Join Portfolio Analytics and Receive Immediate Access

Just $430 per year

60 day full money back guarantee

You’ll also receive a free membership to 5i Research

(a $249.95 per year value)

Just $430 per year

60 day full money back guarantee

You’ll also receive a free membership to 5i Research

(a $249.95 per year value)

Do-it-yourself investorThink about it, if you’re a DIY investor, you are managing your portfolio and just looking for an independent second opinion from a true expert that isn’t just trying to sell you something on the side.

You want to make sure you are on the right track and not making any critical errors that will cause you to lose your wealth or, or be forced to work for years longer than you want to.

What are your options? Pretty much to either go take a finance course or go to an advisor and pay a large portion ofyour assets in fees which can add years to how much longer you’re forced to work.

And maybe your portfolio is totally fine. But how do you know? Where do you check, and what do you look for when analyzing and optimizing your portfolio?

Using an AdvisorLets say you have an advisor and you like them just fine, but it’s your money and you want to be sure it is being managed appropriately.

Totally understandable. But where can you go for an independent 2nd opinion?

You could go to another advisor, but they have a financial incentive to tell you that your portfolio is significantly flawed (even if it’s not) in hopes that you move your investments over to them.

Your existing advisor is obviously not going to criticize the portfolio they recommended to you.

And maybe your portfolio is totally fine. But how do you know? Where do you check, and what do you look for when analyzing and optimizing your portfolio?

What questions do you even ask your advisor? And is your portfolio missing something critical that’s increasing your risk or limiting the returns you could be getting?

Even if you’re happy with your advisor, you don’t know what you don’t know. Too often are the clients put at a position of weakness with their advisor and forced to take their word for it. This is fine, it is what you pay them for. Portfolio Analytics, however, helps to shift the balance of power and at least provide you with a starting point where you can ask the right questions and get clarification on where the advisors recommendation differs from our high level suggestions.

Your advisor knows you better but you should still be able to be in a position to ask the hard questions with confidence.

It is YOUR money after all!

Using a robo advisor

While robo advisors charge lower fees than what traditional advisors charge, the fee is still much higher than what you could be paying.

The extra fees can easily amount to thousands of extra dollars per year that you’re limiting your returns by, all of which can be avoided by simply buying the investments yourself, instead of letting a robo-advisor (the middleman) hold them for you.

But how do you know which investments to buy? And how to ensure that you’re buying the right amount of each investment based on your financial situation and goals?

The difference? We let you hold the investments yourself which can save you thousands of dollars a year in management fees.

And the larger your portfolio, the more you’ll save as we never charge a percentage of your entire portfolio like they do.

New to Investing

Even if you only have a few thousand dollars in savings, we can help you get set up so that you’re on the right track with your portfolio, while paying the lowest possible fees.

Have questions? Use our member-only Q&A section where you can submit private or public questions directly to our Team of Analysts. Or, discuss your questions and get feedback from other members through our forums.

Unlike other services, we don’t sell any investment products, so you never have to worry that we’ll suggest something just because we’re getting a commission or bonus on the back-end (unlike many of the advisors out there).

Once you’re done with the initial setup of your portfolio, it’s easy to scale up as your savings continue to grow. And, unlike robo-advisors, your costs don’t go up as your portfolio grows. This can amount to tens of thousands of dollars saved in fees over the course of your investment life.

