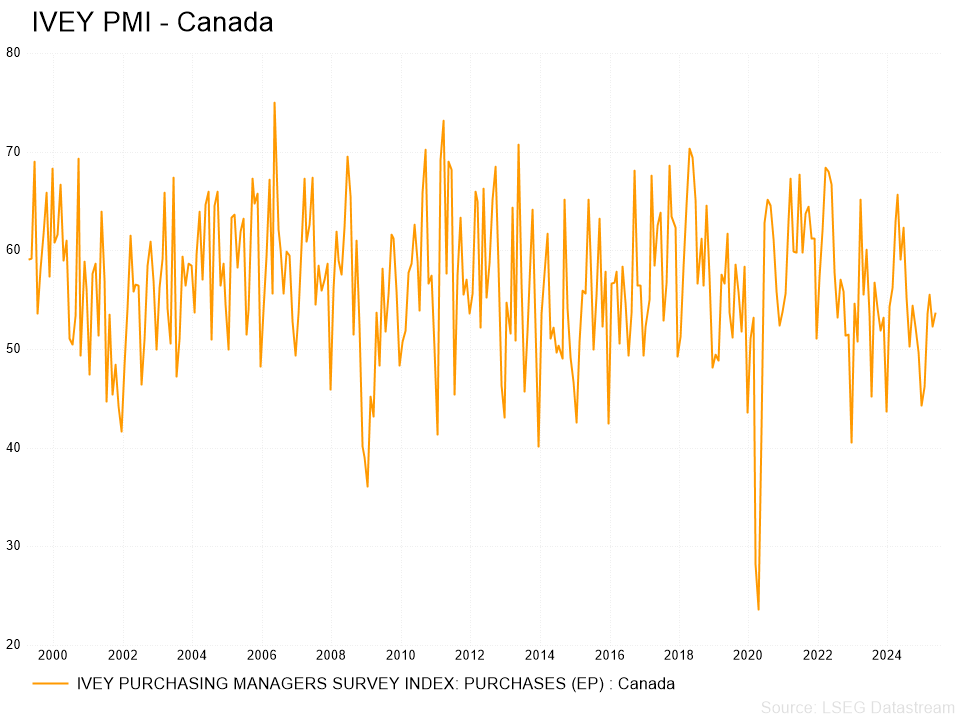

Ivey PMI - Canada

The Ivey PMI is an abbreviation of the Ivey Purchasing Managers Index. The index indicates whether purchasing managers see the manufacturing and services sectors as expanding or contracting. It is often seen as a leading indicator to the future direction of the broader economy since purchase orders by manufacturers lead consumer activity. Generally, a reading above 50 is seen as leading economic expansion and below 50 is economic contraction. Recently, the PMI index has been expanded and is near a level that supports some amount of economic expansion.

