Equity Research Reports

- Access to 50+ easy-to-understand research reports, written for DIY investors like you!

Preview Reports:

| Features: | 5iResearch $249.95 / year |

5iResearch + Portfolio Analytics $430 / year |

| 50+ easy-to-understand reports on the top companies in Canada | ||

| Three model portfolios: Balanced, Income, and Growth | ||

| Ask our Research Team your investing and portfolio questions | ||

| Searchable database of over 100,000 answered questions | ||

| Customizable alerts and analysis on stocks from your Watchlist | ||

| Access to 5i's member-only forums | ||

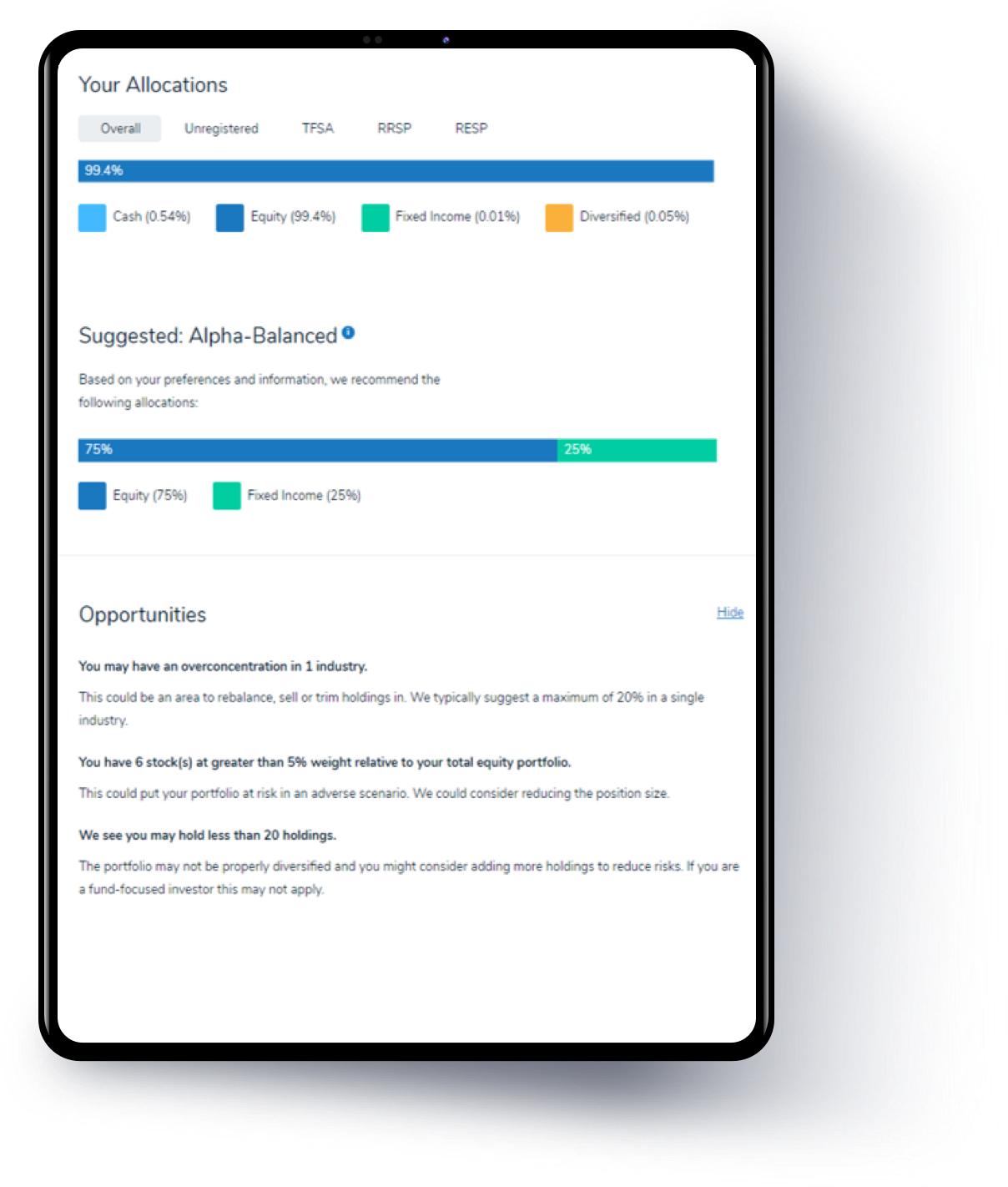

| Screening your portfolio for critical mistakes and opportunities | ||

| Portfolio allocation suggestions | ||

| All your investment accounts in one place | ||

| Statistics and idea generation | ||

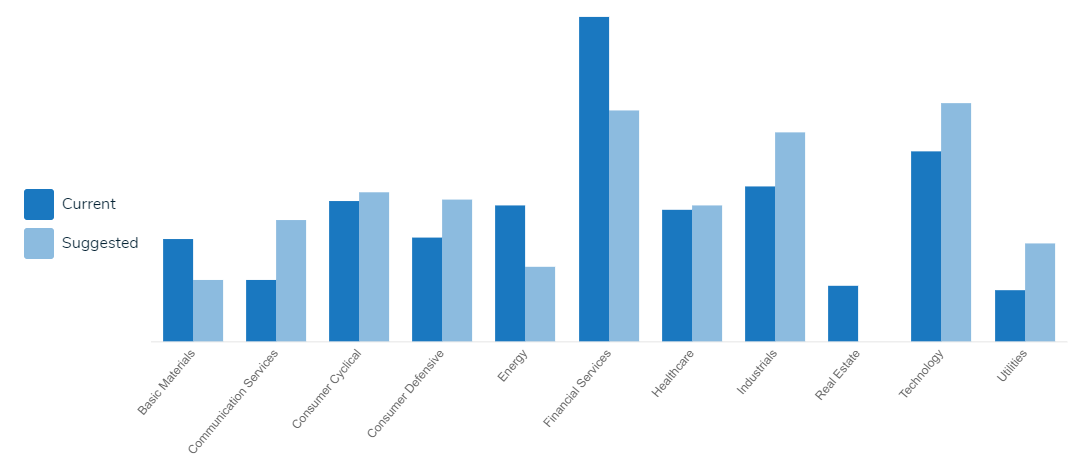

| Instant view of your portfolio by asset class, geography and sector | ||

| Portfolio management alerts to help keep your portfolio optimized |

Preview Reports:

Answers to Your Investment Questions

*Please note that we do not give individual portfolio advice. We answer questions about general stock, ETF, fund, and investment.

Whether you’re a DIY investor or using an advisor, how do you know if you’re taking unnecessary risks with your portfolio?

How do you know you’re not limiting your investment returns because you overlooked something or if you’re portfolio isn’t setup properly?

Who can you even ask?

Who can you even ask?With Portfolio Analytics, we’ll automatically analyze your existing portfolio and inform you of any dangers and opportunities that we see.

For example, we’ll tell you:

Portfolio Analytics provides Independent opinions on current portfolio allocations.

Ten years ago I was forced from work due to illness, at the age of forty with three young children, my financial situation was very precarious. My wages were reduced by 50% and I had never invested in the stock market, it was imperative that I did something to supplement my income. With great views from you and lots of reading and research, I was able to learn enough to almost return my earnings to their original levels.

- Robert S.

Portfolio Analytics looks under the hood of all the funds that you own, and understands the risks that you might not even know exist.

If you hold multiple diversified funds, it is very hard to understand what your regional, sector and even asset class exposures really are.

For example, each fund that you own can have hundreds of bonds and/or stocks within it, spread across different sectors and countries. If you own multiple funds, how do you know that you aren’t overconcentrated in any particular asset class, country, or sector? You could be taking on enormous unnecessary risk without even knowing it.