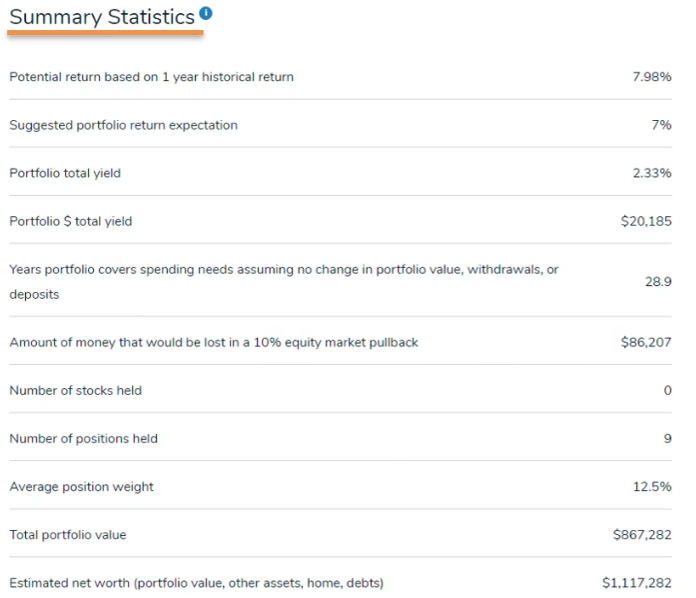

We provide automated analysis to help you optimize your portfolio reach your financial goals quicker, based on over 50 years of professional investing experience, and the past experience of managing over 1.5 billion in assets.

Our only goal is to provide you with insights and best-in-class research.

Ten years ago I was forced from work due to illness, at the age of forty with three young children, my financial situation was very precarious. My wages were reduced by 50% and I had never invested in the stock market, it was imperative that I did something to supplement my income. With great advice from you and lots of reading and research, I was able to learn enough to almost return my earnings to their original levels.

- Robert S.

Whether you’re a DIY investor or using an advisor, how do you know if you’re taking unnecessary risks with your portfolio?

How do you know you’re not limiting your investment returns because you overlooked something or if you’re portfolio isn’t setup properly?

Who can you even ask?

Who can you even ask?With Portfolio Analytics, we’ll automatically analyze your existing portfolio and inform you of any dangers and opportunities that we see.

For example, we’ll tell you:

