In the wake of global warming awareness, human rights and social justice issues, investors have grown an interest in companies that show corporate social responsibility. This has resulted in investors looking for ‘greener’ companies, companies that donate to charities, and give back to local communities. However, corporate social responsibility is not just limited to reducing carbon emission, rather it casts a wider net and covers issues such as worker rights, racial/gender discrimination, transparency and other social issues. Investors usually invest in these companies for personal or moral reasons and out of wanting their money to be invested in causes that are aligned with their values. Many investors also realize that corporate social responsibility is an indirect contributor to long-term returns. We think an investor can argue that companies with positive environmental, social and corporate governance (ESG) factors are more likely to generate shareholder value in the long-run. This makes sense given that investors tend to feel more comfortable putting their money with companies that are less likely to face reputation destruction.

Filtering Out The Bad Apples

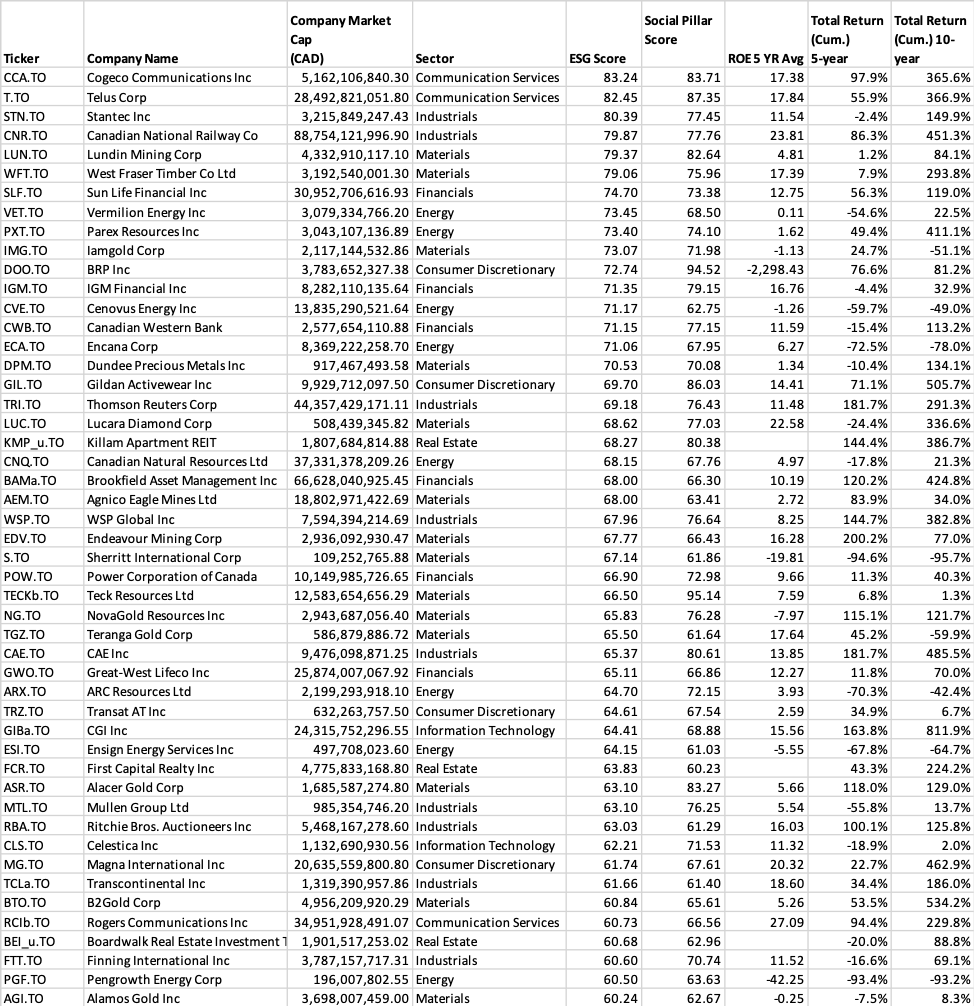

Aside from the fact that it is difficult to quantify, corporate social responsibility will not necessarily generate superb returns, however, we think it could be a good indicator for long-term shareholder value or at least an indicator for companies less exposed to reputation risks. We have created a screen for readers interested in a list of ‘ESG’ companies with at least a decent ESG score developed by the Refinitiv platform. Companies below are listed from best to worst in terms of “Combined ESG Score” (based on the environmental, social and corporate governance pillars) then “Social Pillar Score” (a measure of a company’s capacity to gain trust and loyalty with its workforce, customers and society). The latter score is meant to complement the former as it reflects a company’s reputation and the health of its license to operate which we find relevant to long-term shareholder value. The list we have provided includes only companies with a score above “60” for both indicators. This gives investors wishing to only focus on more ‘socially responsible’ companies a reasonable universe of 49 Canadian stocks.

Unexpected Industries

It is interesting to note here that the companies with higher scores are primarily in industries that may face environmental controversies (mining, energy, railroads) and are also quite reflective of the prominent sectors in Canada (materials, industrials, energy and some financials). Some familiar names include Stantec (STN), Canadian National Railway (CNR), Sunlife Financial (SLF) and Vermilion Energy Inc. (VET). Scores may also be high for these companies if the ESG scores are based on how companies fare relative to their industry, and this makes sense given that each industry has its own regulations. For example, one would not expect to see any energy companies on this list whose very job is to produce fossil fuels to be consumed, but in fact, there are two (Vermillion and Parex Resources) in the top 10. There are non-polluting companies, but energy companies may be given a high score based on their relative effort in reducing carbon emissions as well (through renewable energies for example). One would expect to see more technology companies on the list due to their lack of carbon footprint than most other sectors exhibit and reputation of good treatment of employees, but this may simply be due to the smaller number of technology companies in Canada.

ROE & Total Return

We have also included return on equity (ROE) and total return (5 & 10 years) columns for your viewing. It is arguable that effective management practices (often quantified using ROE) work hand in hand with corporate social responsibility and in turn giving back to shareholders. Names like Gildan Activewear (GIL) and CAE Inc (CAE) who consistently buy back shares and grow their dividend can attest to this theory. The two companies show a 5-year ROE of 14.41% and 13.85 % and 5-year total cumulative returns of 71.1% and 181.7% respectively.

As noted earlier, a high ESG score does not necessarily imply a high potential for return on its own, but for investors interested in companies that score high on corporate social responsibility, we find this list to be a good starting point for deeper research while using other metrics like ROE to screen for companies with sound management.

Disclosure: Authors of this article do not have a financial interest in securities mentioned.

Comments

Login to post a comment.