We breakdown all the funds you (and your household) hold by sector, geography and asset class, allowing you to see holistically if you are over or under-concentrated in any particular area.

We’ll warn you if any concentration issues exist, and tell you what’s driving them, allowing you to quickly optimize your portfolio and decrease the unnecessary risk.

5i, You are the best. Prompt, clear, and concise responses during this tough period, you are worth your weight in gold ! Thank you for your continued support and excellence in service and knowledge. You are definitely the best investment service out there.

- Jeff

No more pulling your data from multiple accounts and institutions, and then having to do the same for your partner to get a holistic view of your entire household's portfolio.

Now you can quickly and easily have all your investments tracked in one place, with the values updated automatically using the latest market data.

With just a click, you’ll know the status of you and your households entire portfolio across all your accounts, and know exactly where you stand with your investments.

I just wanted to take a minute and thank-you for adding the "Question" section to the 5i website - I love, love, love it. I'm extremely new to investing and I'm finding everyone's questions and answers very educational. Keep up the excellent work that you're all doing there at 5i, I'm really enjoying your website and love your newsletters. Thanks for watching out for us "little guys/gals".

- D.S.

| Features: | 5iResearch $249.95 / year |

5iResearch + Portfolio Analytics $430 / year |

| 50+ easy-to-understand reports on the top companies in Canada | ||

| Three model portfolios: Balanced, Income, and Growth | ||

| Ask our Research Team your investing and portfolio questions | ||

| Searchable database of over 100,000 answered questions | ||

| Customizable alerts and analysis on stocks from your Watchlist | ||

| Access to 5i's member-only forums | ||

| Screening your portfolio for critical mistakes and opportunities | ||

| Portfolio allocation suggestions | ||

| All your investment accounts in one place | ||

| Statistics and idea generation | ||

| Instant view of your portfolio by asset class, geography and sector | ||

| Portfolio management alerts to help keep your portfolio optimized |

We believe 5i Research® will be your best investment yet. But if you try it today and decide it's not for you, e-mail info@5iresearch.ca within 60 days of purchase and you will receive an unconditional refund (refund does not apply to users taking advantage of any free trial offers or renewals).