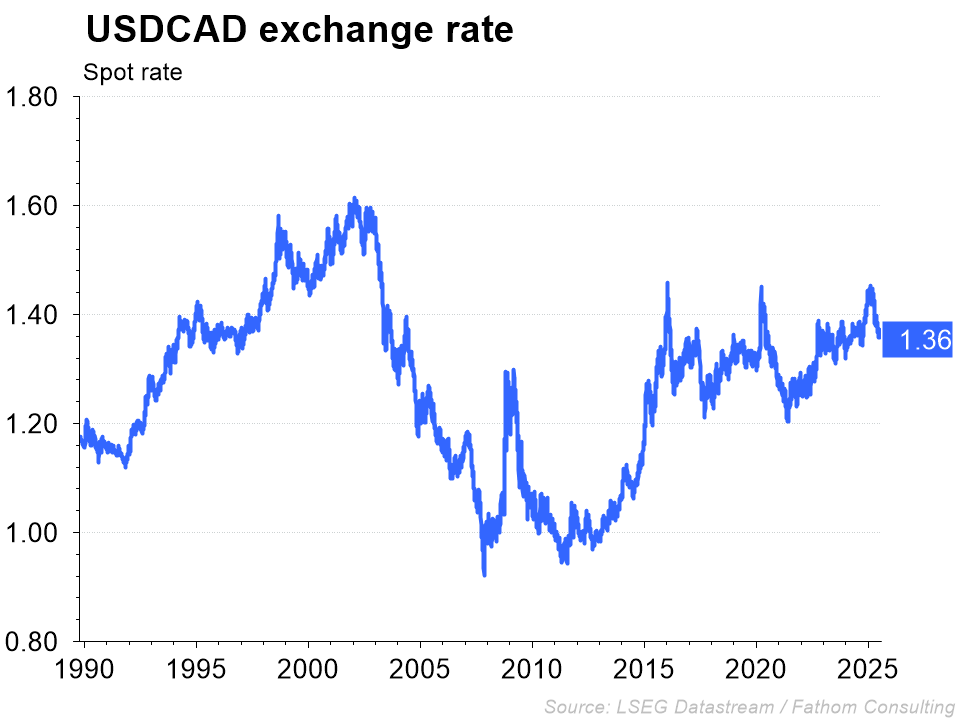

USD/CAD Exchange Rate

Changes in the USD/CAD foreign exchange rates are driven mostly by economic factors, although one of the more important factors is the difference in the two countries’ interest rates. When a country’s central bank raises its interest rate, that country’s bonds become more attractive to foreign investors as the yield on the bond has risen. Bond purchasing by foreign investors increases the value of that country’s currency. For example, if the United States' interest rate is well above Canada's level of interest rates, foreign investors will be more inclined to purchase US bonds, thereby increasing the value of the US dollar against the Canadian dollar.

These slight differences in central bank interest rates are a main contributing factor to fluctuations in foreign exchange rates. The Bank of Canada has been more aggressive to cut interest rates due to weak economic numbers, while the Federal Reserve has kept rates unchanged for sometime - this could put continued upward pressure on the US dollar relative to the Canadian dollar.

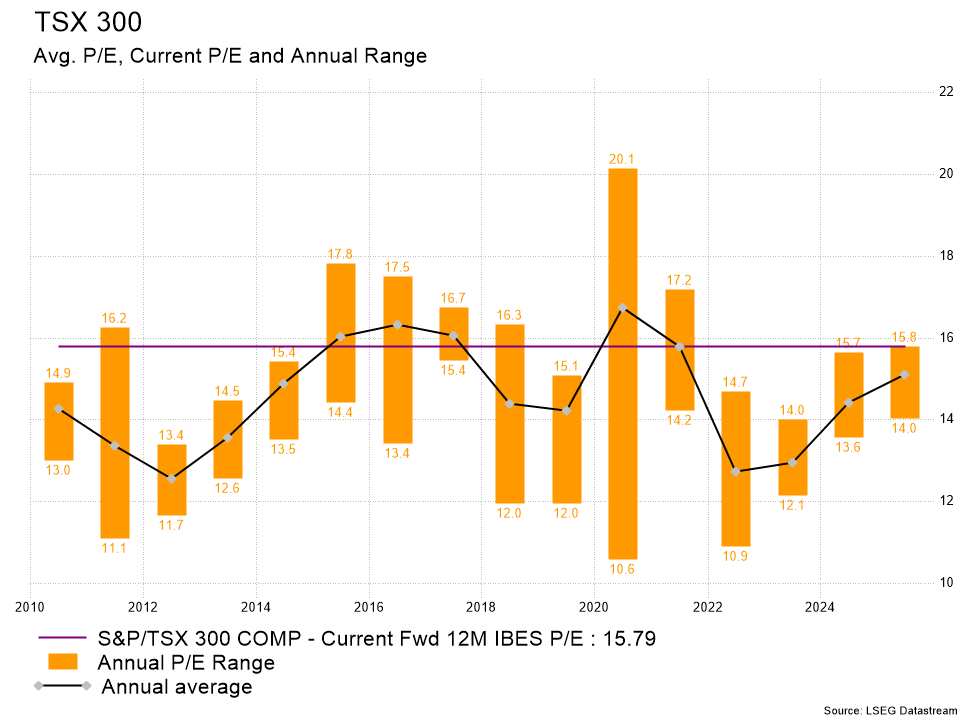

TSX P/E

This chart is known as a ‘floating bar chart’. Each bar represents the high and low range that the TSX P/E fluctuated between for each respective year. The black line outlines the annual average P/E for each year. There are a few interesting items to note about this graph – the first is that certain years can be seen to have a smaller bar than other years, indicating that the TSX traded in a tight P/E range for that year. The second item is that the average P/E has fluctuated over the years, hitting a high of ~18X P/E and a low of ~12X P/E. The current forward P/E for the TSX is 15.8X, which is similar to levels last seen in 2018, representing an attractive valuation multiples.