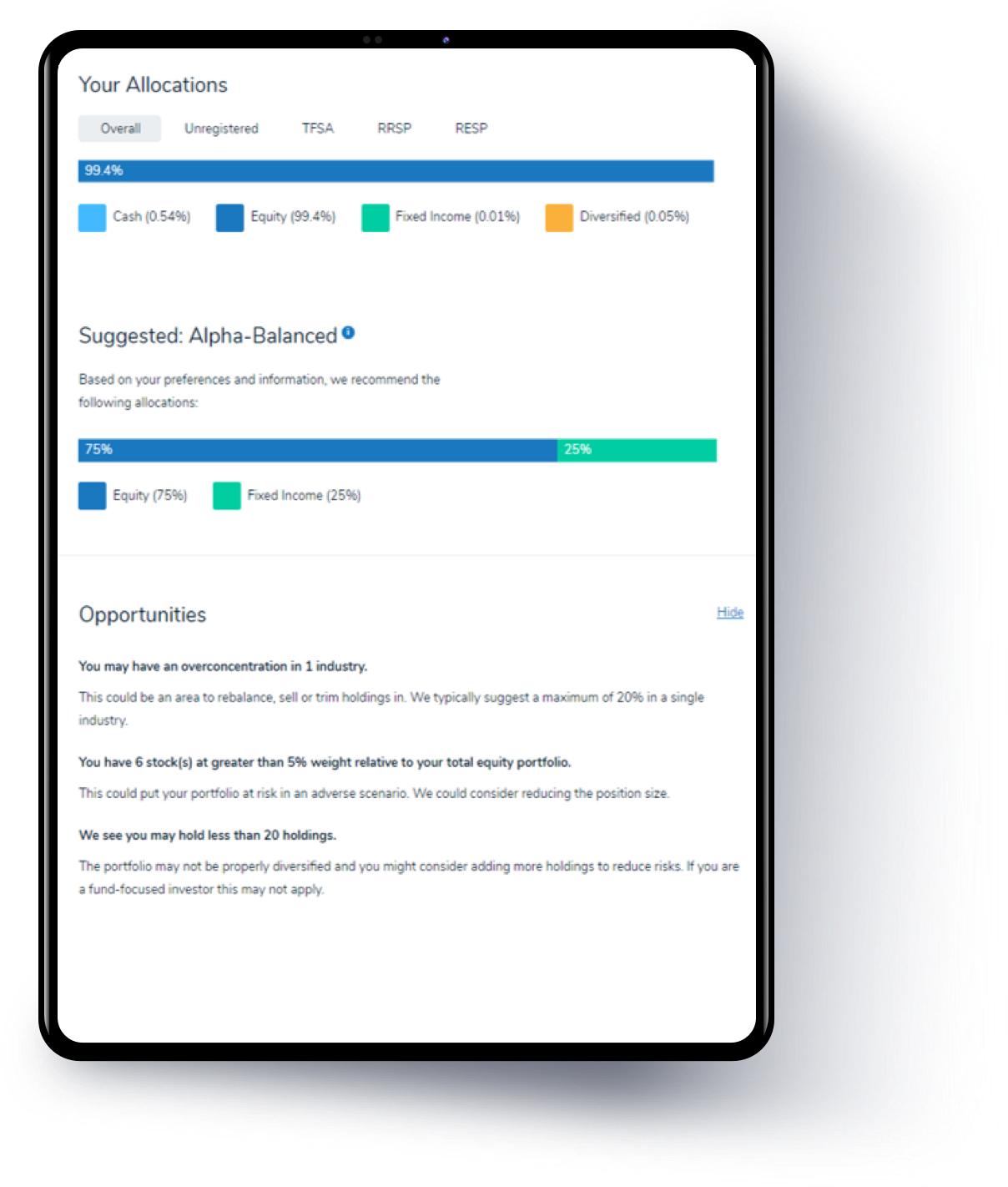

Portfolio Analytics provides Independent opinions on your current portfolio allocations and holdings.

5i, You are the best. Prompt, clear, and concise responses during this tough period, you are worth your weight in gold ! Thank you for your continued support and excellence in service and knowledge. You are definitely the best investment service out there.

- Jeff

Portfolio Analytics looks under the hood of all the funds that you own, and understands the risks that you might not even know exist.

If you hold multiple diversified funds, it is very hard to understand what your regional, sector and even asset class exposures really are.

For example, each fund that you own can have hundreds of bonds and/or stocks within it, spread across different sectors and countries. If you own multiple funds, how do you know that you aren’t overconcentrated in any particular asset class, country, or sector? You could be taking on enormous unnecessary risk without even knowing it.

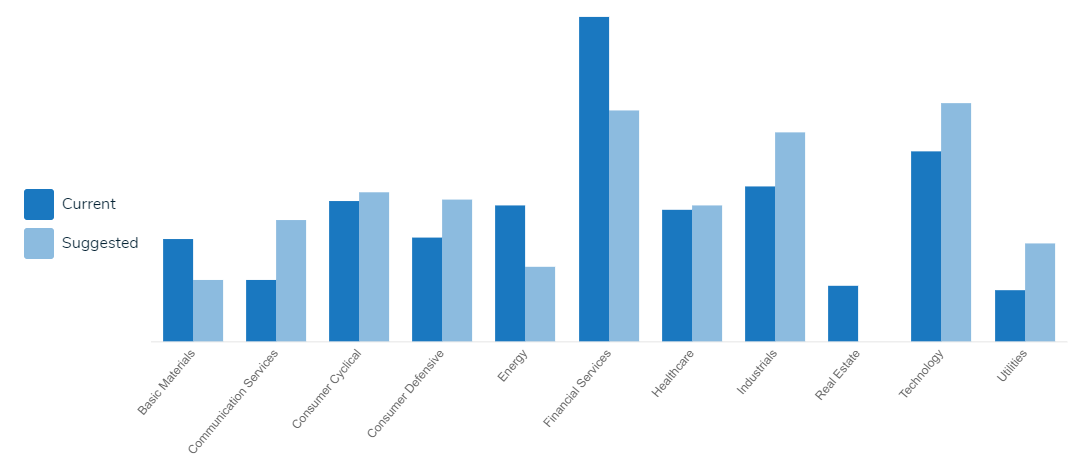

We breakdown all the funds you (and your household) hold by sector, geography and asset class, allowing you to see holistically if you are over or under-concentrated in any particular area.