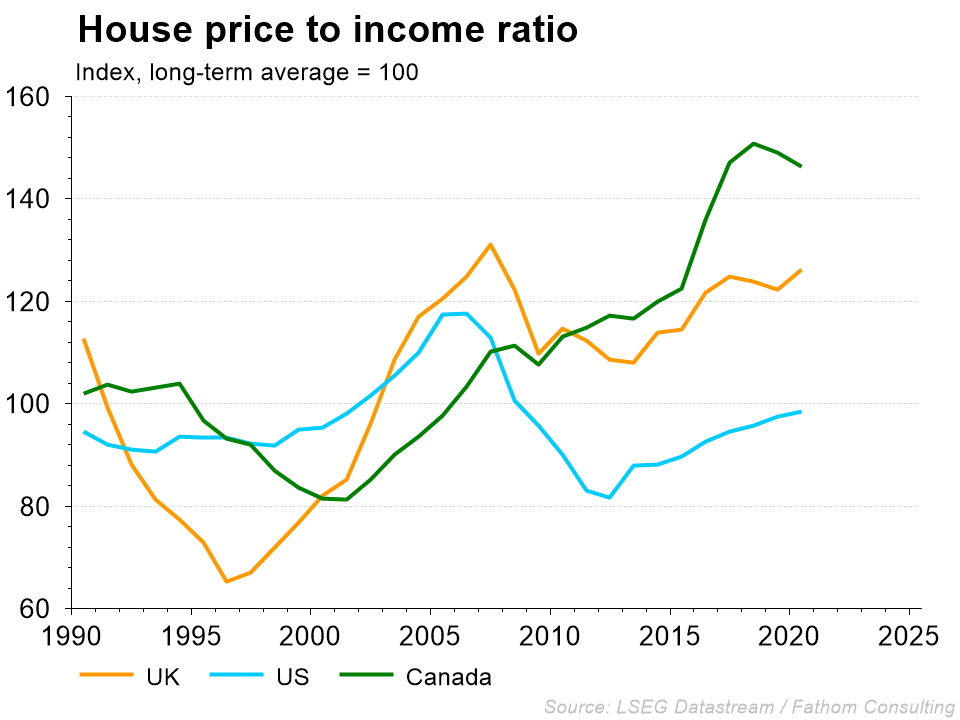

House Price to Income Ratio

The house price to income ratio demonstrates any expansion or contraction in the relative expensiveness of a home to income levels. The higher the ratio, the more expensive a home is compared to one’s income. Although, a key caveat is that the cost of carrying a home is made up of two components; the home price and mortgage rate. While the home price to income ratio might be moving up, if mortgage rates are simultaneously moving lower, the total borrowing cost of a home to income levels can be flat. This chart demonstrates the relative increases in home prices across countries compared to income levels, and we can see that Canada has witnessed a steeper ratio relative to the UK and US.

Unlock the Power of Informed Investing with 5i Research!

DIY investing doesn't have to mean going it alone. At 5i Research, we're your trusted partner in navigating the stock market. Our platform offers comprehensive stock and market research, empowering you to make smart investment decisions.

- Investor Q&A: Have burning questions? Get answers from our team of experts and fellow investors in our dedicated Q&A section.

- Research Reports: With over 60 meticulously researched Canadian stocks, our reports offer in-depth analysis, giving you the confidence to invest wisely.

- Model Portfolios, Alerts, Forums, Portfolio Tracking, and Much More...

Take Care,

Comments

Login to post a comment.