We’ll warn you if any concentration issues exist, and tell you what’s driving them, allowing you to quickly optimize your portfolio and decrease the unnecessary risk.

I just wanted to take a minute and thank-you for adding the "Question" section to5i website - I love, love, love it. I'm extremely new to investing and I'm finding everyone's questions and answers very educational. Keep up the excellent work that you're all doing there at 5i, I'm really enjoying your website and love your newsletters. Thanks for watching out for us "little guys/gals".

- D.S.

No more pulling your data from multiple accounts and institutions, and then having to do the same for your partner to get a holistic view of your entire household's portfolio.

Now you can quickly and easily have all your investments tracked in one place, with the values updated automatically using the latest market data.

With just a click, you’ll know the status of you and your households entire portfolio across all your accounts, and know exactly where you stand with your investments.

Interested in specific stocks? Use 5i’s research reports and model portfolios to find our top picks of the best stocks in Canada.

Add your holdings to the watch list and get instant alerts and analysis as we answer any questions on them (or submit your own questions).

If so, you’ve probably heard of the thousands of dollars in fees that you may be paying every year (some of these fees may be hidden, especially if you’re using an advisor that claims to not charge you anything for the service).

You can bypass these fees and save thousands per year by becoming a do-it-yourself investor.

But how do you make the switch? And, where can you go to get an independent expert opinion on how to build and optimize your own investment portfolio?

With Portfolio Analytics, you can easily track and manage your own portfolio. This can make the transition to being a DIY investor seem a bit less scary.

But what if you like your advisor?

Maybe you’re completely happy with your advisor but just want a bit of confidence and confirmation that everything is on the right track and that you are getting what you pay for.

Or you just want a starting point for a conversation with your advisor on how and why they have structured your portfolio a certain way.

Portfolio Analytics can help with this by offering a second opinion on your portfolio. If there are differences, then that can lead to a productive discussion. If they are similar, then you just might sleep a bit better at night.

Plus, we offer a 60-day full money back guarantee, letting you try Portfolio Analytics risk free and see how it compares. At the very least, you’ll learn exactly whether you’re actually getting what you’re paying for from your advisor.

While we like how robo-advisors are moving Canadians away from high fee mutual funds, their services are still very expensive for what you’re actually getting.

Yes, what they do makes the process easy for beginner investors, but with a little bit of time to educate yourself, it’s easier than ever to become a do-it-yourself (DIY) investor instead.

But why bother?

The answer: Full control of your investments (instead of only buying what they tell you to buy), and it enables you to pay rock-bottom investments fees.

These fees can easily amount to over $100,000 in savings over your investment lifetime (based on a 1% all-in fee that investors can pay through robo-advisors).

The bottom line: You definitely don’t need to pay a robo-advisor 1% (i.e. over $100,000 over your lifetime) just to be put in a passive ETF portfolio that you can easily replicate yourself.

By signing up (and for no extra charge), you can choose to get notifications on time sensitive annual events that you can use to save on taxes and maximize government benefits that you receive.

Notifications include:

Receive important alerts on any of the ETFs and stocks held in your portfolio, as well as on any that you are considering.

You can also ask our team of Research Analysts any stock, ETF and portfolio questions that you have.

Plus, you can ‘follow’ any stock or ETF and we’ll inform you when we answer any member question on that particular investment.

We believe 5i Research® will be your best investment yet. But if you try it today and decide it's not for you, e-mail info@5iresearch.ca within 60 days of purchase and you will receive an unconditional refund (refund does not apply to users taking advantage of any free trial offers or renewals).

Just $430 per year

You’ll also receive a free membership to 5i Research

(a $249.95 per year value)